by Carl R. Tannenbaum, Asha Bangalore, Northern Trust

The London Interbank Offering Rate sounds like something the financial gentry might discuss in a back room at the Oxford and Cambridge Club. But LIBOR, as it is more commonly known, has graduated from the quiet corners of British banking to become one of the most influential indexes in the world. It drives the rates paid on consumer, mortgage and small business loans, and is the basis for interest rate derivatives traded on exchanges throughout the world. In total, LIBOR affects an estimated US$300 trillion of transactions worldwide.

Despite this prominence, LIBOR is not well-understood. Its construction remains somewhat mysterious, and the index has been the subject of strategic manipulation at crucial times. LIBOR’s movements can be difficult to anticipate; this summer’s unexpected rise may challenge both borrowers and policy makers. A closer look is in order.

The first LIBOR “fixing” was published at the beginning of 1986. The term “fixing” is entirely appropriate, because the index is not determined through market trading. Instead, it is set through a survey which asks bankers to estimate the rate at which they could borrow funds. LIBOR rates are now available in a series of different currencies, for tenors (the length of a loan’s life) up to 12 months.

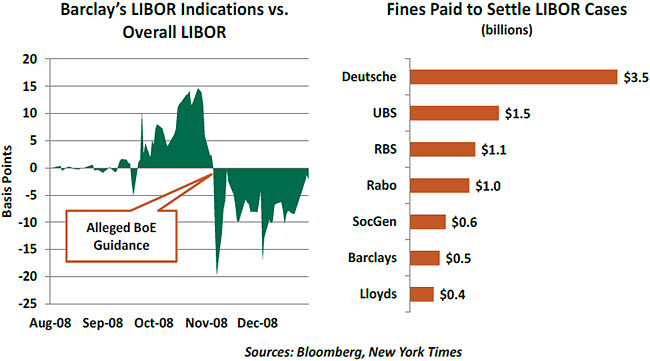

Contributing institutions are not required to offer proof they can actually transact at the levels they report. This presents the possibility of tampering; during the 2008 financial crisis, Barclays was allegedly encouraged by a Bank of England official to understate its borrowing costs to keep LIBOR low and promote the impression of financial stability. In the days after the communication between the two organizations, Barclays’ reporting patterns changed markedly.

In other situations, firms that hold positions benefiting from movements in LIBOR have steered LIBOR indications in the hope of enhancing profit. Claimants have won judgements against financial institutions for this kind of LIBOR-rigging.

The British Bankers’ Association (BBA) has taken additional steps over the years to enhance the integrity of LIBOR, but the index remains a non-market index. This might be of academic concern to the average investor or businessperson, but during its 30-year history, LIBOR has worked its way into the mainstream. The prime lending rate, once the benchmark for many types of U.S. credit, was de-emphasized after the courts challenged the method through which a “prime” borrower might be determined. The application of LIBOR expanded rapidly thereafter.

Typically, LIBOR moves in sync with other market rates, such as Treasury bill yields. Differences between them are most often due to concerns over the health of financial institutions, since LIBOR is rooted in transactions between banks. Indeed, LIBOR went up sharply during the 2008 crisis and again during the 2010-2012 sovereign debt crisis in Europe. Through the LIBOR channel, Greece’s intermittent flirtation with default directly affected borrowing costs for U.S. consumers and businesses.

Typically, LIBOR moves in sync with other market rates, such as Treasury bill yields. Differences between them are most often due to concerns over the health of financial institutions, since LIBOR is rooted in transactions between banks. Indeed, LIBOR went up sharply during the 2008 crisis and again during the 2010-2012 sovereign debt crisis in Europe. Through the LIBOR channel, Greece’s intermittent flirtation with default directly affected borrowing costs for U.S. consumers and businesses.

LIBOR has been on another upward bend this summer. Concerns about banks were elevated slightly in the wake of the recently concluded European stress tests, and as a result we have seen a slight uptick in non-U.S. LIBOR rates. In contrast, American LIBOR rates have risen sharply, and the main driver seems to be anticipation of new money market mutual fund regulations.

Money market mutual funds have long been an attractive alternative to bank deposits. They typically offer comparable redemption features and (at least until very recently) better interest rates. Owners are not insured, but funds manage their exposures carefully to preserve investors’ principal. This veneer of stability was punctured, however, when the Reserve Primary Fund “broke the buck” in 2008, prompting indiscriminate panic that was only arrested through the implementation of insurance programs offered by the Federal Reserve.

To avoid a recurrence, many money market funds will soon convert from a constant net asset value (CNAV) to one that varies (VNAV). This means investors in a VNAV product may experience small capital gains or losses upon redemption. In addition, VNAV products will be subject to liquidity fees and redemption restrictions, which could come into play during periods of market instability.

Funds that invest exclusively in government securities are exempt from this treatment. As a result, substantial amounts of capital have been shifting from “prime” funds (which have a VNAV) to government funds, reflecting investors’ desire for absolute stability of principal. Conveniently for the U.S. Treasury, the new regime will repress government borrowing costs.

Funds that invest exclusively in government securities are exempt from this treatment. As a result, substantial amounts of capital have been shifting from “prime” funds (which have a VNAV) to government funds, reflecting investors’ desire for absolute stability of principal. Conveniently for the U.S. Treasury, the new regime will repress government borrowing costs.

Prime funds typically invest in a broader range of high-quality, short-term instruments, including commercial paper and bank placements. The rates on many of these instruments are tied to LIBOR, so as investors shift to government funds, demand for alternative instruments has fallen and LIBOR has risen.

Some suspect the stress on LIBOR will prove temporary. No one is suggesting that LIBOR-based instruments are unsafe, even though some regulation treats them as second-class citizens. Eventually, investors not bound by those rules or not bothered by small and temporary changes in value should step forward.

Others worry recent trends are only the beginning of a stretch in which liquidity gets forced into only the safest products and raises costs for a broad range of borrowers. This potential scenario might complicate efforts of central banks to manage credit conditions.

So LIBOR, which originated a generation ago in a far corner of the financial markets, is now front and center. This summer’s events may keep it in the spotlight for some time to come.

Don’t Fence Me Out

A colleague from Mexico surprised me during a recent global get-together. He announced his willingness for Mexico to pay for a wall spanning the border between the U.S. and Mexico. (Such a structure has been proposed by one of our presidential candidates.) There was a catch, though: the barrier would be based on the borders of 200 years ago, when California and Texas were part of Mexico. Those two U.S. states together have output that is almost four times larger than Mexico’s.

Leaving aside the specific contours of a wall and the source of financing to erect it, the idea of erecting a partition along the southern perimeter of the United States may be based on a mistaken impression. It is true that Mexicans have been anxious to cross the border during the past decade; but more often than not, they are actually returning to Mexico.

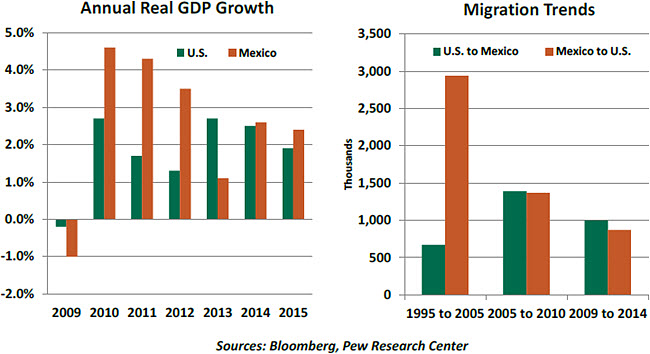

A study released late last year by the Pew Research Center reviews the evidence in detail. During the 50 years ending in 2015, an estimated 16 million Mexicans moved to the United States (legally and illegally). As with other migrations, new arrivals span the economic spectrum and come for a variety of reasons. Opportunity is certainly one of them; the relative strength of the U.S. economy over that time made it a preferred destination.

But in the years since the Great Recession, lower tiers of the job market have fared particularly poorly, with wages falling and opportunities hard to find. At the same time, the Mexican economic growth has been better than U.S. economic growth.

The recovery of North American auto sales has been a boon to production facilities in Mexico, which are responsible for about 20% of the continent’s car manufacturing. Tourism has thrived, thanks to the weak peso and some moderation in rates of violent crime. Mexico also has a substantial service sector, with telecommunications performing particularly well.

Mexican unemployment has fallen to less than 4%, and wages are rising by more than 4% annually. All of this in spite of the correction in oil prices, which has challenged the Mexican energy industry. Mexican companies are recruiting actively and offering enticements for workers to return.

Mexican unemployment has fallen to less than 4%, and wages are rising by more than 4% annually. All of this in spite of the correction in oil prices, which has challenged the Mexican energy industry. Mexican companies are recruiting actively and offering enticements for workers to return.

There are certainly a number of non-economic reasons why Mexicans have gone home; reuniting with family was cited as a major motivation in the Pew study. Many immigrants face challenges when assimilating to new communities and, as a result, consider returning.

As a result of all of this, about 1 million people left the United States. for Mexico between 2009 and 2015. The level of unauthorized Mexican immigrants in the United States is estimated to have fallen by more than 1 million people in the past decade. Border arrests are at 40-year lows. Illegal crossings into the United States still occur, but the broader trend is in the other direction.

Economic conditions run in cycles, of course. Mexico faces some important challenges in the year ahead; the weak peso has raised inflation and forced the central bank to increase interest rates. The government has been pursuing an austerity program to limit debt levels, which have doubled as a percent of gross domestic product (GDP) in the past decade. As an emerging market reliant on commodities, instability is a constant threat for Mexico.

Nonetheless, the northern migration seems to have stalled and even reversed. So a wall may be unnecessary…no matter who is asked to pay for it.

Making the Most of Monetary Policy

This month’s Bank of England (BoE) monetary policy package included a new plan to ensure the recent 25 basis point cut in interest rates is passed onto the real economy. It will be interesting to see whether the plan is successful in spurring economic activity.

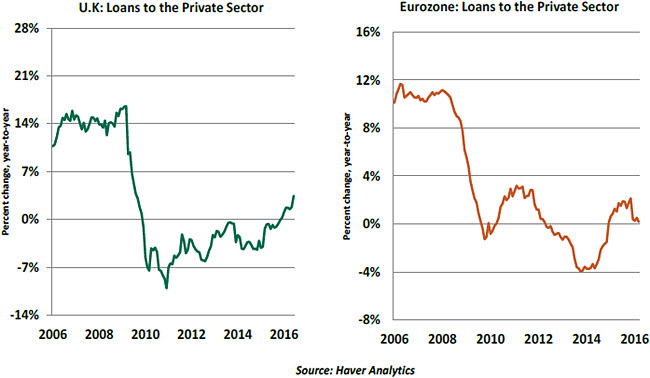

In Europe’s low (and in some places negative) interest rate environment, bank interest margins (the difference between the rate at which commercial banks borrow and lend) have come under pressure. Institutions have been reluctant to lower their deposit rates fully and have therefore kept lending rates high. As a result of the banks’ reaction, Margin compression results in a reduction in the supply of loans and defeats the purpose of easing monetary policy.

The BoE’s Term Funding Scheme (TFS) aims to ensure the base interest rate cut is passed on to companies and consumers by enabling banks to realize wider net interest margins in their lending activity. Under the program, the BoE will lend commercial banks up to £100 billion for four years at close to 0.25%, which is lower than current funding costs. This program requires banks maintain or expand net lending. If a participating bank’s level of lending falls, it will face the 0.25% interest cost plus a fee that increases linearly.

The BoE’s Term Funding Scheme (TFS) aims to ensure the base interest rate cut is passed on to companies and consumers by enabling banks to realize wider net interest margins in their lending activity. Under the program, the BoE will lend commercial banks up to £100 billion for four years at close to 0.25%, which is lower than current funding costs. This program requires banks maintain or expand net lending. If a participating bank’s level of lending falls, it will face the 0.25% interest cost plus a fee that increases linearly.

The European Central Bank (ECB)’s experiment with targeted longer-term refinancing operations shares similarities with the TFS. However, the eurozone’s program did not succeed in bringing about increases in bank lending.

The situation in the U.K. is different because the U.K.’s banking system and its economy are in a stronger position than those of the eurozone. Complementing the TFS, the BoE put in place two other measures that offered banks some capital relief, removing a constraint to balance sheet expansion. With weak capital levels, this step was not available to the ECB.

The multi-pronged approach to encourage bank lending seems promising, but as the BoE notes, expectations from TFS are modest. If Brexit (the U.K.’s referendum decision in June to exit the European Union) makes borrowers reluctant to extend themselves, small encouragements won’t matter.

Copyright © Northern Trust