Can Dividend (Swaps) Replace Bonds?

by Corey Hoffstein, New Found Research

Summary

- As a stand-alone asset class, dividends may make an interesting alternative to fixed income: they offer low volatility, are generally robust to market crises, and may serve as an inflation hedge.

- Accessing dividend strips was previously restricted to institutional investors, using over-the-counter swaps or exchange traded futures.

- For retail investors today, the ETF DIVY enables access to this market. But given the expectation fair pricing in the derivatives market, how and why do we expect to earn a dividend risk premium going forward?

Note: In this letter, we discuss the Reality Shares DIVY ETF. Newfound does not currently hold any position in this ETF. We are performing ongoing research into the product for potential use within our models, however we do not have any pending investment committee proposals that would add it to our models in the immediate future.

In recent commentaries, we’ve been discussing our unbundle and rebuild philosophy to constructing new-age core bond alternative portfolios. The concept is to break down bonds into four unique objectives – capital preservation, diversified growth, income generation, and crisis alpha – and build a unique non-bond portfolio that can meet each objective. Then, depending on our preferences, we can rebuild a portfolio by mixing together the sleeves we built.

A popular trend in the recent ZIRP world has been the use of (high) dividend paying equities as a bond alternative. The danger here, of course, is that equities are considerably riskier than bonds, so the marginal income bump comes with an excessive bump in realized volatility.

Dividends on their own, however, without the associated price volatility risk, could be an interesting asset class. They are generally less volatile than earnings, exhibit considerable robustness to market downturns (as companies are reluctant to cut dividends), and are generally seen as an inflation hedge.

On their own, they may make a perfect substitute for traditional fixed income – or at least fit well in the diversified growth sleeve.

In the early 2000s, the market began offering access to stripped dividends in the form of dividend swaps: a financial contract, traded over-the-counter, whereby two parties agree to swap the future realized dividends paid (either by a single name equity, basket, or index) for a pre-determined fixed amount of cash. As of October 2015, exchange traded dividend futures are now also available for the S&P 500.

Today, access to these contracts is open even to derivative-averse retail investors through an exchange-traded fund launched by Reality Shares (“DIVY”).

Have we found a solution to our bond problem?

A Brief Introduction to Swaps

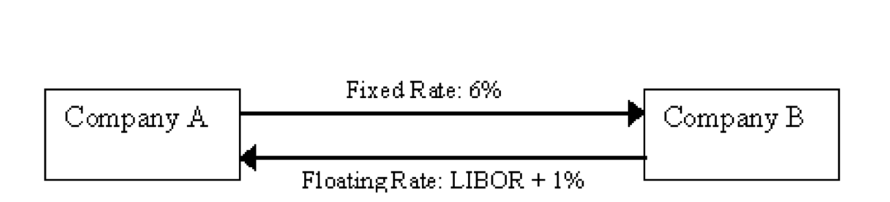

In its simplest form, a swap is a contract where two parties come together and agree to swap something at some time in the future.

Traditionally, swaps have what is called a fixed leg and a floating leg. The fixed leg has no uncertainty in the payment (beyond counterparty risk), while the floating leg is often tied to some variable financial instrument.

The text-book example of a swap is an interest rate swap. With a vanilla interest rate swap, the receiver of the fixed leg accepts a pre-determined, stable interest rate payment while agreeing to pay the receiver of the floating leg a spread above some variable base rate (e.g. LIBOR).

Source: Investopedia.com

Mr. Market, Make Me a Match

Swaps are structured to have zero up-front cost for the parties that enter them.

In the case of our vanilla interest rate swap above, there are two variables that have to be determined: the fixed rate and the spread above LIBOR. One leg will be set based upon the other. For example, if a party comes to the market trying to enter into an interest rate swap where they receive a fixed 5% rate, the spread in the floating rate leg will be determined such that the swap is zero-cost.

To be zero-cost, both sides have to think they are receiving a fair deal: the expected net present value of both sides has to be equal.

For a dividend swap, the two legs are a fixed payment and the realized dividends. If we go to market trying to offer our future realized dividends for a fixed payment, the fixed payment we are offered will be the market’s best guess as to what the fair value of all the future dividends will be.

If the guess is fair, the floating leg will benefit when dividends are larger than expected, but lose out when they are smaller than expected.

The Perpetual Dividend Swap and the Equity Risk Premium

Consider, for a moment, a theory you may have learned in your Finance 101 class: the price of a stock is equal to the net present value of all future dividends.

Based on this theory, if there existed a perpetual dividend swap where the floating leg receives all future dividend payments, then the net present value of the fixed leg must be equal to the price of the stock.

Given this equivalence when the contract is entered, a subsequent increase in the price of the stock implies that the swap underestimated future dividends, and so the fixed leg is being undercompensated. Conversely, a decrease in stock price implies that the swap overestimated future dividends, and the fixed leg is being overcompensated. The mark-to-market value of the swap for the fixed leg, then, should simply be equal to the change in value of the share price at the time the swap was struck and the current share price.

Now consider that we generally expect to earn a risk premium for holding stocks: over the long run, we expect the price to appreciate faster than the risk-free rate.

Since the floating leg benefits from price increases, we can say that we also expect this leg to earn the equity risk premium. The fixed leg, then, is explicitly paying this risk premium to have its losses insured.

From Equity Risk Premium to Dividend Risk Premium

Perpetual is not a time period most people like to operate over. It should come as no surprise that dividend swaps are typically offered at fixed, shorter terms normally between 1 and 10 years.

The fixed nature of these swaps change the dynamics. Like with bonds, as maturity falls, so does duration. In this case, however, it is dividend duration: the sensitivity to changes in expected future dividends.

While a longer-term dividend swaps may look like equity, a short-term dividend swap looks more like a bullet bond payment – especially since dividend payments tend to be fairly well estimated (based on corporate guidance) close to a year before they are paid. Therefore, as the maturity of a swap decreases, so does the exposure to the equity risk premium.

Yet short-term swaps appear to exhibit their own unique risk premium – and a rich one at that.

In Risk and Return of Short-Duration Equity Investment (Cejnek and Randl, 2014), the authors construct a rolling 1-year dividend swap strategy and find a puzzling result: the approach earns a significant return premium. To quote,

“The result is even more puzzling in the light of the fact that a substantial amount of dividends that are to be paid in one year’s time are announced the year before. So there is very good visibility in terms of the expected level of realized dividends. Since most dividends for the next year have already been announced, the gradual increase in dividend swap strikes is similar to the pull to par effect of a bond, despite the fact that equity investors only have residual claims on company profits. It seems that the moderate dividend risk of the one-year maturity strategy offers investors a disproportional realized risk 8 premium.”

Where does this premium come from?

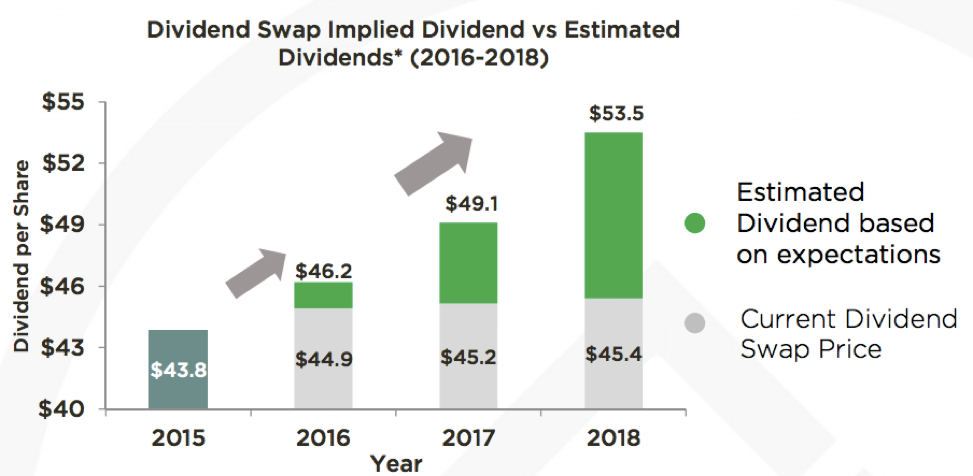

Consider the difference in implied versus estimated dividends in 2017 (estimated as of 3/31/2016). The gray bar reflects implied dividend levels from current swap prices; the green bar reflects estimated dividends from bottom-up estimates.

Source: Reality Shares.

In fact, dividend growth estimates are suppressed going out well into the 2020s compared to the long-run average of 6.5%.

Source: Reality Shares

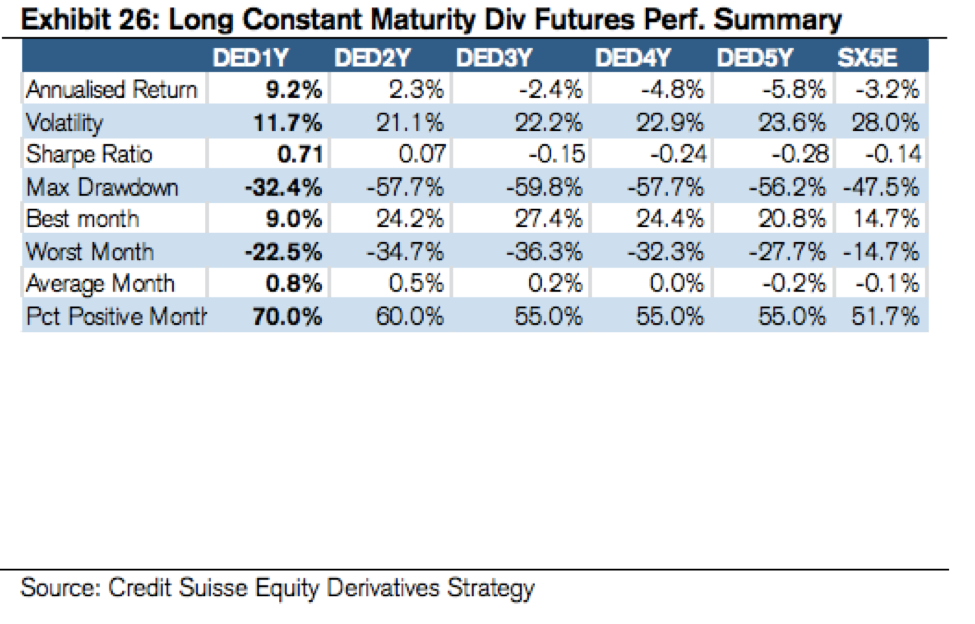

The premium captured by a rolling short-term swap strategy would be the realized dividends minus the implied. In this case, a fairly significant difference. In a 2013 equity derivatives strategy commentary, Credit Suisse estimated the dividend risk premium from this sort of strategy to be as high as 10%.

So what gives?

Explaining the Dividend Risk Premium

One answer for why dividend futures typically trade at a discount to forecast levels is due to the perceived risk of negative dividend surprises.

In practice, this could happen for three reasons.

The first is that investors simply systematically overestimate the risk of dividend cuts.

The second is that investors underestimate the benefits of diversification against dividend cuts in indices.

The third is that dividend growth exhibits negative skew, and so the floating leg demands a higher premium to offset the risk that the negative surprises will dramatically outsize the positive ones.

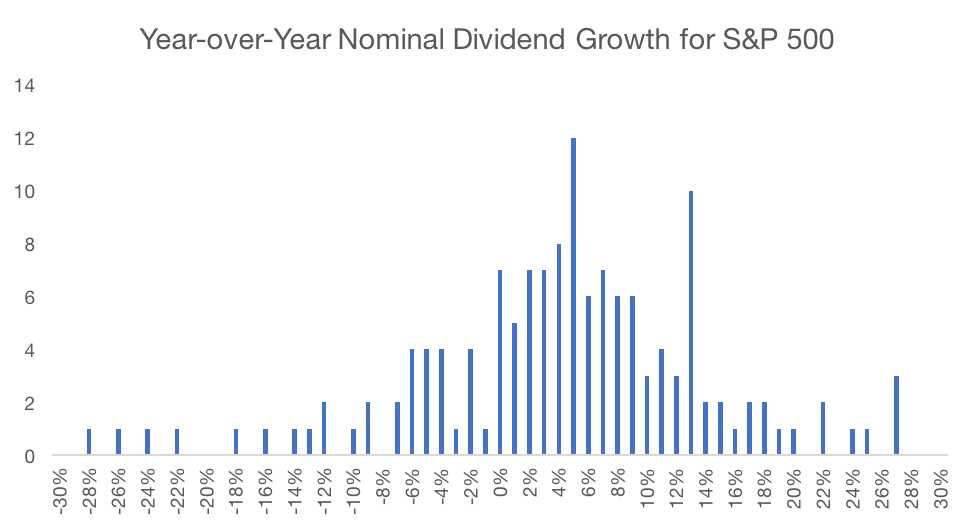

Data Source: Robert Shiller. Calculations by Newfound Research. Year-over-year nominal dividend growth is calculated as the December-to-December change in trailing twelve month dividends.

In evaluating independent year-over-year nominal dividend growth levels, we can see slight skewness in the data (a skewness measure of approximately -0.3). This lack of symmetry may cause floating leg purchasers to demand a lower fixed leg to compensate their risk for insuring against these outsized losses. Hence the market looks like it is consistently underestimating future dividends, when in reality the fixed leg is just paying an insurance premium to the floating leg.

Considering that a 1-year dividend cut is much more meaningful in the case of a 1-year swap than it is for a perpetual swap, the investor in the floating leg of the 1-year swap will likely require greater compensation for that risk.

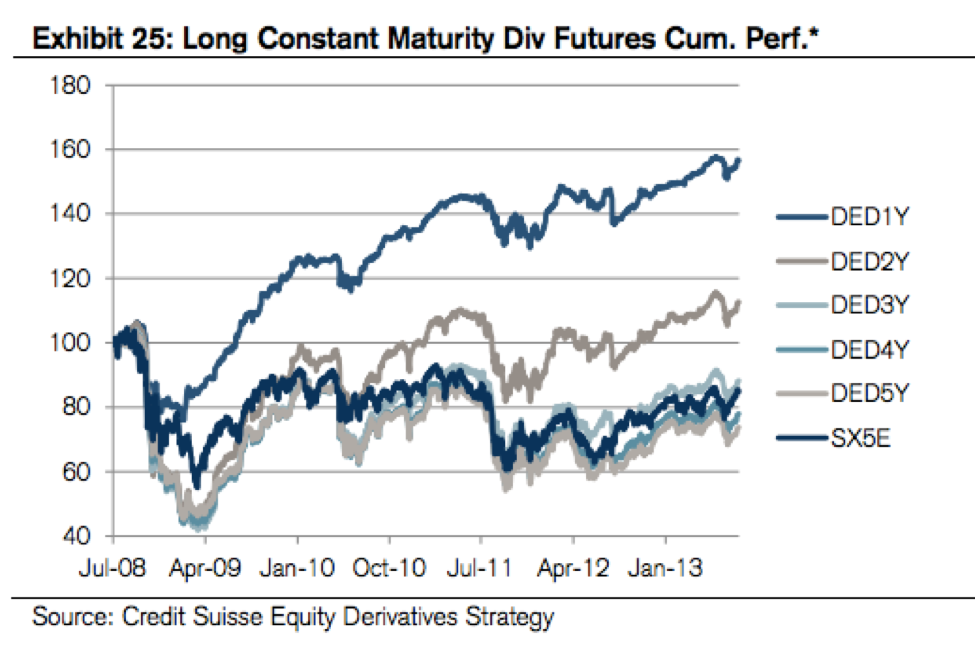

We can see, below, a simulated 1-year constant maturity dividend futures strategy (on the EURO STOXX 50). While it trounces the benchmark index futures strategy, it still exhibits a -32.4% drawdown, representing the significant left-tail potential of dividend cuts.

A final potential explanation of the dividend risk premium is structural. The derivative desks of banks are natural sellers of dividend risk and may create a mismatch between supply and demand in the market. Credit Suisse estimates that this overhang may cause a mispricing as large as 4.7% per year.

Conclusion

Dividend strips could be an incredibly interesting alternative to core fixed income. They would be less volatile than equities, more robust to the market’s animal spirits, and potentially serve as an inflation hedge.

Today, retail investors can tap into this market using the ETF DIVY, which holds a mix of dividend swaps and futures. While longer-term swaps share many similar risk characteristics to equities, short-term swaps and futures – like those held in DIVY – exhibit their own unique dividend risk premium.

That said, the jury here at Newfound is still out for as to exactly why this premium seems to exist. Investors rarely willingly give away free return.

If the source of this premium is a systematic overestimation of dividend cuts, unless that overestimation comes from a persistent behavioral bias, it will likely correct. Similarly, for underestimating the benefits of correlation. The correction may come in two forms. First, the fixed leg purchasers may adjust their behavior, recognizing their perpetual underestimation. Second, an influx of purchasers of the floating leg may enter the market, seeking to exploit this mispricing. An increase in demand for the floating leg would drive up the price paid for the fixed leg to the point it converges with the bottom-up estimates.

If the premium comes from the negative skew exhibited by year-over-year dividend changes, then the return is simply compensation for risk and we should be aware of the downside potential if those risks are realized.

Finally, if the result is structural, then it may be a result that eventually erodes as more participants step up to invest in the floating leg, helping right size the supply and demand mismatch in the market.

DIVY is certainly a unique instrument – one we think is well worth further consideration. Without a clearer understanding as to why the dividend return premium exists, however, or why we can expect it to persist, replacing the majority of our core bond exposure with DIVY is likely ill-advised – particularly given the high drawdown levels of simulated results in the EURO STOXX 50 dividend futures market.

Nevertheless, we’ll be keeping this one on our radar.

Copyright © Newfound Research