Better Times Ahead

by Carl Tannenbaum, and Asha Bangalore, Northern Trust

The U.S. economy went through a soft patch in the first quarter. Seasonal adjustment issues played a small role in tipping growth to the soft side. More importantly, a positive outlook for the rest of the year remains in place.

One of the key developments is that the January global market turbulence is behind us, for now. Key economic indicators in major economies maintain a forward momentum for the most part. U.S. economic growth during the rest of the year is predicted to advance at a decent clip.

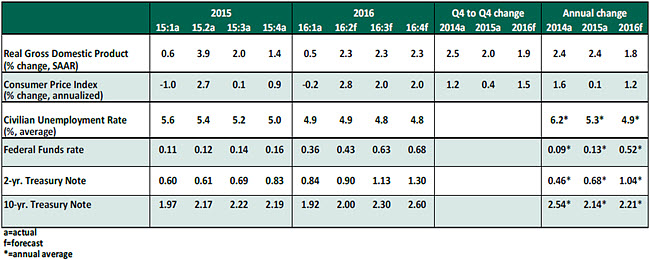

Key Economic Indicators

Key Elements of Forecast

- Consumer spending is predicted to advance at a stronger pace in the second quarter after a 1.9% increase in the first three months of the year. Auto sales fell in March and trimmed consumer spending, but they turned around in April. Income growth is solid, which supports expectations of an increase in consumer spending in the second quarter.

- The magnitude of the decline in business spending during the first quarter was a surprise. Outlays on structures have dropped for three straight quarters. Equipment expenditures fell 8.6%, the largest in the current expansion. Total real business fixed investment including both these components and intellectual property slipped 5.9% in the first quarter. This reflects weakness not only in the oil-related industry but also high-tech, industrial and transportation components. It should be very safe to say that this performance will improve and be less of a drag on growth in gross domestic product.

- Real residential investment expenditures posted significant increases in the last two quarters. Low mortgage rates and favorable employment conditions bode well for continued growth in the housing sector. The Pending Home Sales Index advanced in February and March. This index leads actual existing home sales by one or two months. Single-family housing starts rose at a 20% annualized rate in the first quarter, but multifamily construction was weak. Permit extensions for the former grew and suggest that housing activity will maintain an upward trend in the months ahead.

- The April employment report showed a lower, but still solid, increase in payroll employment. The 160,000 increase in hiring is below the gains seen in recent months, but it is still far above the level required to keep the jobless rate steady. Hourly earnings rose 2.5% from a year ago compared with smaller increases seen for an extended period. The unemployment rate held steady in April at 5.0%, which is within the range of what is considered as full employment, and seems to be on an upward trajectory. The rate at which workers are quitting their jobs for better ones now matches the readings seen before the onset of the recession. The share of long-term unemployment has dropped, and there are fewer part-time workers who would prefer to work full-time.

- The Fed has nearly met its full-employment mandate and is making progress on the inflation front. The personal consumption expenditure price index rose 0.8% from a year ago in March and the corresponding core price gauge, which excludes food and energy, increased 1.7% in the same period. Inflation expectations increased about 60 basis points from the low seen three months ago, continuing to track oil prices very closely. Continued forward momentum of the economy should result in higher inflation in the near term.

- The 10-year U.S. Treasury note is trading at 1.76%, down about 20 basis points from two weeks ago. It appears that markets have not fully removed the downside risks to the global economic outlook. The minutes of the March Federal Reserve meeting noted that the “underlying factors abroad that led to a sharp, though temporary, deterioration in global financial conditions earlier this year had not been fully resolved and thus posed ongoing downside risks.” The Fed revised this view at the April meeting and downgraded the importance of the financial conditions. The absence of significantly bearish fundamental global economic data is underappreciated at present.

- The next Federal Reserve meeting is June 14-15. All upcoming economic reports will be under more-than-usual scrutiny. Markets have almost removed a June policy hike from the radar screen, but recent comments from Fed officials indicate that a June rate increase is still on the table. The data-dependent Fed will have enough evidence for a lively debate about the path of monetary policy at the meeting. It is premature to rule out the possibility of a higher policy rate in June.

Copyright © Northern Trust