by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Tuesday March 29th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points in pre-opening trade. Investors are waiting for a speech to be made by Federal Reserve Chairperson Janet Yellen at Noon.

Lions Gate added $0.27 to $21.83 after Pacific Crest initiated coverage with an Overweight rating and a $27 target.

Chipotle slipped $10.30 to $465.01 after Wedbush downgraded the stock to Underperform from Neutral. Target is $400.

Lennar added $1.59 to $48.29 after reporting higher than consensus first quarter revenues and earnings.

MMM (MMM $166.00) is expected to open higher after issuing positive long term earnings guidance.

Foot Locker added $1.12 to $66.32 after its shares were added to the S&P 500 Index this Friday. Foot Locker replaces Cameron International.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/28/stock-market-outlook-for-march-29-2016/

StockTwits Released Yesterday

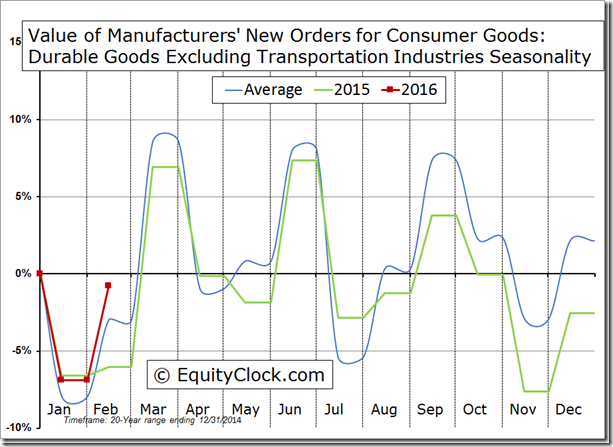

Excluding transportation, new orders for durable goods is trending above the seasonal average so far in 2016.

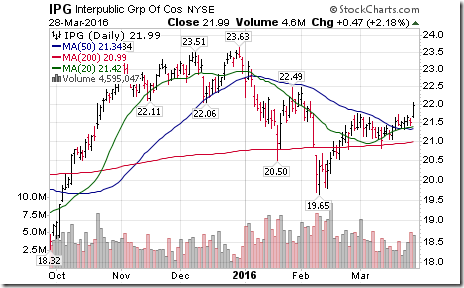

Technical action by S&P 500 stocks to 10:00 AM: Quiet. One stock broke resistance: $IPG. None broke support.

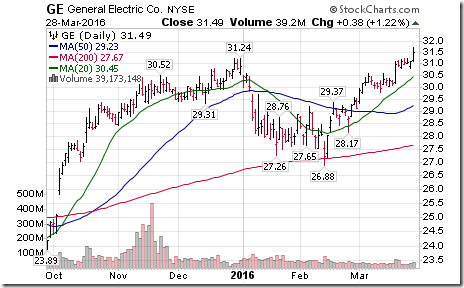

Editor’s Note: After 10:00 AM, technical action remained quiet. Additional breakouts: General Electric and Robert Half. Breakdown: GameStop

Nice breakout by General Electric $GE above resistance at $31.24 to reach a 14 year high.

Trader’s Corner

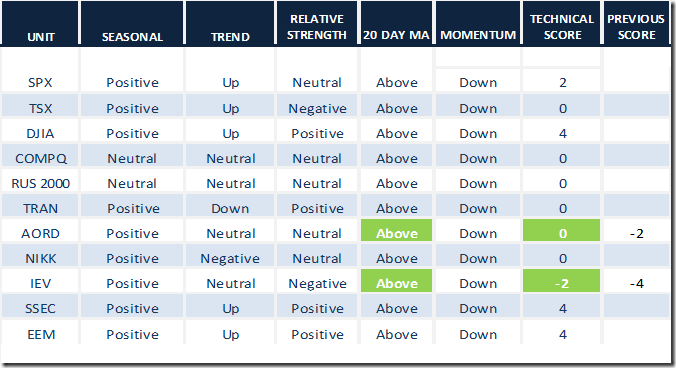

Daily Seasonal/Technical Equity Trends for March 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

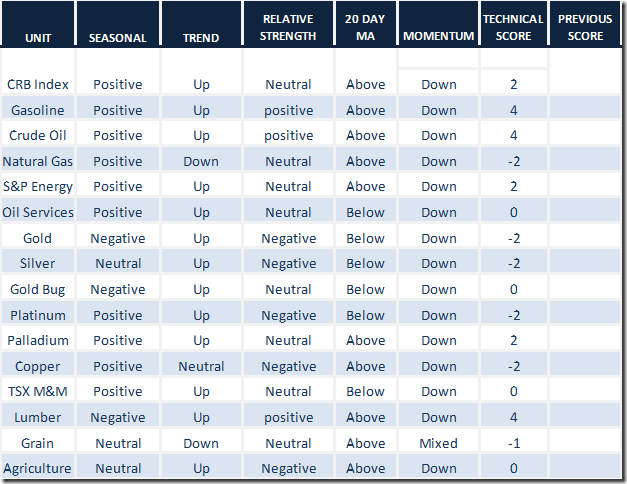

Daily Seasonal/Technical Commodities Trends for March 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

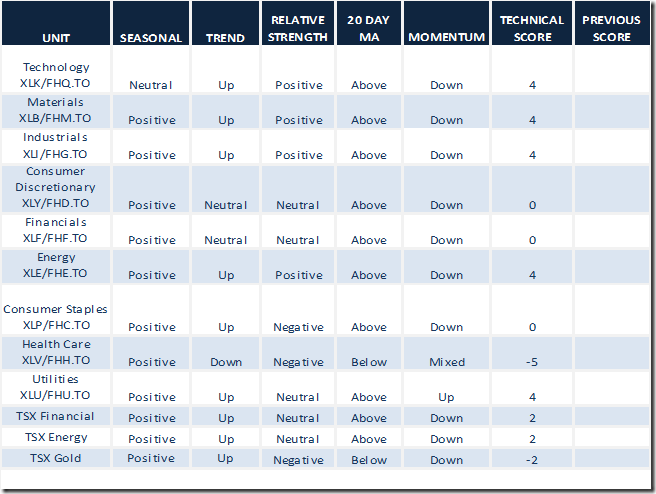

Daily Seasonal/Technical Sector Trends for March 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca