For the Love of Mobile Money in Frontier Markets

by Equity Research, AllianceBernstein

With a simple cellphone text, a dairy farmer in a remote African village can receive cash for the milk he sells, pay his farmhands and buy supplies. It’s called mobile money and it’s reshaping financial services across the developing world.

Mobile money–transfer services are taking off in many lower-income countries in sub-Sahara Africa, Southeast Asia and Latin America, offering millions of people a faster, safer, cheaper and more convenient way to send and receive cash. As an instrument of financial inclusion and broader economic development across smaller emerging economies, these platforms offer investors an exciting growth opportunity that is still in the embryonic stages.

Welcome to Bankless Banking

The poster child of the mobile-money boom is Kenya’s M-Pesa, launched by Safaricom, one of the country’s largest wireless service providers. Unlike similar services in the developed world, M-Pesa users don’t need a bank account, credit history or even very much money. All they need is a basic mobile phone and access to M-Pesa’s network of 85,000 agents (typically a corner store selling airtime) across Kenya. Think of this agent network as a giant grid of human ATMs.

Cellphones are driving the boom. In many smaller emerging countries, cellphone ownership significantly exceeds that of credit cards and bank accounts. Lower costs also help. In Kenya, the cost of a bank transaction at a branch is US$1, versus a nickel using a mobile platform. Though Pakistan has only 47 credit card readers per 100,000 adults (versus the global average of 473), merchants overcome this limitation by accepting payments over the phone. These advantages enable mobile-money services to attract customers that would otherwise be shut out of formal payment and banking channels.

A Gateway to Advanced Financial Services

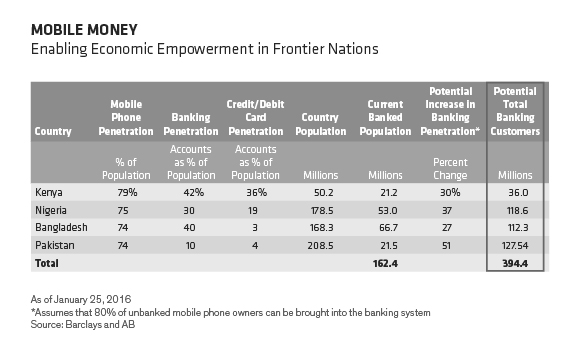

Mobile money is capable of transforming banking systems in frontier countries. Assuming that 80% of the unbanked mobile phone owners in Kenya, Nigeria, Bangladesh and Pakistan are “bankable,” we estimate that these services could more than double the number of banking customers in those four nations (Display).

Mobilizing Investment Opportunities

So what’s the best way for investors to access this emerging-growth story? Most mobile-money platforms are a part of the services offered by telecom firms (e.g., Safaricom, Senegal-based Sonatel or Zimbabwe-based Econet Wireless) or banks (e.g., Kenya’s Equity Bank or Bangladesh-based BRAC Bank). For investors, it’s important to assess the value of these businesses in the early stages.

We think first-mover platforms offer the greatest growth potential. These players have already devoted the investment and time (sometimes years) to building out their agent networks, attracting an ample customer base and forging a trusted brand. They are best positioned to expand beyond person-to-person money transfers into other parts of the financial ecosystem, including business-to-business payment processing, savings and loans, e-commerce, mobile advertising and data analytics.

The Multiplier Effect

As they leverage powerful network effects, mobile-money platforms of scale should be a source of rapid revenue growth as stand-alone businesses for telecoms and banks, in our view. They can also drive revenue synergies and cost savings in core business lines.

We estimate that lower customer churn and airtime distribution expenses can slash a telecom’s cost of sales by up to 25%. For banks, mobile-money services offer a much cheaper way to draw new customers than opening a new branch, and are an extra source of fee income, cheap deposits and loan growth.

The potential is enormous. Our research suggests that a typical telecom’s mobile-money business can dramatically increase its revenue over five years by expanding the service to half of its existing customer base (Display). These assumptions are based on feedback from companies and growth patterns of similar services in more mature markets.

Obstacles to Growth

The hurdles to success are formidable. M-Pesa’s extraordinary growth notwithstanding, most mobile-money initiatives have been failures.

That’s because beyond company execution and first-mover advantages, success has been dependent on a mix of local regulatory, cultural and social conditions, which vary greatly from country to country. So financial and telecom regulators must work together to develop clear and flexible frameworks to foster innovation and mobile-money network expansion. Consumer uptake will likely be strongest in countries like Nigeria, Bangladesh and Pakistan, where cash transactions still rule and where banks don’t have a strong presence—but cellphones do.

In those cases, we see mobile money ultimately becoming the backbone of the financial system, accelerating growth and economic empowerment—and opening up robust, new opportunities for investors.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Research Analyst—Emerging Markets Equities

Christine Phillpotts is a Research Analyst covering sub-Saharan Africa for AllianceBernstein’s Emerging Markets portfolios, including the Next 50 Emerging Markets Fund. Prior to joining the firm in 2013, she was the global portfolio manager for the Grassroots Business Fund (GBF), which invests in privately held companies in emerging and frontier markets. While at GBF, Phillpotts sourced, structured and supervised investments across several countries, including Kenya, Tanzania, Zambia, Ghana, Rwanda and Mozambique. As a member of the fund’s internal investment committee, she also assessed and approved transactions in Latin America and Asia. Before that, Phillpotts was an equity research associate at J.P. Morgan Asset Management. She holds a BA in economics from Columbia University and an MBA from Harvard Business School. Phillpotts is a member of the board of directors of the New York Society of Security Analysts. She is also a Robert Toigo Foundation Fellow and a CFA charterholder. Location: New York

Chief Investment Officer—Emerging Markets Value Equities

Henry S. D’Auria is the Chief Investment Officer of Emerging Markets Value Equities, a position he has held since 2002, and Portfolio Manager for the Next 50 Emerging Markets Fund. He served as co-CIO of International Value Equities from 2003 to 2012. Prior to that, D’Auria was one of the lead architects of the firm’s global research department, which he managed from 1998 through 2002. Over the years, he has also served as director of research of Small Cap Value Equities and director of research of Emerging Markets Value Equities. D’Auria joined the firm in 1991 as a research analyst covering consumer and natural gas companies, and later covered the financial-services industry. He was previously a vice president and sell-side analyst at PaineWebber, where he specialized in restaurants, lodging and retail. D’Auria holds a BA in economics from Trinity College and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein