Do People Want to be Fooled?

by Michael Batnick, The Irrelevant Investor

“Magicians are the most honest people in the world. They tell you they’re gonna fool you, and then they do it.”

-James Randi

I recently watched “An Honest Liar” on Netflix, which is the story of The Amazing Randi, a magician and escape artist who dedicated his life to unveiling the charlatans. He went on a crusade, targeting the “psychics” and faith healers and exposed them for the con artists that they were.

In the film, there was a scene where Peter Popoff, a self-proclaimed prophet and faith healer was speaking to a room full of people.

When he calls out for Rosa and Kipper, a woman and her child stand up. “You have a lump in your chest? Stand up! God’s gonna burn that thing out right now!”

How could this stranger know about this boy’s illness? Is God speaking directly to him? Well no, but his wife is, right into his ear. We hear her say into a hidden earpiece “Hello Petey, can you hear me? If you can’t, you’re in trouble.”

Randi couldn’t sit by and watch these people be taken, conned out of their money and filled with false hope. He exposed these thieves, freeing his victims from the illusion that they or their loved ones were about to be healed.

But then a funny thing happened.

The crowd turned on Randi. It turns out that people actually wanted to be lied to. These poor, dying people needed the illusion of a higher power. The fact that their wishes were being granted by a snake-oil salesman was no concern of theirs.

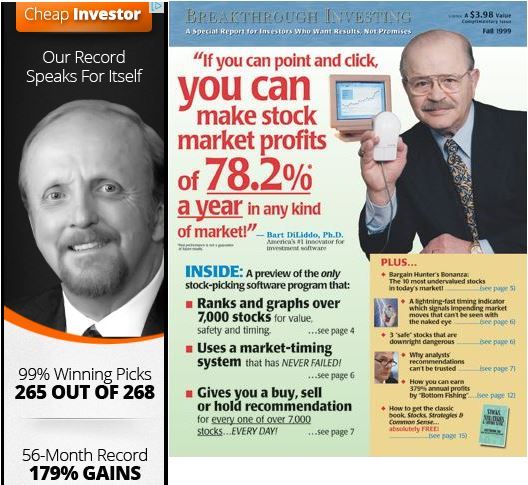

There are many parallels between the world of cheap magic and finance. People are often being swindled by the promise of ridiculous returns. There is an endless supply of financial magicians out there, exhibit A, these guys.

The brilliant Jason Zweig, The Amazing Randi of finance, recently touched on the topic of people who want to be deceived.

“Three ways to get paid for your words:

1) Lie to people who want to be lied to, and you’ll get rich.

2) Tell the truth to those who want the truth, and you’ll make a living.

3) Tell the truth to those who want to be lied to and you’ll go broke. ”

There is a gigantic pool of people out there who want to be believe in the unbelievable. They want to be told that they can beat the market.

I’m putting on my Amazing Randi hat and calling out a “white paper” I recently came across. This is from a large asset management company which manages almost $100 billion. Below, I highlight some true, yet deceptive claims.

“Active management has typically outperformed passive management during market corrections, because active managers have captured alpha on the upside.”

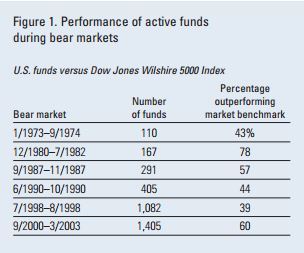

Not true. In a study by Vanguard conducted in 2008, they found that actively managed U.S. funds have outperformed the broad market in just three out of the six previous bear markets. Note that in 2008, 54.3%, 74.7% and 83.8% of all large-cap, mid-cap and small-cap funds underperformed the index.

It turns out that the percentage of funds outperforming during bull markets (in brown) has yet to exceed 50%, refuting the statement that “active managers have captured alpha on the upside.”

“When the current bull market inevitably turns, passive managers could be left holding stocks and sectors with poor fundamentals and inflated valuations. Meanwhile, active managers have the ability to mitigate risk by reducing exposures to expensive areas that will be hit hardest, and conversely, increase exposure as sectors or asset classes recover to capture upside as the new market cycle begins.”

What is this gobbledygook?

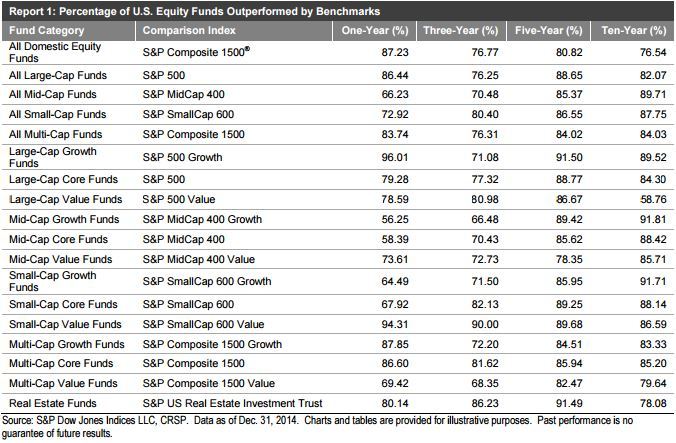

Being that we don’t know when the bull market will “inevitably turn,” why don’t we look at some actual numbers. Not a single actively managed mutual fund style has outperformed their benchmark over the last one-year, three-year, five-year or ten-year period.

“Facts are facts, whether you’re an active or passive manager.”

Alright, this is true.

“In the funds lineup, 21 out of 36 equity and fixed-income funds outperformed their largest ETF competitor during two or more of the following time periods: Year to date, 1 year, 3 year, 5 year, and 10 year.”

Wow! It’s pretty impressive that they’ve managed to outperform in at least two of those time periods. Oh wait a minute, if we take a closer look, there are five time periods. Suddenly, 21 out of 36 funds outperforming in at least two out of the five time periods isn’t so impressive.

Here is the mother lode of suspicious claims.

“From 2000 to 2009, active outperformed passive nine out of 10 times.”

They’re not lying, it’s just a sleight of hand. What you’ll see in the disclaimer, which is of absolutely no use to the laymen, is that their active funds are “made up of funds from the Morningstar Large Blend category that are not index or enhanced index funds.” What this means is, and I don’t know how they’re quantifying this, is that outright index funds or managers that closely resemble index funds are eliminated from inclusion. Fine, that makes sense. But then, they cross the line. They compare these funds to the “Morningstar S&P 500 Tracking Category.” I don’t know what’s in here, but I do know it’s an expensive way to represent the S&P 500.

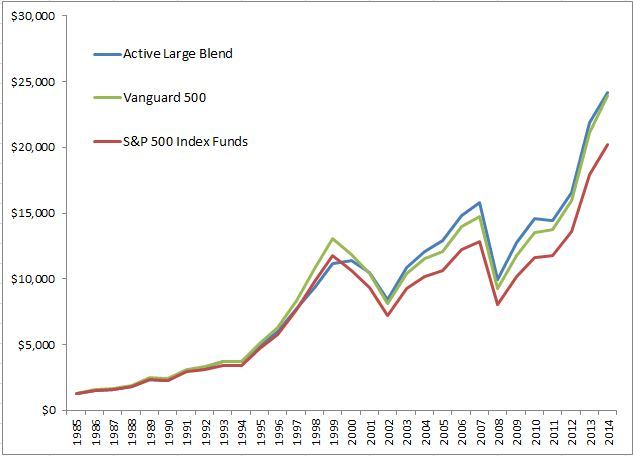

The S&P 500 proxy they used (below in red) underperformed the Vanguard 500 by 0.63% a year from 1985-2014. The active large blend funds they’ve selected sure seem to be cherry-picked, based on the fact that they outperformed the cheap index over a 30-year period. I just don’t buy this. I’d love to know what percent of funds have been excluded from their composite.

Which brings us to the people on the other side of the table. The people who want to be lied to.

Most investors don’t want to be told to expect average returns. Who wants to be average? Surely you can do better if you try a little harder. Unfortunately, there is a really bad misconception that market returns aren’t going to cut it. With investing, being average can actually be extraordinary. My partner Ben Carlson recently showed that the worst thirty-year period ever for the S&P 500 was 850%! Don’t be fooled, if only people were able to receive average returns over the course of their lifetime they would do fantastic!

Lest anyone misconstrue what I’m trying to say, here are a few caveats:

- I have no idea what stock returns will be over the next thirty years. It’s entirely possible that we experience worse returns going forward than we have in the past.

- I’m a big believer in active management, there are some amazingly talented people out there.

- The vast majority of people in the financial services industry are not trying to deceive their audience.

Copyright © The Irrelevant Investor