Does the FOMC decision matter much to markets?

by Cam Hui, Humble Student of the Markets

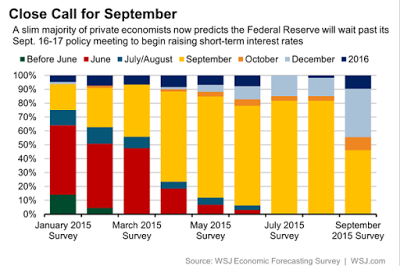

This week, all eyes are on the FOMC announcement Thursday, where there is some actual suspense as to the interest rate decision. The latest WSJ survey indicates that 46% of forecasting economist expect a rate hike in September, though the market implied forecast is lower at around 30%.

About 46% of business and academic economists surveyed over the past week by The Wall Street Journal predicted the Fed’s first rate increase would come at the Sept. 16-17 policy meeting. While a plurality picked September, a majority predicted liftoff would arrive at some later meeting. About 9.5% said the Fed would lift off in October, while 35% said the first rate increase would come in December and 9.5% said the central bank would wait until 2016.

Barron`s believes that the decision is too close to call but considerable angst remains in the fixed income markets:

Only the bond market has been unequivocal: It doesn’t want or expect a rate hike. Traders have kept rates low at the short end of the yield curve. Fed-funds futures signal a less than 30% chance of a September move. The reigning bond king, DoubleLine Capital’s Jeffrey Gundlach, invoked The Rocky Horror Picture Show when he said recently, “Dammit Janet, don’t raise rates,” while pointing to a host of reasons for waiting—slowing China, crashing commodities, scant inflation, to name just a few.

What happens if the Fed does hike rates for the first time in nine years? After all, a 25% chance is still pretty decent odds, notes Anthony Valeri, an investment strategist with LPL Financial.

Markets could get ugly fast. Rates at the short end would rise sharply, and riskier assets—junk bonds and investment-grade corporate bonds—would get hit, and stocks, too. There’s a chance longer term Treasuries might hold up better since they are priced off inflation expectations, which would tumble. However, yields are already low, so don’t bet on it. “There would be few places to hide,” Valeri says.

Jim Kochan, Wells Fargo Asset Management’s chief fixed-income strategist, also sees risk. “The Treasury market is not well-positioned for rising short-term rates,” he says, noting that Treasuries saw weak bids in August even when the stock market was tanking and fears that China would spark global recession were highest. “That could be a warning that if there were some selling pressure, the market reaction might be more adverse than expected,” he says.

Indeed, BIS has warned of a banking crisis on the horizon for Brazil, China and Turkey, which will not be helped by rising US interest rates (via Bloomberg):

Credit growth in China, Brazil and Turkey doesn’t only risk spurring a hangover in bad debt -- it also signals a banking crisis is on the horizon, according to the Bank for International Settlements.

A ratio of credit to gross domestic product, a measure of how much private-sector credit has deviated from its long-term trend, stands at 25.4 percent in China, BIS said in a report on Sunday. That’s the highest of any major economy and compares with 16.6 percent in Turkey and 15.7 percent in Brazil.

“Early warning indicators of banking stress pointed to risks arising from strong credit growth,” according to the bank. Historically, a country with a ratio above a 10 percent threshold has a two-thirds chance of “serious banking strains” occurring within three years, BIS said.

Liftoff worries are so last month...

For the equity markets, the implications of the rate decision is less clear. Jon Hilsenrath wrote that the members of the FOMC are going into this meeting deeply divided:

Federal Reserve officials aren’t near an agreement to begin raising short-term interest rates heading into a crucial week of private discussions before their Sept. 16-17 policy meeting, according to their recent comments.

If we were to see liftoff at the September meeting, the Fed has long signaled that the pace of interest rate normalization will be measured, slow and highly “data dependent.“ If, on the other hand, Yellen cannot get the committee to reach a consensus, there is a middle ground default position (emphasis added):

The Fed’s decision isn’t a binary one—to act or not to act. Before every policy meeting Fed staff economists present officials with a variety of choices, typically three, including middle-ground options that navigate between Fed “hawks” who lean away from low interest-rate policies and “doves” who support easy money.

A middle-ground choice now could involve signaling more strongly the Fed’s intent to raise rates this year once officials become comfortable recent market moves aren’t a sign of deeper problems in the global economy.

Either way, the market focus would start to shift to the overall pace of interest rate hikes in the next year. Worrying about the liftoff date becomes sooo last month.

What would you prefer?

So, if you were a stock market bull, what would you prefer?

- Hawkish pass: A delay in rate normalization, with a signal that the Fed would raise rates once it becomes more comfortable that the global economy isn't falling apart and therefore an October or December hike is on the table; or

- Dovish hike: A 25bp hike, with repeated assurances in the press conferences that the pace of normalization would be slow and measured, which the market would likely interpret as December being off the table and possibly "once and done"?

Personally, I would rather see the rate hike now. Let`s get it over with as the American economy is strong enough to withstand a measly 25bp increase in short rates. Option 1 would leave me start wondering whether the global growth risks that tanked stocks in August are more serious than thought.

Regardless of what the FOMC decides, the stock market implications are not necessarily binary, where a delay is bullish and a hike is bearish. The market reaction to a dovish hike and a hawkish pass are likely not that different. I therefore believe that the odds favor a modest bullish tilt going into the FOMC interest rate announcement.

Copyright © Humble Student of the Markets