by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

I believe the plunging of the commodity complex is telling us that the China economy could be imploding. Problems stemming from China are spreading further into more sectors and markets (various high yield sectors, emerging markets, EM and commodity currencies).

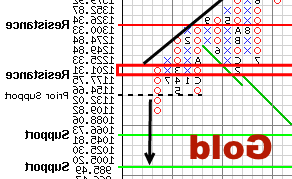

As I wrote in my note Tuesday (Too Much of Everything), Zero interest rates have contributed to over-production, pressuring consumer prices lower. Certainly, borrowing in the energy sector contributed to the over-supply of oil and look what has happened in that sector. Now, weakening demand from China is accelerating the decent in most commodities. Budgets of EM supplier-countries and commodity exporters are being materially impacted.

As commodities fall, the FOMC says that inflation targets are harder to obtain, leading to a self-perpetuating belief that continued cheap money is needed.

Yet, claims fell to the lowest level since 1973, housing is strong, and auto sales are back to almost 17mm units (etc). Clearly, the Fed has gotten itself into a difficult position. By not lifting-off and taking their medicine in 2014 – market imbalances today are now bigger and the consequences greater.

China is unfolding as the most important story of 2015 for markets. Stay alert. Long-dated US Treasuries remain attractive and good place to hide.

Guy Haselmann | Capital Markets Strategy

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Scotiabank | Global Banking and Markets

250 Vesey Street | New York, NY 10281

T-212.225.6686 | C-917-325-5816

guy.haselmann@scotiabank.com

Scotiabank is a business name used by The Bank of Nova Scotia