A Deep Dive Into The Women-Run Hedge Funds Universe by Financial Women's Association

Executive Summary

All too often conversations about women in asset management center on their absence rather than their success. Discussions regarding the representation of women in the industry have a tendency to overshadow the performance and characteristics of those women who are successful in the field. Unfortunately, up until this point little data examining that performance has been available, particularly in the opaque world of Hedge Funds.

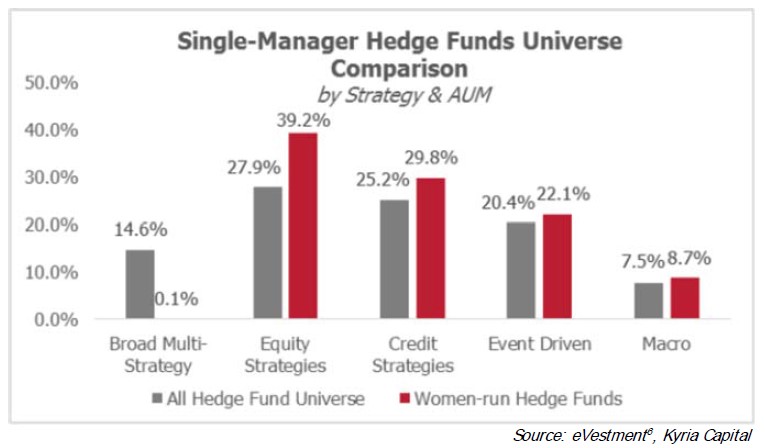

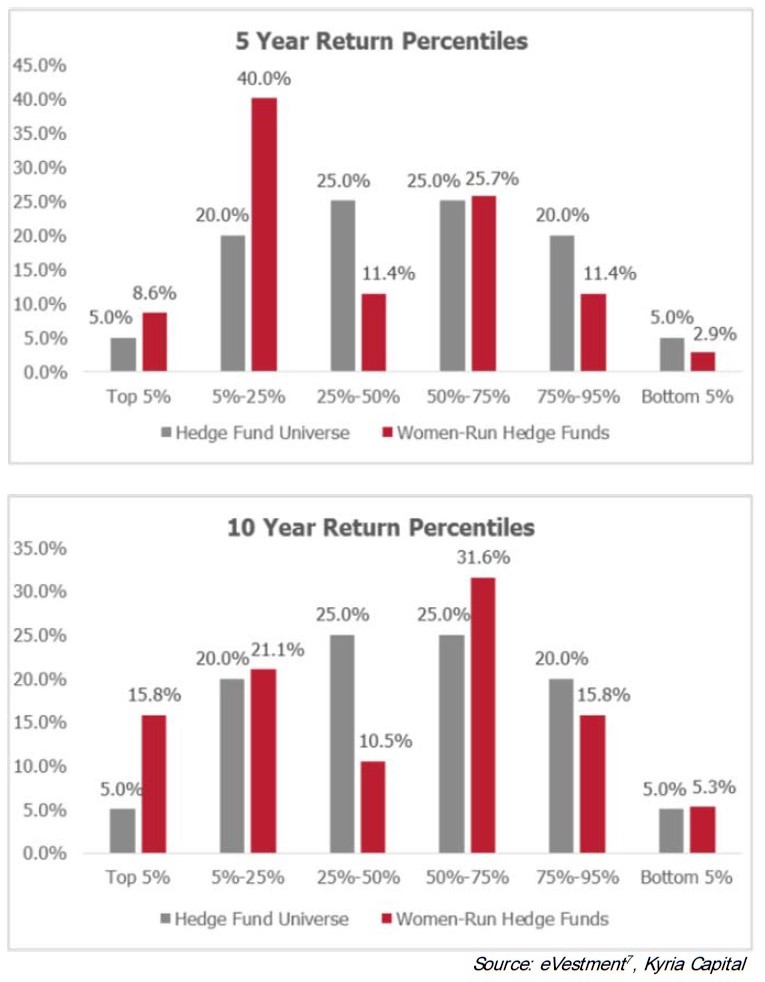

There are approximately 150 to 200 women-run hedge funds currently in existence. These funds are comparably distributed based upon size versus the overall hedge fund universe. The womenrun cohort shows a moderate skew by strategy, particularly favoring equity strategies to the detriment of broad multi-strategy funds. In reviewing their performance, a sizeable skew exists by quartile distribution. Women-run funds show a significantly higher presence in the top quartile of performance over the past decade.

By constructing an index of women-run hedge funds, we observe that these funds post compelling risk and return statistics. These statistics are persistent over a variety of time periods and market conditions. Importantly, efficiency ratios show higher return per unit of risk in every environment tested.

Academic research and industry studies have long examined the behavioral differences between the genders. In considering the concept of downside protection, the drawdown experience of women-run hedge funds during the financial crisis was both shallower and significantly shorter than the broader hedge fund industry. This provides some evidence of consistency with academic studies.

The practical application of this research is best observed when replicating a portfolio inclusive of these managers. By combining women-run hedge funds into a portfolio with a large, multi-strategy fund of funds, improvement is seen in the performance of the balanced portfolio on all but a few metrics. As a whole, the correlation between women-run hedge funds and a sampling of 10 of the largest fund of funds is notably low. This implies that incorporating these managers into a diverse portfolio could improve overall diversification and performance for a broad array of investors.

Statistical adjustments to the women-run hedge fund index should be incorporated to provide the most conservative view of the data. Correction for its smaller sample size, strategy skew, and higher propensity to display survivor bias are important to consider. When accounting for all three of these adjustments, it is still observed that women-run hedge funds outperform the broader hedge fund universe with a high degree of statistical significance over the past 10 years.

The sum total of this analysis presents a case for the incorporation of women-run hedge funds into a broad hedge fund allocation. Frequently, the question of inclusion becomes one of social responsibility. We would argue that these funds stand solidly on their own investment merit. It is unfortunate that debate around gender inclusion has a tendency to obscure the investment proficiency displayed by many women-run hedge funds.

A Deep Dive Into The Women-Run Hedge Funds Universe - Introduction

When discussing women in finance, the conversation tends to gravitate towards their absence. At issue is that while women have been earning the majority of bachelor’s degrees since the 1980s, and most other industries have seen marked appreciation in the participation of women, the level of senior women in finance has been practically unchanged at sub-10% for the last twenty years.

This becomes all the more relevant when considering that academic research and industry studies have long shown a behavioral difference between genders in the investment space. While some studies conflict on the degree and the relevance of the bias, the vast majority of research acknowledges its existence. Despite the integrity of the research performed, few investors have considered the implications of what these studies assert. If women are truly showing differentiated behavior in the investment arena, and yet so few women are playing in it, then an inefficiency exists that deserves consideration.

Our goal with this piece is to delve into the universe of women-run hedge funds. By our estimates, approximately 150 to 200 women-run hedge funds are currently in operation. Detailed data on how they have performed and what that performance looks like has been lacking up until this point. So, too, is a review of whether those behaviors discussed in academic research affect the performance of these funds. Without this data, consideration of an allocation to women-run funds all too often understates the investment opportunity they present.

Behavioral Research in Investing

Richard Thaler originally published his seminal work on behavioral economics, The Winner's Curse, in 1992. Since then, the world of behavioral analysis and its influence on economics and investing has exploded. Andrei Schleifer cemented these concepts as they relate to finance in 2000 with Inefficient Markets: An Introduction to Behavioral Finance. The base economic assumption of rational market participants has been called into question ever since. In 2011, Daniel Kahneman brought the discussion main stream with his bestselling Thinking Fast and Slow, and with it the profound impact of human behavior on market dynamics changed from a question to an accepted fact.

As the study of behavioral finance has grown, so has research relating to the nuances of cognitive bias. From an investment perspective, dozens of academic and industry studies have delved into the review of gender bias on investment behavior. While some studies conflict as to the size and impact of this bias, few question its existence. In fact, in 2008 two researchers stated emphatically that “the question whether women behave differently from men has been extensively researched and reveals robust gender differences.”

While a thorough review of the breadth of gender-related behavioral research in finance would warrant its own paper, three common behavioral differentiators are frequently examined. First, experimental and empirical evidence show that women experience fewer losses attributed to overtrading and overconfidence. Second, studies indicate women exhibit increased discipline and consistency as it relates to investment decisions. And third, research suggests that women display an increased focus on downside protection and risk management. Detailed citations of some of the most prominent studies discussing these findings are listed at the end of this paper.

See full PDF below.