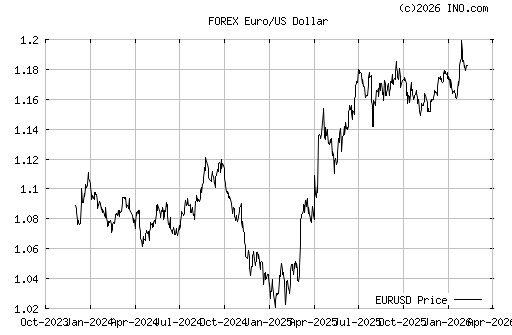

As pointed out by one of our favourite commentators, Hugh Hendry, CIO, Eclectica Asset Management, Ireland's plans to guarantee all bank deposits could have a destructive impact on the value of the Euro. |Take a look at the chart. At the time of this posting the Euro has dropped against the USD from $1.41 to $1.38. Despite the fact that EU central banker, Trichet, has opted to leave rates alone, the market appears to be paying attention to the toll that Ireland's guarantees may have on the Euro if they are allowed to go forward with this.

Relative to this development that has arisen out of the widening of spreads and the tightening of credit in the UK and Europe (as well), the US dollar is enjoying the illusion of being stronger. Given the differences in monetary policymaking, it appears that in the near term, the strength of currencies will depend on the winning moves of some policymakers and the losing moves of others.

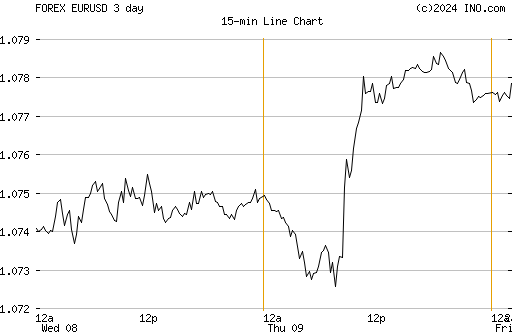

In this vein, it appears the Fed and the Treasury are making the winning moves. It remains to be seen what the EU will do. Take a look at the Daily and 3-day charts of EUR vs USD.

The bailout package should turn out well in next few weeks. Dollar will be in the earlier heroic position, again.

Lisa

Hedge Fund Jobs