Patiently Waiting

-

The Fed faces a number of obstacles now and may require greater justification to suggest raising interest rates as soon as June.

-

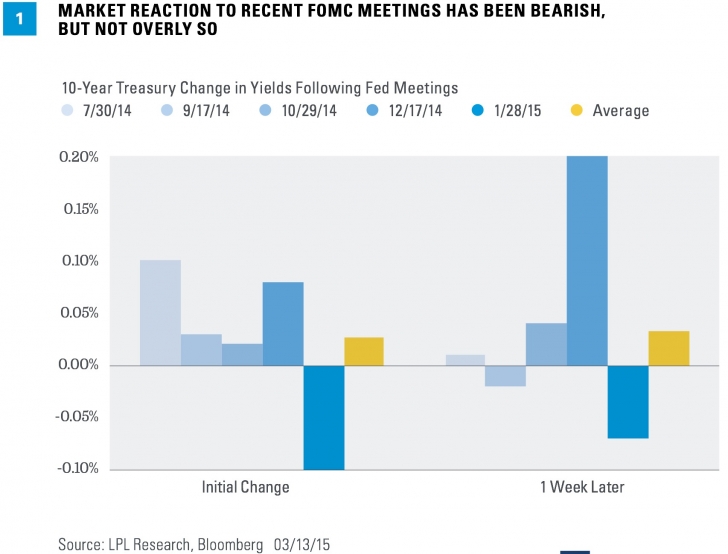

Bond market reaction to recent Fed meetings has been initially bearish but muted overall.

-

Maintaining the word “patient” could have different implications for segments of the bond market.

by Anthony Valeri, Investment Strategist, LPL Financial

The Federal Open Market Committee (FOMC) meeting takes center stage this week and investors will once again don their literary caps and analyze every word that Janet Yellen and the other members offer up. Rightfully so—the Federal Reserve (Fed) may offer guidance on when to expect perhaps the most anticipated rate hike in financial markets’ history. The content in the upcoming FOMC meeting hinges on the word “patient,” the Fed’s latest strategic forecasts, and Fed Chair Yellen’s press conference. Yellen has said that inclusion of the word “patient” means that the Fed won’t hike rates for at least the next two Fed meetings; therefore, removing it would open the door for rate hikes in June. The Fed may not necessarily raise rates in June 2015, regardless; but in order to have the option to do so, the word “patient” would likely have to be omitted from this week’s statement.

BEARISH BIAS

Since the middle of 2014, market reaction following the conclusion of Fed meetings has been bearish initially. Treasury yields have moved higher following the Fed meeting, suggesting that investors took the Fed more seriously in its intention to raise interest rates in 2015 [Figure 1]. Still, the limited reaction, with only two meetings showing a change of 0.1% or more, and more mixed market reactions one week after, suggests the Fed has managed its message well. It also suggests that many investors continue to doubt the Fed will actually follow through with a potential rate hike on their approximate June 2015 time frame even if the word “patient” is omitted.

Obstacles

Recent employment data, which have exceeded expectations, reflect positively on the trajectory of the U.S. economy, but several obstacles suggest the Fed may take a cautious stance this week.

· Low inflation expectations. U.S. inflation expectations increased off the January 2015 low, but they remain very low by historical comparison and have turned lower again over the past week. The U.S. dollar has surged higher again this month after a strong start to the year and significant gains in 2014. Oil prices are still hovering near multiyear lows and wage pressures have yet to materialize in any meaningful way. Both have caused inflation expectations to remain at levels below what the Fed would find optimal for a rate hike.

· Strong dollar impact. The dollar’s rally has an economic impact as well, making U.S. exports more expensive abroad, slowing export-sensitive economic activity in the process. Businesses with an international presence are also hurt, as profits denominated in foreign currency take big hits when translated back to U.S. dollars.

· Weaker first quarter 2015 growth. Consensus forecasts for first quarter gross domestic product (GDP) growth have decreased to the mid-1% range, down from 2-3% growth forecasts. Consumer spending has underwhelmed so far in 2015 with weaker than expected retail sales in January and February. So far, consumers have chosen not to spend all of the savings generated from lower gasoline and energy prices. Add West Coast port disruptions, lower investment from the energy sector, and weaker exports due to a stronger U.S. dollar, and you get a slower than expected pace of growth to start 2015.

· Global central bank easing. In 2015 alone, 23 central banks across the world have cut interest rates. If we consider the 19 countries represented in the Eurozone and covered by the European Central Bank (ECB), the number of individual countries reaches 41. Can the Fed swim against the tide of global rate cuts? Perhaps, but the Fed would need a strong case to support raising interest rates in the face of global easing.

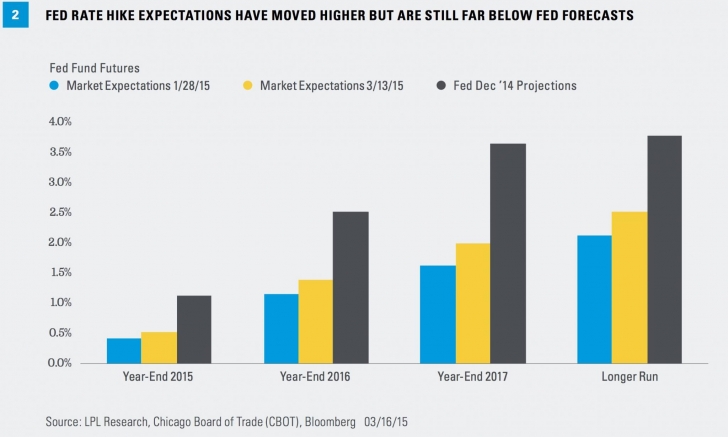

Still Calling the Fed’s Bluff

These obstacles help explain why the bond market does not seem convinced of a midyear start to rate hikes. Rate hike expectations have increased since the end of the last Fed meeting in January 2015 but remain well below the Fed’s forecasts, as outlined in its quarterly strategic economic projections and the “dot plot” (the appropriate level for the fed funds rate at year-end 2015, 2016, 2017, and in the “longer run”) [Figure 2]. Timing of the first rate hike is October 2015 according to fed fund futures, up from November 2015 following the January 2015 meeting but still later than what many Fed officials have implied.

The fed funds rate projections in Figure 2 are from the December 2014 meeting, but the composition of Fed policy voters has changed since then. Charles Plosser and Stanley Fisher, previously two of the most hawkish FOMC members, have retired and are not voters in 2015; they were replaced with only one hawkish voter, creating a slightly more market-friendly, or dovish, Fed compared with 2014. As a result, when new fed funds rate projections are published at the conclusion of the March meeting, median interest rate projections may come down slightly.

The Market's Verdict

So far in 2015, signs that the Fed is moving ahead with a potential rate increase as soon as June 2015 have been greeted with mixed results. Yields on short-term Treasuries, such as the 2-year note, have continued to move higher, with the 2-year yield not far from a cycle high of 0.74% reached in December 2014. Longer-term 10- and 30-year Treasury yields have moved lower in response, a sign the bond market views potential rate hikes as reinforcing the low inflation outlook. Riskier segments of the bond market, such as high-yield, have responded with modestly weaker prices, as an early rate hike may add to the sluggish growth environment.

On the other hand, market reaction to signs the Fed may be “patient” and wait longer to raise rates has generally been positive for risk assets such as high-yield bonds and stocks. Short-term Treasuries have also benefited from the delay in interest rate hikes as it reduces rising rate risk; while longer-term Treasury yields have been mixed to higher, depending on overseas influences, which continue to support Treasuries. The yield advantage of 10-year Treasuries relative to German government bonds sits near an all-time record level of 1.9%, keeping foreign interest on U.S. government bonds.

The ups and downs of bond yields dissecting the Fed’s intentions are normal around the start of Fed rate hikes. The main takeaway is that recent moves have been muted, and absent a surprise from the Fed we believe a more “data-dependent” Fed may keep that trend in place. (See the Weekly Economic Commentary, “FOMC Preview: When, How Often, and How Much,” released on March 16, 2015.) As the eventual first rate hike draws near, and economic growth bounces back from what could be a soft first quarter, we still see the potential modest rise in interest rates keeping bond investors challenged in 2015.

Read/Download the original report below:

Bond Market Perspectives 03172015

Bond Market Perspectives 03172015

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Copyright © LPL Financial