Fed-Up

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

· Yellen would never admit it, but the FOMC is (and has been) on a pre-set course to hike rates in June. However, a pre-set course is not a guarantee. Any deviation from this path has required a significant change in financial, economic, or geo-political conditions, particularly as ‘mid-2015’ has approached. Markets will, therefore, have to contend with one of two evils: worsening conditions, or an interest rate hike in June. In a worst case scenario, markets could be hit by both at the same time.

· The first time that ‘mid-2015’ was introduced as part of the Fed’s calendar-based guidance was back in 2012. How could the FOMC have been able to target a date three years in the future with any accuracy, particularly given the Fed’s dismal forecasting record? What the Fed knew back in 2012 was that Operation Twist replaced short-dated bonds with securities due to mature beginning in 2016. In other words, the Fed knew in 2012 that because its balance sheet would begin shrinking quickly in early 2016, they would be forced near mid-2015 to make a few decisions.

o How can the FOMC be both forward looking and data dependent?

· A declining balance sheet is a defacto tightening. Therefore, it is hard to imagine the FOMC beginning the normalization process of lifting rates at the same time the Fed’s balance sheet is shrinking. Since the FOMC has appeared highly sensitive and concerned about the market’s reaction to ‘lift-off’, the last thing the Fed would want is to have two policy changes at the same time. This is why the Fed has been on a pre-set course for quite some time, i.e., a mid-2015 rate hike prior to the 2016 maturities. If they don’t hike in ‘mid-June’, it will be because serious problems have unfolded (which in turn complicates their options in 2016).

· The FOMC has been hoping that economic conditions would cooperate enough to justify a hike in June. To date, it has not been a stretch to believe that the Fed could have gotten lucky with the timing of the business cycle. However, it is also possible that the FOMC missed the ideal window for ‘lift-off’ (2014) and now risks a downturn in the cycle. It is interesting that should the Fed hike, the Fed could get the blame for a market and/or economic down turn.

· Since the FOMC has moved the guidance pertaining to ‘lift-off’ so frequently in recent years - in order to delay the timing and pace of accommodation - investors never believed the warnings of a mid-year hike with much conviction. It is for this reason that the market’s pricing for the future level of Fed Funds was always so far below the Fed’s dot plot (Today, the average level, of where the FOMC believes the appropriate target level of the fed funds rate should be, fell materially over the next two years.)

o Therefore, should markets have been surprised today by the magnitude of drop in the dot plot? After all, since the Fed’s predictions for this level fell toward what the market was already pricing in, it could be argued the market over-reacted.

· However, there is another possible explanation. Concerns around the market’s reaction function to a hike have been one of the reasons for FOMC emphasis on ‘gradual’ and ‘measured’. Tempering expectations on the speed of rate hikes has likely helped the Fed mitigate and control potential market downside fears. What the Fed was able to accomplish today (deliberately or by accident) was to also mitigate the potential market fallout by capping expectations for where the terminal fed funds rate will be at the end of the hiking cycle. Markets might be adjusting accordingly. (Crowed long dollar trades may be the most impacted over the next few days)

o The lowering of the dot plot means that financial assets may only be able to price-in a few periodic hikes, rather than a series of hikes that brings Fed Funds to some higher long run equilibrium level. This requires a good deal of faith that the Fed will ultimately do what they are forecasting. The market may re-adjust in the near-term, but such faith will be difficult to maintain on the day of the first rate hike, regardless of what the Fed is forecasting.

· Today’s meeting does not change my odds of a June hike. The Summary of Economic Projects (SEPs) forecast full employment in 2016. The SEPs also did not show a drop in inflation forecasts for 2016 or 2017 (and the upper end of the range is near the Fed’s 2% target). As a matter of fact, Stan Fischer was asked three weeks ago at a conference about the recent drop in inflation. He said that the Fed could still hike rates “if it had reasonable confidence to believe that the inflation rate would return to its 2% target in the medium term – which I define as 2 to 3 years’ time. I have great confidence that target will be met, I assure you”.

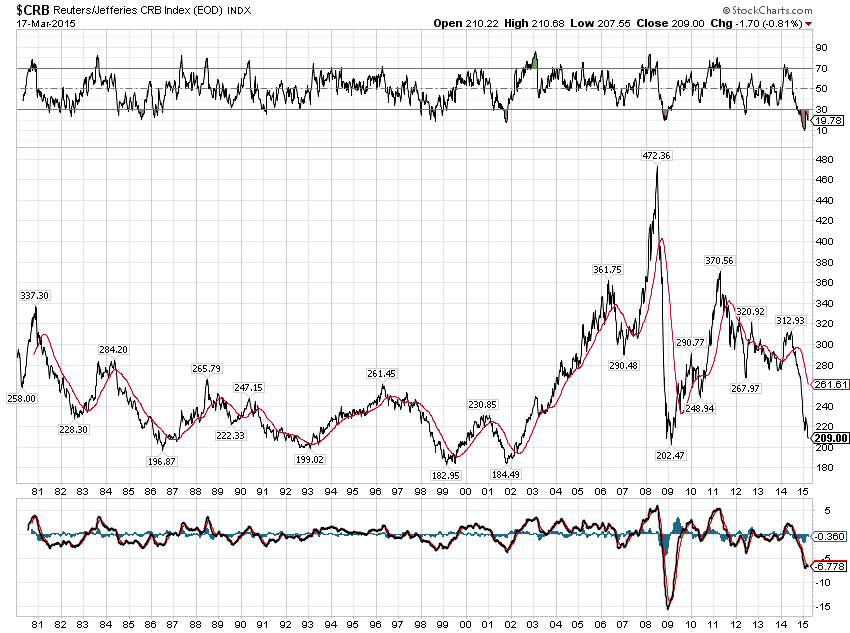

· Furthermore, conditions to hike rates might be as close to ideal today as they are going to get. Combined with the reasons above, the unemployment rate (5.7%) is near full employment. Inflation is expected to be at target in the medium term and has been relatively stable for 15 years (ex-2008/09). Interest rates and spreads are low. The equity market is near record highs. WTI oil is trading below $45 per barrel. Market speculation is rising. Lending standards are falling. A growing number of international debt securities are moving into negative yields. US corporate debt issuance continues to break records. Many are these conditions advanced further today. The general risks to financial instability continue to mount.

· A zero interest rate policy (ZIRP) is a temporary choice that should be reserved only for emergency situations, because after crisis conditions lift, unintended consequences begin to mount. Yet, the Fed has maintained this policy for the past 6 years, while the US economy has grown and continues to plod along. Foreign countries are implementing aggressive policies to combat their own challenges. The US veered out of an emergency state a long time ago (pick the year), so the Fed should have already move away from its ZIRP.

· I still like hiding in the back end of the Treasury market for the reasons I have outlined ad nauseam. Longer-term, I expect the dollar to rise but suspect a retracement and flush-out of crowded exposures will take place over the next couple of weeks. Equities remain in a virtual world where front-running Fed accommodation trumps the reality of extreme fundamental valuations.

· “The best way to predict the future is to create it” – Peter Drucker

Regards,

Guy

Guy Haselmann | Director, Capital Markets Strategy

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Scotiabank | Global Banking and Markets

250 Vesey Street | New York, NY 10281

T-212.225.6686 | C-917-325-5816

guy.haselmann[at]scotiabank.com

Scotiabank is a business name used by The Bank of Nova Scotia

Copyright © Scotiabank GBM