Debt-To-GDP Ratios Demand Debt Jubilee

by Jeff Nielson, Sprott Money

February 24, 2015

In the 1980’s; Canada was governed by (at that time) the most incompetent, fiscally irresponsible regime in the Western world: Brian Mulroney’s “Conservative” government. In a mere eight years; Canada’s national debt tripled, and its debt-to-GDP ratio soared to what was (at the time) an astronomical level above 70%.

Canada was considered to be in an official “debt crisis”. What is meant by the term debt-crisis? It’s all a function of simple arithmetic. It is where the total debt-load approaches a point where it is no longer mathematically possible for the economy to remain viable over the long term.

While the precise quantum where an economy passes “the point of no return” is somewhat dependent upon economic assumptions; a very crude standard is the 100%-level. Once an economy accumulates a mountain of debt equal to its entire, national, economic output; that economy no longer has sufficient financial/economic mass to (responsibly) “service” this mountain of debt.

In other words; once past that point-of-no-return, as a simple function of arithmetic it is inevitable that total debt (and thus total interest payments) must just continue to go higher and higher and higher, until…? Outright bankruptcy. The economic Holy Grail of a “balanced budget” is no longer even mathematically possible; maintaining the same fiscal course is nothing less than economic suicide.

With the only possible (long-term) outcome being national bankruptcy, and with every year a government continues past the point-of-no-return inflicting enormous, additional, economic harm; once past the point-of-no-return any legitimate/responsible government would immediately look to either “restructure” (i.e. reduce) its total debt-load – or simply default (i.e. declare Debt Jubilee).

In the case of Canada; its debt-crisis of the 1980’s led to a new, fiscally responsible government taking power: Jean Chretien’s Liberal government. Its harsh fiscal management produced a full decade of budget surpluses, where the debt-to-GDP ratio was roughly cut in half. It was an example of successful “Austerity”; the only such success, anywhere in the Western world, over the past quarter-century. It was successful precisely because Canada had not yet passed that economic point-of-no-return.

Flash ahead roughly a quarter century. Canada has a new Conservative regime, meaning another woefully incompetent/grossly irresponsible government. Not only has Stephen Harper undone all of Canada’s previous debt-reduction during his “reign of error”; but Canada’s debt-to-GDP ratio has exploded to a level more than three times higher than the “debt-crisis” created by the last Conservative regime.

Canada’s debt-to-GDP level has skyrocketed to more than 220%. It is not simply (way) past the economic point-of-no-return (mere insolvency); this nation is bankrupt – in blatant economic terms. Continuing to service this obviously unsustainable debt is nothing more than economic sadism, perpetrated by Stephen Harper against the people of Canada.

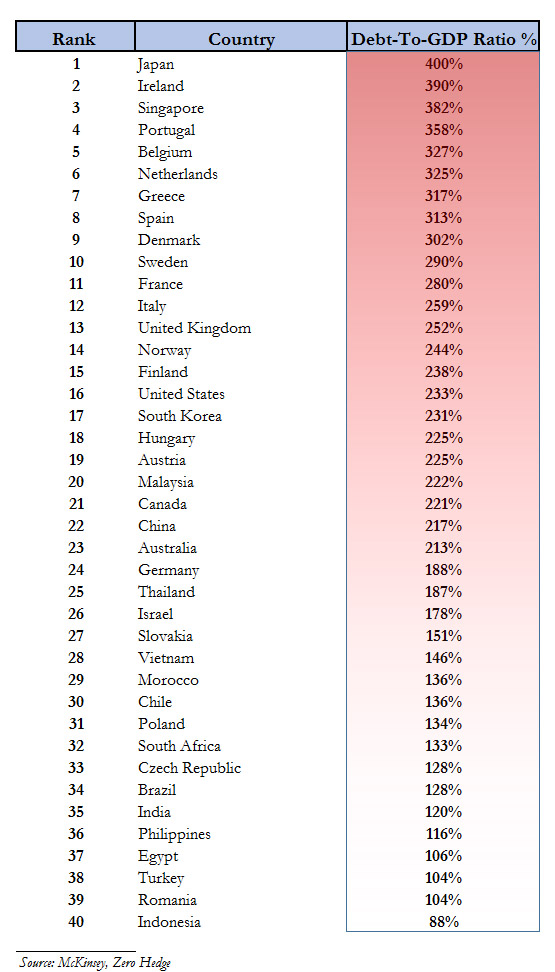

However, as indicated in the chart below (originally produced at Zero Hedge); Canada is far from alone. Membership in the international Bankruptcy Club has soared to roughly 40 nations. Canada’s previous “debt crisis” would no longer even earn it a place in the world’s “top-40” of most-indebted nations today.

A quarter-century ago; discussing nations being economically past the point-of-no-return was theoretical and predictive. Today, the 21st century’s Bankruptcy Club provides unequivocal, empirical proof (in the form of dozens of examples) that continuing to service these unsustainable debt-loads is pure sadism, and thus effectively economic treason, on the part of all of these illegitimate regimes.

In collective terms; the unequivocal proof that these regimes must (immediately) declare Debt Jubilee comes in many forms. We start with the fact that none of the members of the Bankruptcy Club ever manage to improve their fiscal standing (i.e. lessen their level of obvious insolvency). While there may be occasional, annual “blips” in the economic self-destruction of these nations; examine the balance sheet of any member of the Bankruptcy Club over five-year increments, and their fiscal position is always worse.

What is the colloquial definition of “insanity”? Repeating a past (failed) policy, but expecting a different outcome. What is the definition of economic treason? Continuing to pursue the same, failed economic policies year after year, despite their self-destructive consequences, but pretending that repeating this failure will lead to a different outcome.

For many years (decades?): “extend and pretend” has been the unofficial mantra of the entire, U.S. economy. Roll-over the corporate debt, despite the fact that much/most of it is unsustainable. Roll-over the municipal debt, despite the fact that much/most of it is unsustainable. Roll-over the state debt, despite the fact that much/most of it is unsustainable. And roll-over the gigantic debts/obligations of the U.S.’s federal government, despite the fact that its $100+ TRILLION in debt/liabilities is roughly ten times greater than what can be sustained by this crippled, and relatively tiny economy (tiny relative to the size of its gigantic obligations).

The reality with an entire economy based upon “extend and pretend” is that it has no future. The economic suicide/self-destruction continues on and on and on until…? Total economic implosion. It begs the question: why wait? Why inflict more and more damage on their own economies, when any politician capable of operating a calculator knows that the only, possible long-term outcome is national bankruptcy?

In the corporate world; honest management teams never prolong such financial/economic death-spirals, because it is a well-known economic reality that “resolving” insolvency as early as possible minimizes total harm and economic loss. It is only the corporate entities run by fraudulent individuals where bankruptcy is a “sudden” event – i.e. the fraudsters managing the corporate entity are forced to acknowledge their insolvency when the entity literally implodes financially.

The fact that no Western government (other than Greece’s new government) is (a) acknowledging its own, obvious insolvency, and (b) taking concrete steps to seek to reduce (or simply erase) these gargantuan debts is prima facie proof that none of these other regimes are legitimate. They represent not their own peoples, but the banksters who are continuing to rape us for “interest payments” on these ridiculously excessive/unsustainable debts.

As noted in previous commentaries; Debt Jubilee is a long-standing economic “tradition” of our species, as financial mismanagement (at the national level) is an endemic problem of our species, irrespective of the historical era, or the system of government. Arithmetic is arithmetic. Continuing to (attempt to) “sustain” the unsustainable is at best economic suicide, at worst economic treason.

Moreover, our own sovereign debts are fraudulent, on several different levels. Wiping away these gargantuan debts, and restoring solvency to the Western world is not only economically necessary and morally imperative, it is legally justifiable. The “legal remedy” for fraud is a very simple one: the fraudulent transactions (i.e. our debts and accumulated interest) are instantly rendered null-and-void. For injured parties with “clean hands”; they can seek restitution for any losses through the branch of law known as Equity. Needless to say there would not be any bankers standing in that line.

Clearly if Western governments were ‘merely’ drowning in debt-to-GDP ratios of roughly 100%, then they could still argue that attempting to manage these debt-loads was legitimate rather than treasonous. However, Germany’s government (debt-to-GDP of 188%) can no longer make that claim. Nor can:

Canada’s government (221%),

Austria’s government (225%),

the U.S. government (233%),

Finland’s government (238%),

Norway’s government (244%),

the UK government (252%),

Italy’s government (259%),

France’s government (280%),

Sweden’s government (290%),

Denmark’s government (302%),

Spain’s government (313%),

the Netherlands’ government (325%),

Belgium’s government (327%),

Portugal’s government (358%),

or Ireland’s government (390%).

Further absolutely irrefutable proof that all of these Traitor Governments are past the economic point-of-no-return comes in the form of all the failed examples of European “Austerity” following the Crash of ’08. Unlike Canada; which produced budget surpluses and cut-in-half its debt-to-GDP ratio; not one of these debt-bloated governments has been able to produce a single budget-surplus (despite the most-extreme belt-tightening possible). Every one of these European “debt crises” has simply continued to worsen.

Unless we are to believe that only (some) Canadians are capable of managing an economy in an economically competent manner; then the only possible conclusion that we can reach is that European Austerity has failed (again and again) because it was never possible to succeed. They have proven that they are all past the point-of-no-return.

If a nation (or any entity) can never reduce its debt – even under the most-extreme financial management – but rather its (enormous) debt simply grows larger and larger; that is the literal definition of insolvency. It is a state of existence which must inevitably result in outright bankruptcy. Yet when Greece attempts to stand-up to these corrupt governments and argue that its debt-load must be reduced (and not increased ad infinitum), every one of these traitorous “extend-and-pretend” regimes is endeavouring to bully Greece into bowing to the will of their true Master: the One Bank.

Pay the bankers their interest. Increase the debts until these bankrupt economies literally collapse under the weight of their own interest payments (as has already happened to Greece once). The politicians are too corrupt to care. Our Zombie populations are too stupid to notice/understand – apparently none of them can operate a calculator, either.

When Western debt-levels began soaring past the point-of-no-return at the beginning of this millennium; it suggested that the West (and thus the whole global economy) was due for the latest Debt Jubilee. When these already-excessive debt levels exploded to a ludicrous level, following the so-called “bail-outs” (to these same bankers) from the Crash of ’08; this required an immediate Debt Jubilee. However, the insane/treasonous numbers in the previous, current chart shout out an even simpler message: we demand Debt Jubilee.

Sprott Money Ltd. General Use Disclaimer

Sprott Money Ltd., its owners and operators, content creators, presenters, and interviewees, offers no financial or investment advice. The content in this material is for information purposes only and is not an offer or solicitation for the sale of any financial product or service. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon, and their particular needs from a registered financial advisor. Sprott Money Ltd. is not a registered securities or investment dealer. Sprott Money Ltd. products are not insured by the Canada Deposit Insurance Corporation (CDIC) or any other government insurer.

Copyright © Sprott Money