by James Tierney, AllianceBernstein

Deep into the US earnings season, the halo from Apple’s shining performance has lit up an otherwise lackluster market. This is no consolation for the rest of the companies in the S&P 500. In this type of market, we believe investors need to be especially discriminating.

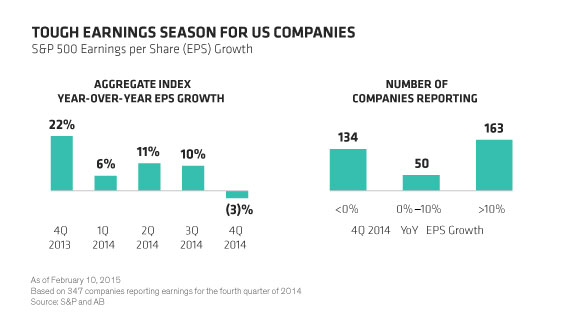

The earnings season isn’t quite over yet. But as of February 10, Apple’s fourth-quarter profit growth exceeded those of all the S&P 500 companies that have reported, combined. In aggregate, 347 companies reported a 3% contraction in earnings (Display, left). And the pain was widespread, with more than a third of S&P 500 companies showing year-over-year declines (Display, right)—as some of the biggest companies in the index dragged down aggregate earnings growth.

Bumper Quarter for Apple

Apple had an excellent quarter. It sold almost 75 million iPhones, fueling revenue growth while increasing the average selling price per unit. Strong revenues helped boost earnings by about 50%, through expanded margins as well as fewer shares outstanding due to a stock buyback program. But one healthy Apple—which accounts for about 4% of the index—isn’t really enough to keep the doctor away from the rest of the market.

Other companies reported mediocre results. We believe that several factors—including a strong US dollar, modest global economic growth and potential pressure on wages—are creating challenges for revenue and earnings growth.

Strong Dollar Cuts Revenue

Over the past year, the US dollar has strengthened by more than 10% compared with a basket of currencies. International sales represent about 35% of total S&P 500 revenues. So if the dollar strength persists, we expect it to take a bite of about 3% from overall revenue this year.

Wages are a growing pressure point in early 2015. Excess labor—resulting in modest wage gains—helped to keep profitability elevated over the past five years. But in the February 6 employment report, wage inflation exceeded 2%. If this trend continues or accelerates, it could signal a peak for profit margins.

Mixed Impact from Oil Shock

Low oil prices have had a mixed impact on the market. After plunging by about 50% from a year ago, many energy companies—which account for about 8% of the S&P 500—are feeling the squeeze. For other companies, lower energy costs are likely to help reduce expenses. And consumers will enjoy a windfall from falling energy prices, which should buoy consumer spending—as well as US and global economic growth.

Some argue that underlying profits are actually healthier than they look. We disagree. The dollar and oil shock are real factors and shouldn’t be stripped out of earnings to paint a prettier picture. In our view, investors should ask whether the sluggish earnings season is the start of a bigger trend after six strong years and a recovery of profit margins from 4.5% in 2008 to a record 10% in 2014—and should ask what it means for their portfolios.

Start by thinking about how these complex dynamics will affect diverse companies as the year unfolds. For example, pressure on margins from rising wages could be offset by better revenue growth, as consumers have more disposable income. Since every company will experience this differently, selectivity is becoming increasingly important.

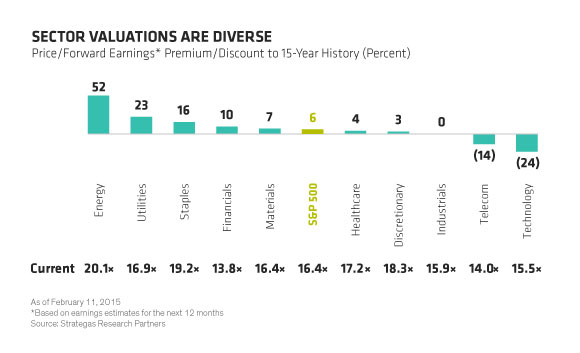

Sector valuations also deserve attention. The US equity market is not a homogenous entity. Utilities and staples look expensive relative to history as the quest for yield has inflated valuations (Display). In contrast, the industrials and technology sectors appear relatively inexpensive given concerns about short-term earnings. This is a good starting point for stock pickers. Within these sectors, we believe there are undiscovered opportunities.

Be Selective

Equities still have an important role to play in investor allocations. With global bond rates at or close to record lows, investors can’t really afford to stay on the sidelines of the stock market to meet their long-term goals. That said, we believe market conditions today demand a more selective approach, as opposed to the last few years, when a diversified approach was rewarded.

With earnings growth more difficult to find today, owning a few select names is preferable to owning 500 companies via an index, in our view. In particular, we believe that companies with exposure to secular growth drivers, which are relatively uncorrelated with macroeconomic conditions, have the best chance of delivering superior results.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

James T. Tierney, Jr, is CIO – Concentrated US Growth at AB (NYSE:AB).

Copyright © AllianceBernstein