Odds and Ends

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

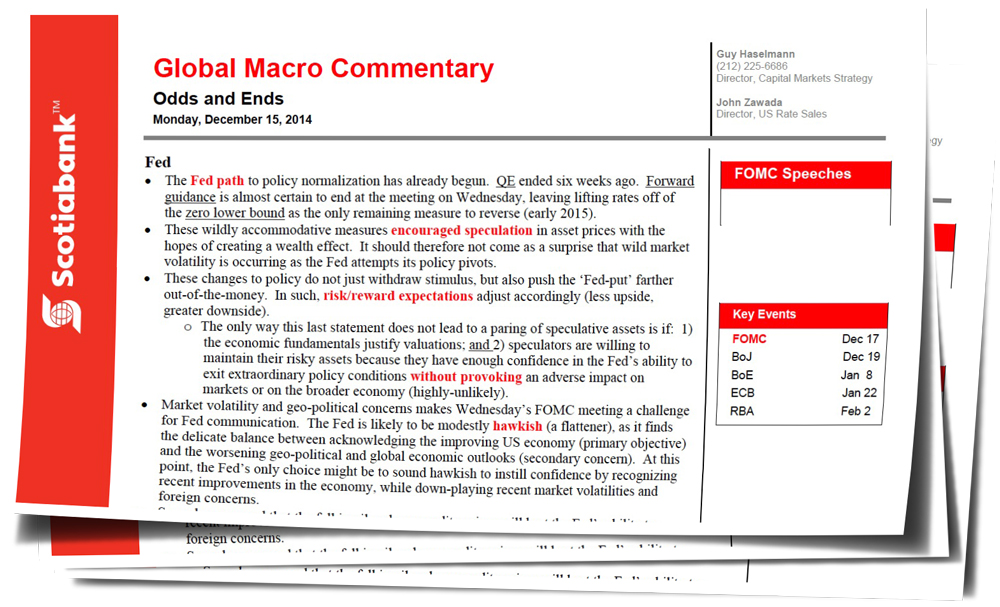

Fed

• The Fed path to policy normalization has already begun. QE ended six weeks ago. Forward guidance is almost certain to end at the meeting on Wednesday, leaving lifting rates off of the zero lower bound as the only remaining measure to reverse (early 2015).

• These wildly accommodative measures encouraged speculation in asset prices with the hopes of creating a wealth effect. It should therefore not come as a surprise that wild market volatility is occurring as the Fed attempts its policy pivots.

• These changes to policy do not just withdraw stimulus, but also push the ‘Fed-put’ farther out-of-the-money. In such, risk/reward expectations adjust accordingly (less upside, greater downside).

o The only way this last statement does not lead to a paring of speculative assets is if: 1) the economic fundamentals justify valuations; and 2) speculators are willing to maintain their risky assets because they have enough confidence in the Fed’s ability to exit extraordinary policy conditions without provoking an adverse impact on markets or on the broader economy (highly-unlikely).

• Market volatility and geo-political concerns makes Wednesday’s FOMC meeting a challenge for Fed communication. The Fed is likely to be modestly hawkish (a flattener), as it finds the delicate balance between acknowledging the improving US economy (primary objective) and the worsening geo-political and global economic outlooks (secondary concern). At this point, the Fed’s only choice might be to sound hawkish to instill confidence by recognizing recent improvements in the economy, while down-playing recent market volatilities and foreign concerns.

• Some have argued that the fall in oil and commodity prices will hurt the Fed’s ability to achieve its dual mandate. However, the Fed could argue that the drop in food and energy prices will provide a nice boost to real wages.

• It is counter-factual to know, but I believe the Fed over-played QE and should have hiked rates already. The US economy would have been able to handle it. Through its transition process, the markets are going to be highly volatile. Unfortunately, the longer the Fed waits, the greater the probability the Fed misses its window of opportunity and the worse the financial market fallout could be.

ECB

• Six months ago, Draghi promised to expand the ECB balance sheet by €1 trillion, yet the balance sheet today is actually smaller.

• Over this time period, the market has come to realize that increasing the balance sheet by €1 trillion with only ABS and covered bonds was mathematically impossible, so hints and expectations for sovereign QE developed.

• The market is now just beginning to realize that ECB support for Sovereign QE may also be suspect or limited. The language around the balance sheet growing by €1 trillion was even changed from “expected” to “intended”. Expectations for a large and effective program are too optimistic.

• The press has suggested that there are 6 ECB members against such action, including 3 executive board members (Lautenschlager, Mersch, and Coeure). Without German support, it is likely that the ECB would be able to deliver a token program, if anything can be delivered at all. A “whatever it takes” program is expected by markets, but disappointment is likely. Periphery spreads are fully priced and have room to widen.

• The EU imports the majority of its energy needs. Therefore, most argue that the decline in oil is wonderful news. However, benefits to the EU consumer are dwarfed by those of the US consumer. EU petrol is taxed considerably limiting the benefits that get passed down to EU consumer. In addition, the depreciation of the Euro (and other currencies relative to the US dollar) makes the oil drop in Euro terms less beneficial.

Russia

• Congress approved more sanctions against Russia. The Ruble basket lost 11% today. WTI and Brent crude lost 4.5% and 2.6% respectively. Expect Putin to announce counter-measures or take provocative actions soon to play the nationalistic card.

“I thought that you were driving, but you’ve given me the wheel / There’s rain clouds out there, that you don’t wanna feel” -Pink

Regards,

Guy

Guy Haselmann | Director, Capital Markets Strategy

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Scotiabank | Global Banking and Markets

250 Vesey Street | New York, NY 10281

T-212.225.6686 | C-917-325-5816

guy.haselmann@scotiabank.com

Scotiabank is a business name used by The Bank of Nova Scotia

Global Macro Commentary Dec 15

Copyright © Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM