by William Smead, Smead Capital Management

The economies of China and the United States appear to be headed in the opposite direction. China’s economy is decelerating fast and the U.S. looks right on the cusp of having its economic growth accelerate, as evidenced by the revised quarterly GDP number of 3.9% released on November 25th, 2014.

We think investors in common stocks must understand the relationship between the forces that affect overall stock prices in one to two-year time frames, even as they pursue long-duration common stock wealth accumulation. The forces we will consider include valuation, psychology, monetary policy and competing alternatives.

China has grown the last 30 years via its initiation of state-run capitalism, a huge competitive advantage in labor cost (causing a manufacturing and export boom) and a ramp up in fixed-asset investing creating some of the biggest infrastructure the world has ever seen (think the Olympic Stadium called the “Bird’s Nest”).

As wages and other costs have climbed and worldwide export markets have struggled, the competitive advantage has been reduced. Since the financial meltdown of 2007-09, China stepped up its use of debt to finance more and more fixed-asset investments. As is usually the case, building for the sake of building ends with the productivity of those investments waning through the law of diminishing returns. Also, the borrowed money becomes harder to pay back and stretches the financial system to make future loans. A slowdown equivalent to a recession appears in the offing.

The U.S. economy seems to be going in the opposite direction. A depression in home building is slowly ending; the job market appears strong enough to raise wages and now gasoline prices are giving an after-tax fiscal stimulus. The 86 million Americans between 19 and 38 years old seem about to take over as the main driver of economic activity. Banks have purged the sins of the last 8 years and stand ready to meet much better economic activity on the Main Street level.

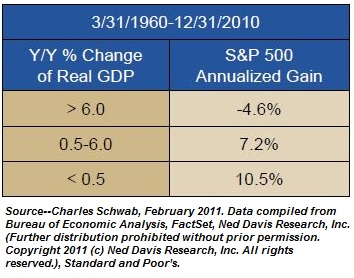

The irony of this contrasting situation between these two economic giants starts with the chart below:

Stocks perform the best when the economy stinks and produce progressively poorer results during booming economic times. The U.S. stock market has soared in value the last five years as the economy produced very sub-par growth in GDP. Even now, many highly thought of economic thinkers see the U.S. stuck in 2 to 2.5% GDP growth rates. China’s stock market has been among the most miserable among large countries in the world even as their growth has remained in the 7-10% year-over-year category.

Valuation Matters Dearly

When the economy is terrible stocks get cheap. Just thinking about Starbuck’s (SBUX) and Nordstrom (JWN) trading in 2009 near $8 per share is hard to accept today. Both traded at ten times very depressed earnings near the bottom. Numerous academic studies show that low P/E stocks outperform more expensive ones. Cheap stock markets outperform expensive ones over long time periods.

Psychology

The one to two-year movement in stock prices is heavily affected by psychology. When the economy is booming, most humans get very optimistic and have already acted boldly. Warren Buffett says, “You pay a high price for a cheery consensus.” When the economy is contracting, it is very hard for most investors to be optimistic about the future. Extremes of pessimism have historically correlated closely with stock market bottoms and extreme optimism with market tops.

Monetary Policy

When economies boom, investors seek out capital thereby increasing demand for it. At that point, monetary authorities seek to rein in expected inflation and the capital boom by tightening credit. When economic growth is underwhelming, monetary policy is very accommodative. If the money supply grows more than the economy can use, the excess finds its way into stocks and bonds. If the economy grows faster than the money supply, business people will pull money out of stocks and bonds to do business on the ground.

Competing Alternative Investments

When a national economy is booming, there are numerous public/private companies and real estate investments drawing on capital which had resided in common stock ownership. Stocks are liquid and can be accessed easily. Investor interest in non-liquid alternatives and investors/consumer confidence wilts when the economy contracts or grows slowly.

The Chinese and U.S. Economy are heading in the Opposite Direction

China’s stock market looks cheap by most measurements, although we would be skeptical to invest in a country with totalitarian controls. By virtue of being out of favor for the last five years, the psychology is probably very favorable. Monetary policy could become more accommodative (think of the PBOC’s recent rate cuts), but it appears early and risky if you can believe the GDP statistics showing 7% or greater growth. China’s biggest problems could be the over-indebtedness left from the last major stimulus from 2008-2011. They have been unwilling to admit their sins and recapitalize their largest banks. Lastly, investments in gold, condos and capital flight (London flats) had been the most popular competing investments to stocks in China. Gold has fallen like a lead balloon since 2011 and residential real estate in China looks like it is in a long-term price decline.

In our eyes, those looking for cheap markets around the world, negative sentiment from investors, reasonable economic growth rates and favorable monetary policy should buy the tavern and not the beer. Franklin Resources (BEN) is one of the largest managers of foreign stock markets funds and is dramatically expanding its distribution footprint in emerging markets worldwide. With $9 billion in cash on the balance sheet and trading at a P/E discount to similar peers, we like it in our portfolio.

Valuations in the S&P 500 Index on the order of 17 times trailing earnings are above the historical norm of 15 P/E. Extremely low inflation in the U.S. has historically helped to justify these kinds of P/E multiples, but it speaks to a need to be right about future earning success. Sentiment polls (Investors Intelligence and A.A.I.I.) have recently reached concerning high levels that are much closer to market highpoints historically than to low points. U.S. GDP annual growth looks like it could accelerate to above 3% and should be watched closely. Real economic growth above 4% for a year or more could be a warning sign for the “one foot in and one foot out” stock-ownership crowd.

Monetary policy in the U.S. is still very positive with zero short-term interest rates and probably is not a risk until above-average GDP growth evidences itself going forward. Banks in the U.S. look as safe (to everyone besides Senator Warren) and as well-capitalized as they have been in my lifetime. We believe the largest U.S. banks are in a great position to meet much higher demands for credit from Millennials. We like the shares of Bank of America (BAC), Wells Fargo (WFC) and JP Morgan (JPM) going forward.

High interest rates probably don’t come until the U.S. economy hits “escape velocity” of 4% real GDP growth consistently. Our guess is that the next full blown bear market in the S&P 500 Index will include much higher GDP growth rates and could be triggered by a substantial increase in short-term interest rates and a yield-curve inversion.

The competing alternative investments in the U.S. have been in private equity, hedge funds, other sophisticated/illiquid investments and in the bond market. They have been the anointed chosen alternatives for American high-net-worth individuals and institutional investors. Growth at the level of “escape velocity” and higher interest rates could be damaging to those as well.

China and the U.S. seem to be going in opposite directions in economic growth and are strangers passing in the night. With the S&P 500 Index getting approximately 45% of its revenue from outside the U.S., stock pickers should be aware of the forces which could affect company earnings and stock market returns over the next two years.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management