Policy backdrops and growth trajectories around the world are showing increasing signs of divergence. Yet many bond investors continue to congregate in a few selected pockets of the fixed income universe. In our view, it’s a perfect time to reconsider diversification tactics.

In this environment, we think that sticking with a very limited opportunity set could disappoint. On the one hand, it constrains return-seeking potential and, on the other, it undermines investors’ ability to weather potentially uncomfortable shifts in market dynamics. Moreover, any fresh bouts of market volatility could well be amplified by the fact that many investors are holding similar bonds.

So, what should good diversification looks like in fixed income today? To us, this means seeking out the broadest possible investment universe and building a well-diversified set of exposures that can be dynamically adjusted to enhance returns and also to mitigate risk. Combining investments in securities with low or negative performance correlation can help ensure that if some ideas fail to deliver, they will likely be offset by others that perform well. It should also bring the added benefit of reducing portfolio volatility relative to returns.

Some Pick-able Ideas

It’s always important to be picky. Careful selection and real conviction in the fundamentals of the assets you own really matter when market liquidity is poor. And there should be a compelling value argument driving each portfolio pick. Our research suggests that the following investment ideas could work well together in a portfolio with the scope to invest right across the fixed income universe.

- Subordinated debt issued by European banks that’s due to mature in the next few years. Subordinated bonds offer higher yields than senior bank debt (Display), while the relatively short maturity of those bonds that are due to mature in the next few years provides a buffer against their lower ranking in banks’ capital structures. For example, HSBC US dollar bonds callable in one-year are currently yielding 3.25%, some 300 basis points more than US Treasuries and 225 basis points more than HSBC senior debt, while ABN British sterling bonds callable in 18 months are yielding 3.00%, some 250 basis points more than UK gilts.

2. Selected US commercial mortgage-backed securities (CMBS). Commercial real estate prices in the US are now at all-time highs, having recently breached the peak they hit back in late 2007. Over time, we expect this strong recovery in real estate valuations to drive CMBS spread tightening.

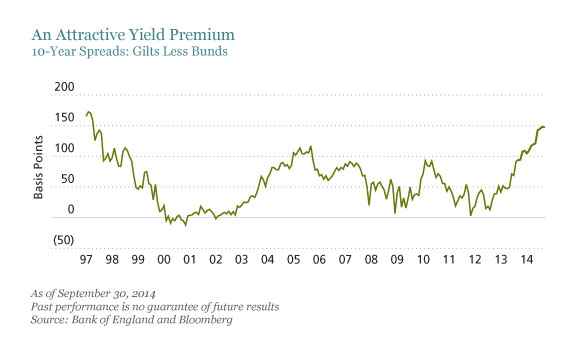

3. Gilts—when the safest government bonds are yielding so very little (and, indeed, longer-dated bund yields have turned negative), UK gilts look attractive from an income perspective (Display). In our view, this should persist now that expectations of the first Bank of England rate hike are being pushed back as UK inflation slows more than expected.

4. Selected peripheral sovereign debt continues to offer attractive yield pickup potential over core European government bonds. And some peripheral economies are seeing sharp improvements in their economic fundamentals—Ireland and Portugal are notable examples. We think that these countries’ sovereign debt offers good value in an environment in which core euro-area bond yields are likely to remain anchored at historic lows given the European Central Bank’s highly accommodative policy stance.

5. Selected local currency emerging market sovereign debt. Some emerging markets that had been confronting inflationary pressures—and, a result, expectations of higher interest rates—are now seeing these pressures recede, in part due to weaker oil prices. As a result, some emerging-market economies, including Mexico and South Africa, are showing positive signs of rebalancing and their local-currency sovereign bonds are rallying.

While we believe each of the ideas outlined above enjoys individual merits, we think their attractions are significantly enhanced when they’re combined. They’re well spread out across fixed-income segments, regions, countries and issuers, while also representing a good balance of credit spread and interest-rate opportunities. As a result, they can offer good risk dispersion as a collective group—so the mixing can be as important as the picking.

In our view, this kind of multi-dimensional approach can deliver relatively high levels of portfolio resilience, thereby improving scope for positive returns in a wide range of market conditions. And, at the same time, we’d expect the diversification benefits stemming from lots of different exposures with limited correlation to secure a smoother investment journey.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

John Taylor is a Portfolio Manager at AllianceBernstein (NYSE:AB).

Copyright © AllianceBernstein