US Elections Impact on Equity Markets

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• The Republican Party had a sweeping victory in the US midterm elections, increasing its majority in the House and taking back the Senate. We believe that President Obama could take a page from President Clinton, who, after the 1994 midterm election, was forced to “move to the center” following the Congressional defeat to the Republicans.

• The Republican win could help to advance the approval of the Keystone Pipeline, roll back stringent new environmental regulations, and tackle tax and immigration reform.

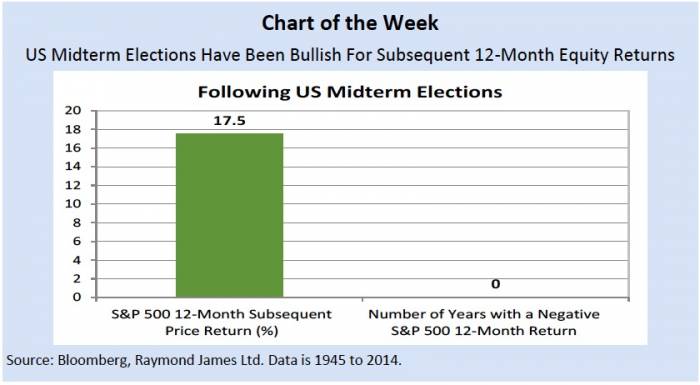

• Regardless of the political outcomes, history shows that midterm elections have been bullish for the S&P 500 Index (S&P 500) in the subsequent 12-month period. Since 1945 there have been 17 midterm elections with every 12-month return following a midterm election being positive. Additionally, the S&P 500 has posted an average return of 17.5% in the subsequent 12-month period.

• The Presidential Cycle, which asserts that the stock market does best in year three of a President’s term, points to additional gains next year with 2015 being the third year of President Obama’s term.

• US election cycles point to additional gains next year, however, given the overbought condition for the US markets, we see the potential for a modest pullback in the short term. Despite this cautious short-term view, the S&P 500 remains above its rising 200-day MA, a sign of long-term technical strength.

Read/download Ryan Lewenza's full report below: