by Ben Carlson, A Wealth of Common Sense

A few weeks ago I took part in a webcast with MarketWatch on long-term investing that was partly spurred on by a post I wrote about my idea for a TV show about investing. MarketsWatch’s Victor Reklaitis ran the show while I was joined by Tim Strauts from Morningstar and Chuck Jaffe of MarketWatch to answer viewer questions.

Here’s one of the questions that I thought deserved a deeper dive:

What’s your advice for handling an awful year for stocks like 2008?

This may seem like a silly thing to think about now, but you don’t start planning for a bear market after it occurs. If you prepare yourself psychologically for any investment environment ahead of time it decreases the chances of blowing up your portfolio by making unforced errors at the wrong time.

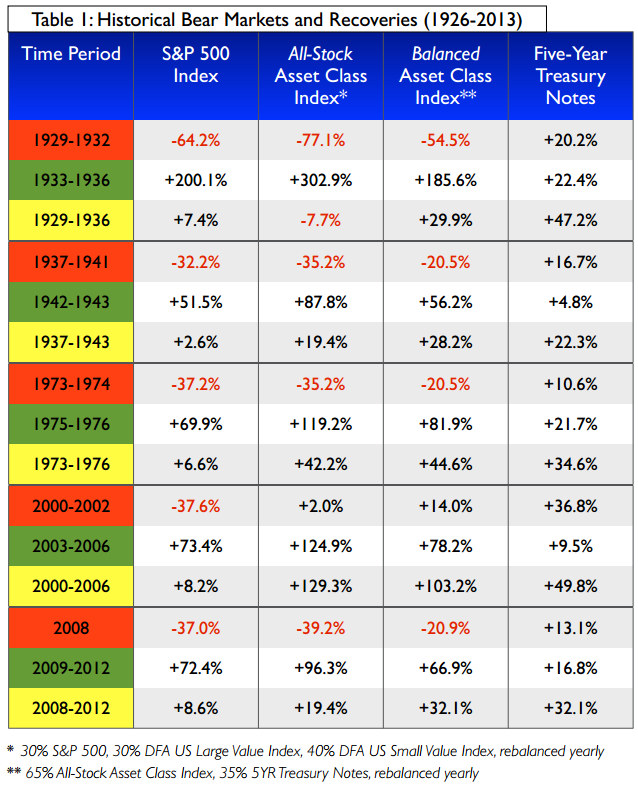

Courtesy of Eric Nelson from Servo Wealth Management, here are the five most severe bear markets since the 1920s broken out by losses, recovery and total return from peak to peak:

A few observations on Nelson’s data:

- You don’t need to get fancy with black swan disaster hedges. High quality intermediate-term bonds have been your best option for preserving capital during an economic disaster. They do their job as the portfolio anchor during periods of stress to give investors dry powder for rebalancing purposes to buy stocks on sale or for spending purposes so stocks don’t get sold after a crash has occurred.

- Stocks can fall far and fast but also tend to recover very quickly. That’s why bailing out of stocks after they crash just compounds your problems if you held them through the crash in the first place.

- Balance is the key to surviving these periodic crashes. The Balanced Asset Class Index which included large caps, small caps, value stocks and bonds fared much better than the all-stock options and outperformed the other options over the full cycle 4 out of 5 times.

- Value and small cap stocks are great diversifiers and return enhancers as you can see from the All Stock Asset Class, but be prepared for large losses as well.

The biggest thing is to have a plan and stick with it (everyone says this but it’s true). You won’t know the exact reasons ahead of time as to why the market will fall, but understand that you will see a handful of market crashes over your lifetime.

There’s no way you can avoid risk in the financial markets if you hope to beat inflation over the long-term and earn a respectable return on your portfolio. Stocks outperform bonds over longer cycles, but bonds provide stability when you need it the most. Stocks wouldn’t offer a risk premium over bonds if they didn’t have these periodic large selloffs.

It’s also important to understand your ability and willingness to take risk. Allocate more money to less volatile investments if you can’t handle losses, but understand that you will likely have to save more to reach your financial goals if you carry a more risk averse portfolio.

And for those investors that are in or approaching retirement, don’t have money tied up in stocks that you’ll need to use for spending purposes within 5 years or so. It’s too much of a risk that stocks could take a hit right when you need to sell if you have an all-stock portfolio.

For most average investors, a good rule of thumb would be to never own more stocks in a bull market than you’re comfortable holding during a bear market.

There really are no easy answers to this question as every investor’s tolerance for risk and investment strategy is different. Investing really is a balancing act that’s full of trade-offs. There is a constant tug of war going on inside our brains between fear and greed depending on the market environment. We want to be able to sidestep losses in the markets and only participate in the gains but it’s impossible to to invest in stocks and not experience periodic losses.

Pick your poison and understand your emotional swings.

Watch the entire MarketWatch webcast here: How to make money in the long run

Source:

When bad things happento good portfolios (Servo Wealth)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealtofcs

Copyright © A Wealth of Common Sense