I don't really spend too much time on market valuation, but I do think about it and post about it every now and then. Of course, debate about market valuation is pretty heated these days due to the super-high looking Shiller p/e ratio, high profit margins etc.

I was reading through some old Buffett annual reports and found a great primer on how Buffett thinks about stock market valuation so I thought I'd post it here. This is similar to what used to be called the Fed model (earnings yield = 10 year treasury yield). The Fed model has been criticized because it only worked for a very brief period (back in the 1980's) and hasn't worked most of the time. (Earlier this year I skimmed through all of Buffett's partnership and BRK annual letters to find comments related to the stock market, but I am now rereading all the annual letters from 1965-2012 again slowly, word-for-word).

But we can see that Buffett does in fact think about stocks using a similar approach. And this makes sense because there is a rational reason why earnings yield can be fairly compared to treasury bond rates. This is not to say that the stock market will always trade at parity with bond yields (history shows that it doesn't).

This may be relevant now to understand why some people like Buffett keep saying the market is trading in a "zone of reasonableness" while some charts show the market to be way out in terms of historical valuation.

And yes, we do understand that Buffett's comments make sense when you think about where interest rates are today (he does keep saying that stocks are better than bonds).

Anyway, this is a long clip but well worth reading almost as a primer on stock valuation, inflation etc.

From the 1981 Berkshire Hathaway letter to shareholders:

Equity Value-Added

An additional factor should further subdue any residual enthusiasm you may retain regarding our long-term rate of return. The economic case justifying equity investment is that, in aggregate, additional earnings above passive investment returns - interest on fixed-income securities - will be derived through the employment of managerial and entrepreneurial skills in conjunction with that equity capital. Furthermore, the case says that since the equity capital position is associated with greater risk than passive forms of investment, it is "entitled" to higher returns. A "value-added" bonus from equity capital seems natural and certain.

But is it? Several decades back, a return on equity of as little as 10% enabled a corporation to be classified as a "good" business - i.e., one in which a dollar reinvested in the business logically could be expected to be valued by the market at more than one hundred cents. For, with long-term taxable bonds yielding 5% and long-term tax-exempt bonds 3%, a business operation that could utilize equity capital at 10% clearly was worth some premium to investors over the equity capital employed. That was true even though a combination of taxes on dividends and on capital gains would reduce the 10% earned by the corporation to perhaps 6%-8% in the hands of the individual investor.

Investment markets recognized this truth. During that earlier period, American business earned an average of 11% or so on equity capital employed and stocks, in aggregate, sold at valuations far above that equity capital (book value), averaging over 150 cents on the dollar. Most businesses were "good" businesses because they earned far more than their keep (the return on long-term passive money). The value-added produced by equity investment, in aggregate, was substantial.

That day is gone. But the lessons learned during its existence are difficult to discard. While investors and managers must place their feet in the future, their memories and nervous systems often remain plugged into the past. It is much easier for investors to utilize historic p/e ratios or for managers to utilize historic business valuation yardsticks than it is for either group to rethink their premises daily. When change is slow, constant rethinking is actually undesirable; it achieves little and slows response time. But when change is great, yesterday's assumptions can be retained only at great cost. And the pace of economic change has become breathtaking.

During the past year, long-term taxable bond yields exceeded 16% and long-term tax-exempts 14%. The total return achieved from such tax-exempts, of course, goes directly into the pocket of the individual owner. Meanwhile, American business is producing earnings of only about 14% on equity. And this 14% will be substantially reduced by taxation before it can be banked by the individual owner. The extent of such shrinkage depends upon the dividend policy of the corporation and the tax rates applicable to the investor.

Thus, with interest rates on passive investments at late 1981 levels, a typical American business is no longer worth one hundred cents on the dollar to owners who are individuals. (If the business is owned by pension funds or other tax-exempt investors, the arithmetic, although still unenticing, changes substantially for the better.) Assume an investor in a 50% tax bracket; if our typical company pays out all earnings, the income return to the investor will be equivalent to that from a 7% tax-exempt bond. And, if conditions persist - if all earnings are paid out and return on equity stays at 14% - the 7% tax-exempt equivalent to the higher-bracket individual investor is just as frozen as is the coupon on a tax-exempt bond. Such a perpetual 7% tax-exempt bond might be worth fifty cents on the dollar as this is written.

If, on the other hand, all earnings of our typical American business are retained and return on equity again remains constant, earnings will grow at 14% per year. If the p/e ratio remains constant, the price of our typical stock will also grow at 14% per year. But that 14% is not yet in the pocket of the shareholder. Putting it there will require the payment of a capital gains tax, presently assessed at a maximum rate of 20%. This net return, of course, works out to a poorer rate of return than the currently available passive after-tax rate.

Unless passive rates fall, companies achieving 14% per year gains in earnings per share while paying no cash dividend are an economic failure for their individual shareholders. The returns from passive capital outstrip the returns from active capital. This is an unpleasant fact for both investors and corporate managers and, therefore, one they may wish to ignore. But facts do not cease to exist, either because they are unpleasant or because they are ignored.

Most American businesses pay out a significant portion of their earnings and thus fall between the two examples. And most American businesses are currently "bad" businesses economically - producing less for their individual investors after-tax than the tax-exempt passive rate of return on money. Of course, some high-return businesses still remain attractive, even under present conditions. But American equity capital, in aggregate, produces no value-added for individual investors.

It should be stressed that this depressing situation does not occur because corporations are jumping, economically, less high than previously. In fact, they are jumping somewhat higher: return on equity has improved a few points in the past decade. But the crossbar of passive return has been elevated much faster. Unhappily, most companies can do little but hope that the bar will be lowered significantly; there are few industries in which the prospects seem bright for substantial gains in return on equity.

Inflationary experience and expectations will be major (but not the only) factors affecting the height of the crossbar in future years. If the causes of long-term inflation can be tempered, passive returns are likely to fall and the intrinsic position of American equity capital should significantly improve. Many businesses that now must be classified as economically "bad" would be restored to the "good" category under such circumstances.

A further, particularly ironic, punishment is inflicted by an inflationary environment upon the owners of the "bad" business. To continue operating in its present mode, such a low-return business usually must retain much of its earnings - no matter what penalty such a policy produces for shareholders.

Reason, of course, would prescribe just the opposite policy. An individual, stuck with a 5% bond with many years to run before maturity, does not take the coupons from that bond and pay one hundred cents on the dollar for more 5% bonds while similar bonds are available at, say, forty cents on the dollar. Instead, he takes those coupons from his low-return bond and - if inclined to reinvest - looks for the highest return with safety currently available. Good money is not thrown after bad.

What makes sense for the bondholder makes sense for the shareholder. Logically, a company with historic and prospective high returns on equity should retain much or all of its earnings so that shareholders can earn premium returns on enhanced capital. Conversely, low returns on corporate equity would suggest a very high dividend payout so that owners could direct capital toward more attractive areas. (The Scriptures concur. In the parable of the talents, the two high-earning servants are rewarded with 100% retention of earnings and encouraged to expand their operations. However, the non-earning third servant is not only chastised - "wicked and slothful" - but also is required to redirect all of his capital to the top performer. Matthew 25: 14-30)

But inflation takes us through the looking glass into the upside-down world of Alice in Wonderland. When prices continuously rise, the "bad" business must retain every nickel that it can. Not because it is attractive as a repository for equity capital, but precisely because it is so unattractive, the low-return business must follow a high retention policy. If it wishes to continue operating in the future as it has in the past - and most entities, including businesses, do - it simply has no choice.

For inflation acts as a gigantic corporate tapeworm. That tapeworm preemptively consumes its requisite daily diet of investment dollars regardless of the health of the host organism. Whatever the level of reported profits (even if nil), more dollars for receivables, inventory and fixed assets are continuously required by the business in order to merely match the unit volume of the previous year. The less prosperous the enterprise, the greater the proportion of available sustenance claimed by the tapeworm.

Under present conditions, a business earning 8% or 10% on equity often has no leftovers for expansion, debt reduction or "real" dividends. The tapeworm of inflation simply cleans the plate. (The low-return company's inability to pay dividends, understandably, is often disguised. Corporate America increasingly is turning to dividend reinvestment plans, sometimes even embodying a discount arrangement that all but forces shareholders to reinvest. Other companies sell newly issued shares to Peter in order to pay dividends to Paul. Beware of "dividends" that can be paid out only if someone promises to replace the capital distributed.)

Berkshire continues to retain its earnings for offensive, not defensive or obligatory, reasons. But in no way are we immune from the pressures that escalating passive returns exert on equity capital. We continue to clear the crossbar of after-tax passive return - but barely. Our historic 21% return - not at all assured for the future - still provides, after the current capital gain tax rate (which we expect to rise considerably in future years), a modest margin over current after-tax rates on passive money. It would be a bit humiliating to have our corporate value-added turn negative. But it can happen here as it has elsewhere, either from events outside anyone's control or from poor relative adaptation on our part.

What Would He Say Now?

So here are current interest rates:

U.S. Treasuries Munis

10 year 2.5% 2.2%

30 year 3.3% 3.1%

Buffett said that stocks should have higher returns than passive, fixed investments. Actually, he said that that is the economic justification for investing in stocks. He didn't say that stock returns should equal fixed income investment returns; just that it should be higher. So we can see the earning yield - bond yield parity model as the upper limit of stock market valuation.

According to this idea the stock market would have to get up to 30-40x p/e (using the pretax U.S. treasury yield for 10 and 30 years) before it starts to look like stocks aren't worth it.

Using Buffett's tax-equivalent model, assuming 20% long term capital gains and qualified dividend tax rates and 3.1% muni yield, the equivalent earnings hurdle for stocks would be 3.9%; this implies a p/e ratio of 26x. Using the 10 year muni rate you'd get 36x p/e. Again, this would be the upper end of a valuation range, not the fair value.

(It's kind of stunning to think that Buffett, in 1981, seemed to be saying stocks aren't worth 7x p/e but says they are reasonably valued now (or at least he said so relatively recently)).

But...

That's silly. I've seen charts showing the differential between earnings yield and interest rates to show how relatively attractive stocks are. Those charts do imply that stocks can get to 30-40x p/e and I certainly hope stocks don't get up there. It probably shows more how expensive bonds are.

Buffett has said that bonds are in a big bubble and is unsustainable (even though I still suspect, because of my having watched Japan post-bubble, that rates will stay a lot lower for a lot longer than most people think).

So if bond rates are unnaturally low due to central bank activity, what is a more natural level of interest rates?

Tangent on No-brainers

What's a post on this blog without an off-topic tangent? Speaking of interest rates, one of the big no-brainers for 2014 was that interest rates would go up due to "tapering". The Fed has been buying truckloads of treasuries every month for so long, if they reduced their purchases interest rates will go up. Simple supply and demand. It's the easiest trade in the world. You would have to be stupid not to understand that. Oops.

I remember a very similar trade when people thought treasuries would crash at the end of QE1 (or QE2, I can't keep track). The no-brainer trade then was the same; everyone knew that the Fed would stop buying bonds (to the exact date), and everyone knew that this would disrupt supply and demand, and it was obvious that bonds had to decline dramatically. Oops. (Bonds rallied dramatically on a collapsing Europe)

One of my early posts on this blog was about gold (Ungold), and gold was a no-brainer too back in 2011. If the economy recovers, inflation would soar and so would gold. If the economy didn't recover, then central banks will have to print even more money and QE-infinity would take gold to $5,000. Heads I win, tails you lose. No-brainer! Oops.

Where Should Interest Rates Be?

So then, let's see where interest rates would be on a normalized basis. First, I thought that the range for the 'real' fed funds rate was around 2.00% - 2.50%. But a quick googling tells me that it averaged 2.7% between 1984 and 2005 (real rates have been deeply negative in recent years, so no need to update).

If inflation is 2.0%, then the Fed Funds rate should be around 4.7%. What about the yield curve? The spread between the 10-year treasury rate and Fed Funds rate since 1954 was 1% or so. That would give us long term rates of around 5.7%. In that case, this would imply a p/e ratio of 17.5x (as the high end).

However, the 20 year and 30 year average spread between the 10-year treasury rate and Fed Funds rate is 1.5% and 1.6% respectively. Using 1.6%, we get a normalized 10 year rate of 6.3%, or an implied p/e ratio of 15.9x.

The S&P 500 index, on a trailing twelve month basis, is trading at a 19x p/e ratio now, and 16.7x forward earnings estimate.

Nominal GDP Growth Rate

OK, so the above normalized interest rate guesses might be a little "noisy". I used real Fed Funds rate and then assumed a yield spread. That's too many indirect assumptions. Don't assume because...

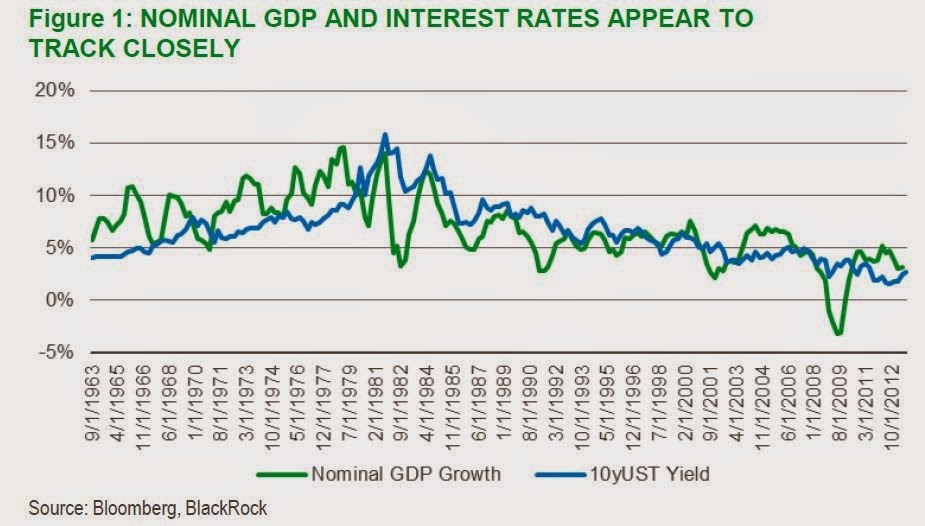

Another more simpler model for normalized long term interest rates is simply the nominal growth in GDP.

I just googled this and cut and paste it from an old BlackRock report. The data is from 1963, so it shouldn't matter too much that it's not up to date.

Using this idea, I think the expectation for real GDP growth is between 2% and 3%, and inflation is expected to be around 2%. The 10-year breakeven inflation rate (on TIPs) is currently around 2.1%. It looks like it gets above 2.5% every now and then so we can use that too to be conservative.

So putting the above together, if you assume 3% real GDP growth and 2% inflation, that's a 5% 10-year treasury rate and implied 20x p/e ratio.

I think at the annual meeting, Charlie said that it would be insane to expect more than 1% growth over the long term. If that is the case, and inflation is 2%, we'll be looking at bond yields of 3% (and 33x p/e ratio).

But more realistic might be 2.5% real GDP growth and 2% inflation for a bond yield of around 4.5% (22x p/e). Oh, and that would be 5% and 20x p/e if you used 2.5% inflation.

You can use whatever assumptions you want and get your own 'normalized' long term interest rate. And yes, I know. Nobody can really forecast economic growth or inflation with any accuracy; I'm just thinking out loud and trying to get my arms around this stuff.

Low Inflation? Really?!

And yes, of course many of you would laugh at the notion of 2% or even 2.5% inflation. With what all the central banks are doing around the world, it's not possible for inflation to remain low for long. Even Buffett said that there will be consequences to all of this and it won't be pretty. He may be wrong this time too, though; he was wrong in 1981 when he said:

In past reports we have explained how inflation has caused

our apparently satisfactory long-term corporate performance to be

illusory as a measure of true investment results for our owners.

We applaud the efforts of Federal Reserve Chairman Volcker and

note the currently more moderate increases in various price

indices. Nevertheless, our views regarding long-term

inflationary trends are as negative as ever. Like virginity, a

stable price level seems capable of maintenance, but not of

restoration.

I have followed Japan over the years so I suspect we are in a similar situation (but much better, of course). The old rules of monetary policy and inflation may not apply. I know this sounds like "this time it's different". But it sort of is in many ways when you think about it.

High Inflation in the 1970's and 1980's

Many people seem to think that we will have another 1970's-like inflationary situation. It might happen, but what bothers me about that is that I strongly believe that the 1970's inflation wasn't really a function of bad policy in the 1960's and 1970's (well, the overspending in that period by the government was a catalyst for sure) but more of a huge adjustment of an unsustainable global monetary structure that was in place for decades.

I think the view is that the U.S. leaving the gold standard was one of the reasons why inflation went out of control, and our abandoning of the Bretton-Woods fixed currency system contributed to the chaos. Books have been written that say things were fine with the gold standard and Bretton-Woods and only after we ditched them did things blow up (so therefore we should go back to them; which makes no sense given the history of price controls!).

Well, my view is exactly the opposite. I just think the 1970's was a huge adjustment to the huge imbalances that were built up over the decades after World War II. As we have seen over and over in the past twenty years with the Asian currency crisis, Latin American crises, Euro etc., fixed currency systems just don't work. And neither did Bretton-Woods. The 1970's was the global version of the above currency crises that we have seen over and over again since then. And they were mostly due to fixing exchange rates, not floating them. Fixing them allowed unsustainable imbalances to build up.

Gold prices were fixed for a long time too (even longer than the currencies in the Bretton-Woods system) so that had an even bigger imbalance built up. It was quite a coiled spring by the time the price control was lifted.

So when I look at it that way, I don't see what that imbalance is, necessarily, that would cause high inflation now. As Dimon said, a lot of the QE money is sitting as reserves in the banking system. When QE is withdrawn, the money will leave bank reserves. This has no real economic impact.

Where is the coiled spring today? (Yes, QE is artificially keeping interest rates low. That is one coiled spring to be sure.)

Conclusion

But anyway, despite all of that, I am not forecasting low inflation forever. It's more of an expression of my doubts about high inflation on the horizon that so many people expect. As I've said for a long time, my suspicion is that we go along the road that Japan has, but in a much better situation.

I really have no idea what is going to happen; where GDP or inflation will go etc. I have no clue.

But playing with these various factors that might impact p/e ratios, I can see why many see the market as reasonably valued despite the really scary looking Shiller p/e charts etc.

Copyright © The Brooklyn Investor