by Ben Carlson, A Wealth of Common Sense

Based on the MSCI World Index, the U.S. stock market makes up over 50% of global equity markets. We constantly hear updates about the Dow Jones, S&P 500 and even Russell 2000, but rarely pay attention to foreign markets.

This home bias causes many investors to overweight U.S. stocks in their portfolio. As everyone debates the current valuation of U.S. stocks, it’s now easier than ever to diversify globally. And while investors worry about the fact that U.S. markets have run so far so fast, many international markets haven’t kept pace.

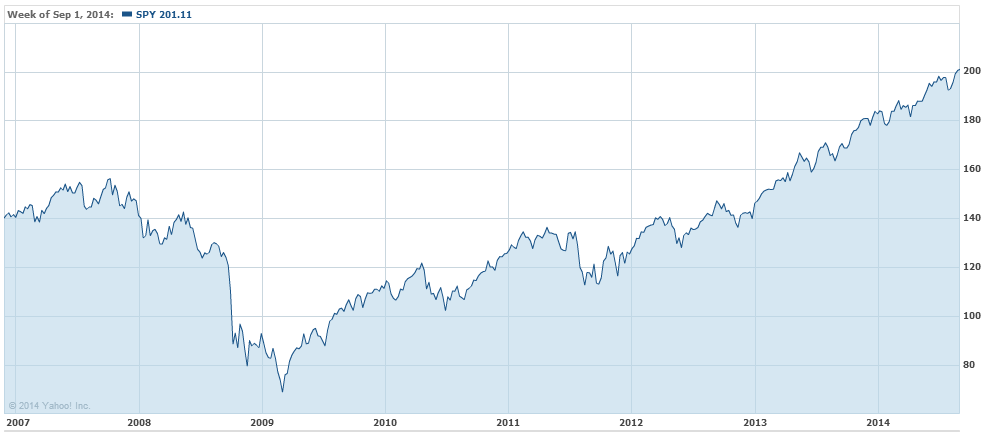

The S&P 500 (SPY) passed through its 2007 peak in early 2013:

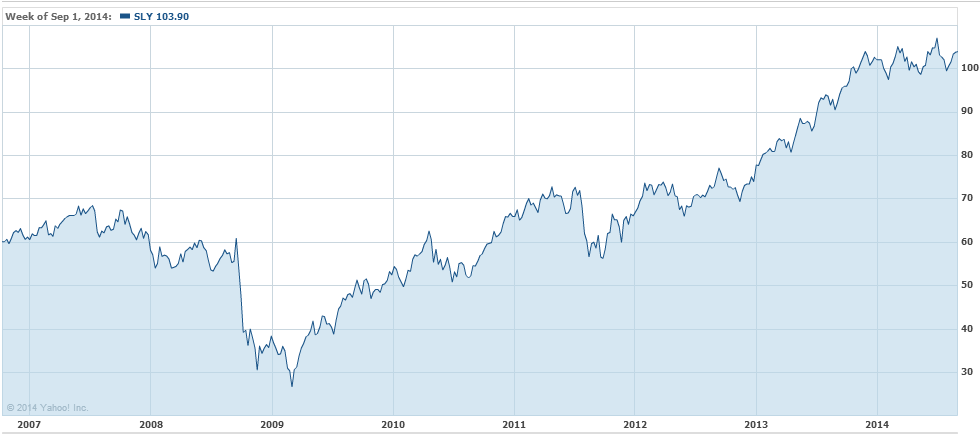

The S&P 600 Index (SLY) of small cap U.S. stocks broke its previous highs in early 2011:

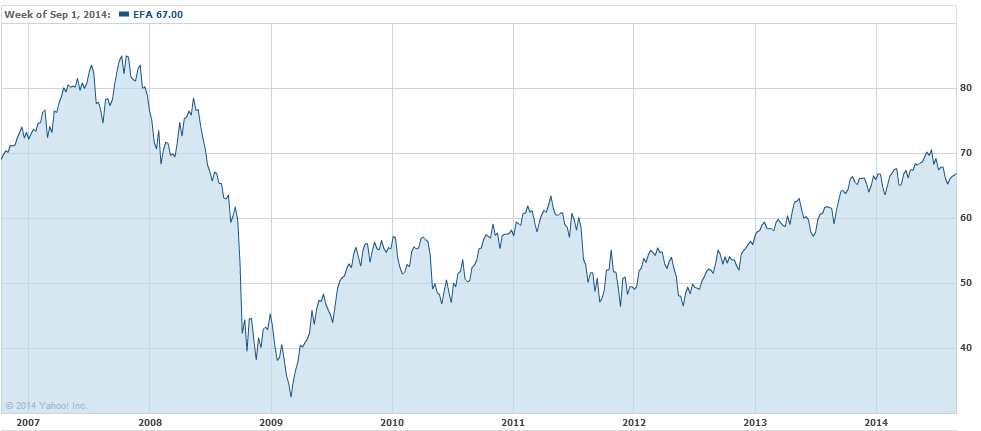

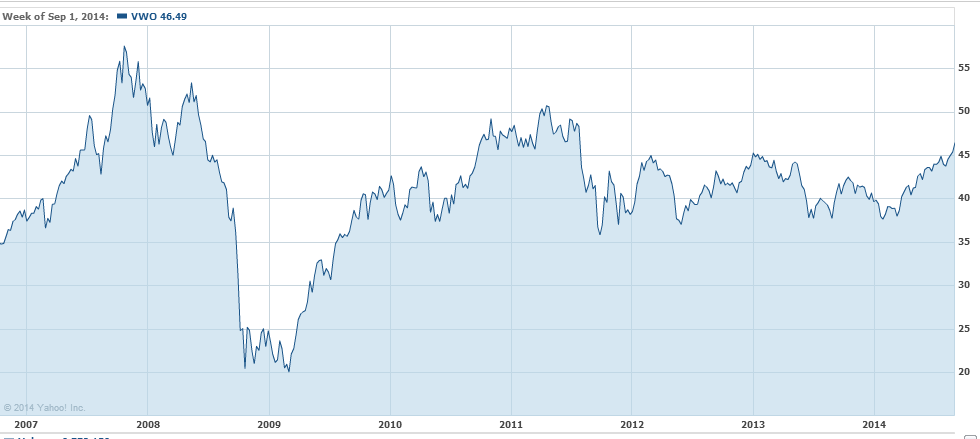

Now for a list of broad foreign markets that are still well below their 2007 peaks seen before the global financial crisis hit.

The MSCI EAFE (EFA):

Emerging Markets (VWO):

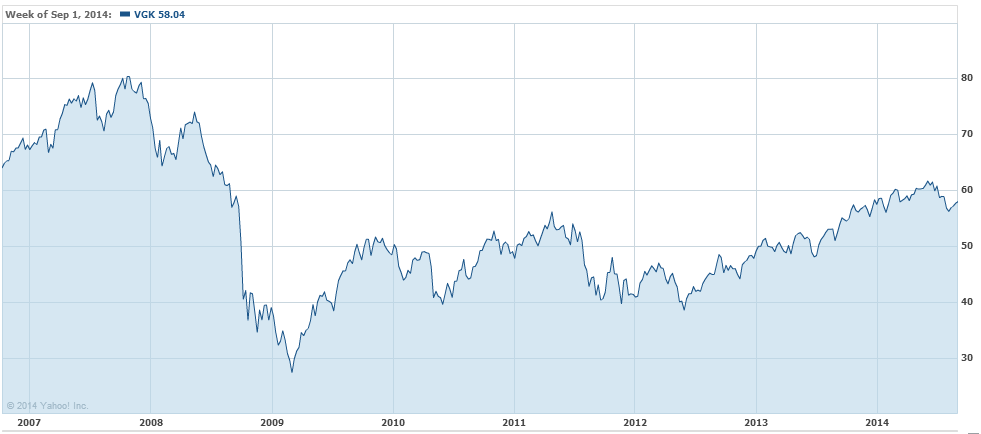

European stocks (VGK):

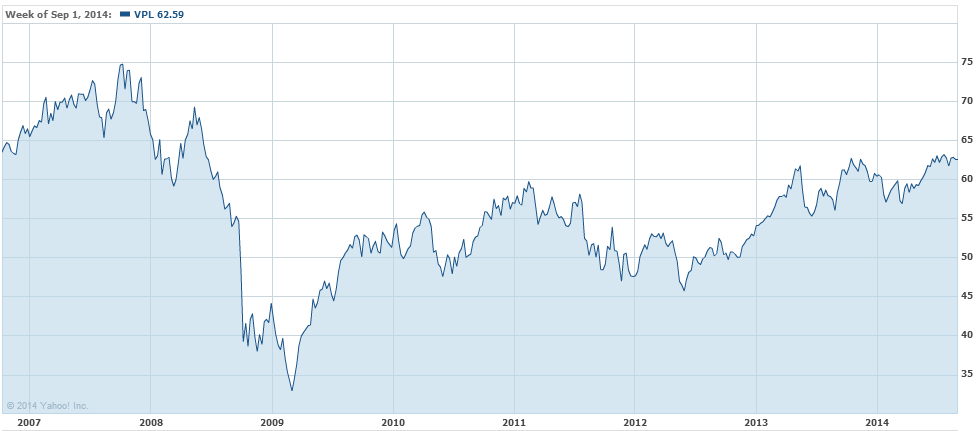

Asian stocks (VPL):

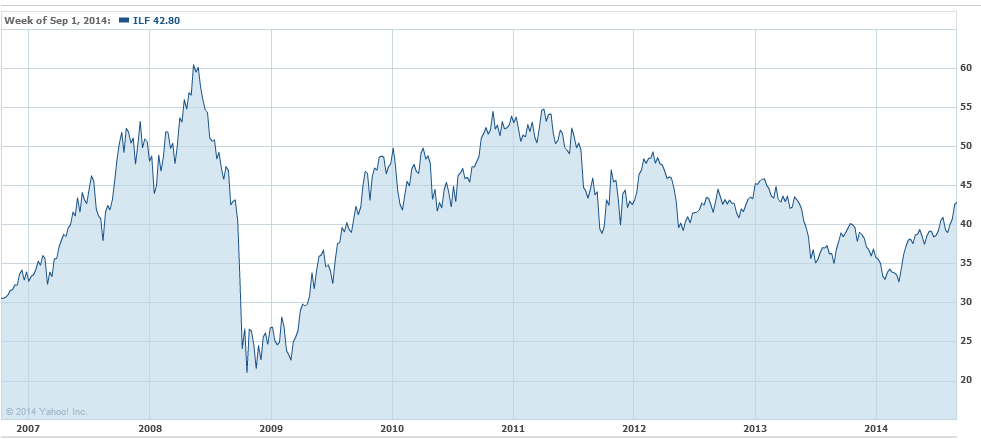

Latin America (ILF):

There’s nothing that says international markets have to immediately outperform U.S. stocks anytime soon. But for those that are worried about CAPE ratios and profit margins, diversifying globally is one of the best forms of risk management over longer time horizons.

Further Reading:

You should hate some of your investments

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense