by Jeff Skoglund, AllianceBernstein

US banks have come a long way since the financial crisis, and that’s good news for fixed-income investors. We think better fundamentals and stricter regulations are creating a good formula for banks’ preferred securities.

In our view, these securities offer an alternative to more traditional credit-related investments, which in recent years have left many income-seeking investors wanting more. As banks rebuild their capital and reduce risk, the market for these securities—which are subordinate to many pure bonds—is set to grow.

The top 25 US banks have already issued nearly $100 billion of preferred securities. We expect the market to expand to about $130 billion in the next few years, as banks ramp up issuance to satisfy the new Basel III global capital rules, which require them to hold more capital as a cushion against losses.

Preferreds satisfy the Basel III requirements because they can be written down or converted to equity if the issuing bank runs into trouble. This ensures that the cost of any future bank rescue or closure falls on shareholders and creditors, not taxpayers.

Banks Shore Up Their Balance Sheets

The chance of being wiped out in a crisis scares many investors, but we think the big improvement in US banks in recent years helps offset that risk. Stronger balance sheets, less leverage and more capital make big banks less likely to revisit their near-death experiences of 2008.

This banking-sector rebound is global. As we’ve pointed out before, banks in Europe and other developed markets are also reducing their risk and firming up their balance sheets, making some Basel III-compliant securities in those markets attractive, too.

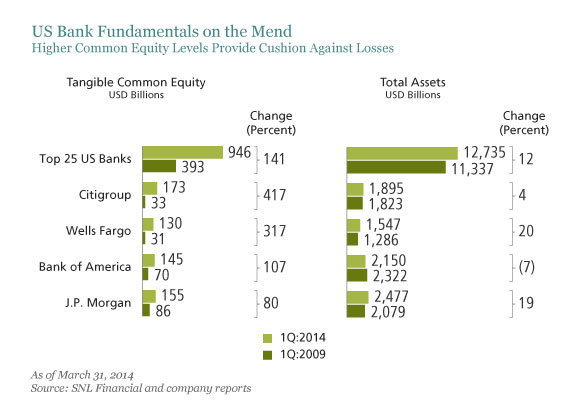

But US banks are running ahead of the pack. Over the last five years, the top 25 US banks have increased their tangible common equity, which can be used to absorb losses, by 141%. Bank assets are up just 12% over the same period. This suggests the banking sector is better prepared to deal with a crisis, reducing the probability of default for banks’ preferred securities and subordinated bonds (Display).

Regulations Dull Banks’ Risk Appetite

As banks have been rebuilding their muscle, bank regulations have raised the bar on what constitutes acceptable risk management. For instance, new rules that prohibit proprietary trading—banks trading for their own accounts instead of clients’—have forced US banks to dial down risky behavior.

We think a stronger US banking sector makes it more appealing to invest in lower tiers within a bank’s capital structure. Preferred securities, also known as Additional Tier 1 (AT1) securities, seem like a particularly attractive opportunity to us. They pay a fixed quarterly coupon and would be the first securities after common equity to absorb losses in times of trouble.

These assets compensate investors for their low perch in the capital structure by offering a higher yield than senior bonds—an attractive proposition in today’s high-yield market, where yields hover near record lows.

What to Watch Out For

There are no specific trigger points that force US preferred securities to be written down or converted to equity—it’s a decision for the regulators, which adds some uncertainty. Regulators or a bank’s board might also suspend coupon payments. But again, we think a more stable US banking sector makes the risk/reward trade-off attractive.

We think rising rates are a bigger concern. Preferred securities don’t have maturity dates, but they do have call dates when issuers can buy back the bonds from investors. The first call date is usually five or 10 years after the issue date. If rates start to rise or yield spreads widen, banks may decide not to call their bonds, since new ones would be more expensive. That would leave investors holding perpetual securities at a time when higher rates are pushing prices down.

Shifting to Floating Rates Can Help

While this risk is worth considering, the fixed-coupon rates on these assets start to float as soon as they reach their call date. That makes it less painful if an issuer decides not to call the bond, and it provides investors some protection against rising rates.

In our view, the potential rewards that US preferred securities offer outweigh the risks. In today’s low-yield environment, that’s something investors probably can’t afford to dismiss too quickly.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Jeff Skoglund is Director of Global Credit Research for Fixed Income and Shrut Vakil is a Global Credit Research Analyst, both at AllianceBernstein.