by Don Vialoux, Timing the Market

Interesting Chart

Grain prices fell to new lows following the WADSE report indicating a larger than anticipated U.S. grain crop.

Stock Twits Released Yesterday

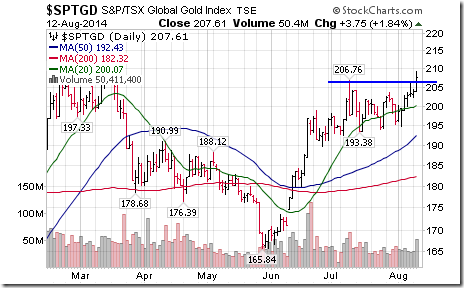

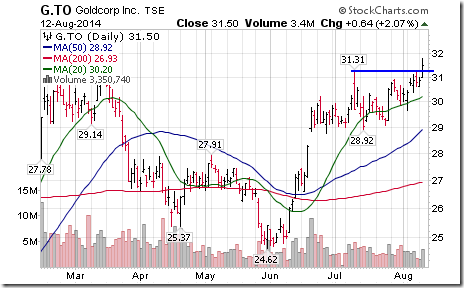

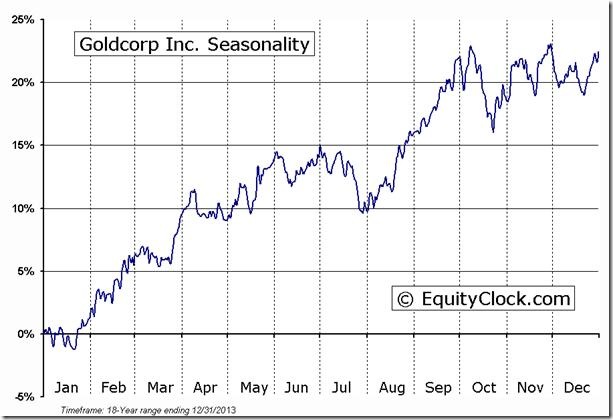

Nice breakout by the TSX Gold Index ($SPTGD) this morning above 206.26! ‘Tis the season!

A reason for breakout by TSX Gold Index was a breakout by $GG above $31.31 Cdn. ‘Tis the season!

Exceptionally quiet technical action by S&P stocks to 10:45. Only one S&P stock broke resistance ($APH).

Technical Action by Individual Equities

By the close, only APH broke resistance and MYL and DO broke support.

Among TSX 60 stocks, G broke resistance and GIL broke support. GIL appears to have formed a short term head and shoulders pattern.

INVESTMENT COMMENTARY

Tuesday, August 12, 2014

TOP ASSET 5 CLASSES, SECTORS AND COUNTRY HEAT MAPPING

Comments:

In the Asset Class group of note are US long bonds now ranking in both the weekly and monthly top 5 and only one equity index, the NASDAQ, remaining in the weekly top 5. The TSX dropped out of the top 5 where the S&P and Russell have long since left. The top 5 of TSX and S&P rankings remain the top 5 with only their order within the top 5 changing. In other words, what has persisted in the shorter term continues.

What we will see at month end is if this shorter term “persistence” affects the longer, monthly, look, a timeframe that is less swing trading and more intermediate term investing.

CHARTS of the WEEK

Long Bonds

Long bonds (rates) have been very profitable since the New Year, much to the surprise of analysts and market strategists. A break below 2.40% on the US 10 year (shown) suggests a move down to the 2% range.

20+ Year Treasury Bonds

Similarly, the US long bond ETF has seen strong performance. The security remains slightly below its long term linear regression line. This is a holding of our Two-Way portfolio. Most clients hold 30% of assets in Canadian long bonds.

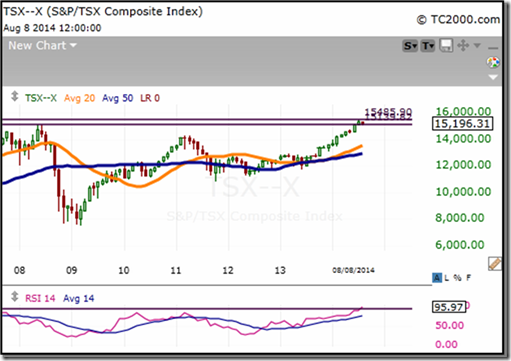

TSX Composite

The TSX has run into 2008 resistance. Many indicators, such as the RSI, are also at high levels. With energy waning – the second summer seasonal strength has not shown up this year – there are fewer sectors carrying the load.

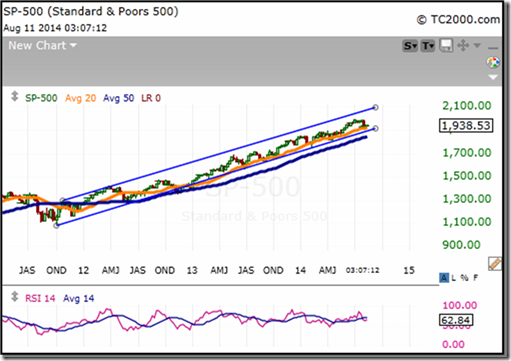

S&P

Similarly the S&P has run into resistance, at the 1990 level. On the shorter term, an up move from an oversold condition appears in the cards. On the intermediate term view, may indicators too are moving lower. That said, the channel is well-defined and corrections (of which a meaningful one has not come for the S&P since 2012) can occur through time and not necessarily price. Technicals, however, cannot often discount truly unknown catalysts

Potash Corp. of Saskatchewan

Potash remains a core holding for a couple of client portfolios. It has been soft of late but is entering a strong seasonal period. A break below the 16 week low of $37.43 would change out outlook for the stock and sector.

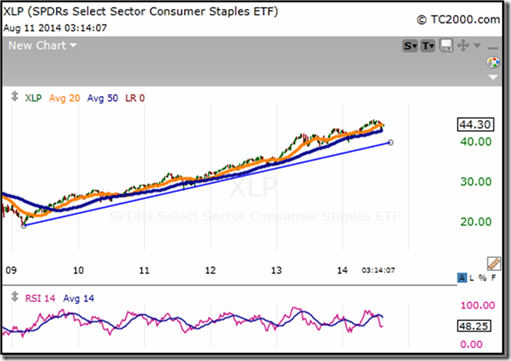

Consumer Staples

The US consumer staples sector has fallen over the last week but has started to show investor confidence with a bid under the unit and indirectly the high quality names that make up the etf, XLP. Upside targets in the low to mid $50 coupled with a downward bias for the C$ makes this a good risk-to-reward client holding.

If you like to receive bi-monthly newsletter or know more about our model portfolios click on the link

http://www.castlemoore.com/investorcentre/signup.php. or just send us an e-mail to info@castlemoore.com

CastleMoore Inc. uses a proprietary Risk/Reward Matrix that places clients with minimum portfolios of $500,000 within one of 12 discretionary portfolios based on risk tolerance, investment objectives, income, net worth and investing experience. For more information on our methodology please contact us.

Buy, Hold…and Know When to Sell

This commentary is not to be considered as offering investment advice on any particular security or market. Please consult a professional or if you invest on your own do your homework and get a good plan, before risking any of your hard earned money. The information provided in CastleMoore Investment Commentary or News, a publication for clients and friends of CastleMoore Inc., is intended to provide a broad look at investing wisdom, and in particular, investment methodologies or techniques. We avoid recommending specific securities due to the inherent risk any one security poses to ones’ overall investment success. Our advice to our clients is based on their risk tolerance, investment objectives, previous market experience, net worth and current income. Please contact CastleMoore Inc. if you require further clarification on this disclaimer.

Adrienne Toghraie’s “Trader’s Coach” Column

|

Time to Trust Yourself

By Adrienne Toghraie, Trader’s Success Coach

Too many traders sit on the sidelines of trading because they do not trust themselves or their strategy. And frankly that is where most traders should stay. This article is for those who are ready and for those who want to be ready to trade real money.

Here are two checklists in order to move from the sidelines into the trading arena:

First checklist

1. Education in the markets and trading

2. Specialization in one area

3. Money to start your trading business

4. Getting support of the significant people in your life

5. Putting together a business plan with a theory that becomes your strategy

6. Back testing your strategy

7. Simulating your strategy

If you have accomplished all of these actions on the above checklist, you are ready to start trading.

Second checklist

1. If your strategy does not work, you must go back and refine it until it does

2. If your strategy would work if you followed it, then you must work on yourself

3. If you are good at following your rules in simulation, but cannot follow your rules in real time trading, then you should work with a trader’s coach or you will continue to lose money.

In order to trust your strategy, it has to earn you profits. In order to trust yourself, you must be able to follow your strategy without question.

Sitting on the fence

Harry is one of the most disciplined people I know, but only to the point of being ready to be a trader. For the last ten or more years he has gotten up early in the morning and read through the business section of the New York Times and The Wall Street Journal. He then looks at his charts and follows the markets in simulation. In simulation he cannot follow his rules, but he sees that his strategy works. Harry has a large bankroll, but he is unwilling to take the step of working on himself.

Learning to trust

In contrast to Harry, Joe went through all of the steps above, but could not find a strategy that would work until he worked with a trading coach. After he had a good strategy, he then could not follow it to earn money. He worked on himself by reading trading books and still after two years could not follow his rules.

Joe came to me and said that he was embarrassed that he, a grown man, could not follow the plan of his strategy. I told him that he could continue to be embarrassed and work with me or not be embarrassed and still work with me. The results would be the same. Joe took four years to become profitable and now is a consistently good trader.

Deciding to trust from the start

I met Anthony through a trading coach who I have worked with for years. He sends me the traders who he believes have potential but are struggling with discipline issues.

In Anthony’s case he was into trading six months making all the right moves when I started to work with him. The issue that Anthony had was that he was a perfectionist. Trades had to be perfect and even then he would question himself and the strategy. These issues were imbedded because Anthony grew up in a foster home where he thought that if he was not good enough, he would be sent back to the boy’s orphanage where he spent the first few years of his life.

Anthony had to learn that perfection in trading meant following his rules. He became a consistently successful trader in seven months from the start.

The whole package

Dean was one of the few people that I have met who did everything the right way from the beginning and was rewarded for it within three months from the start of his trading career.

Dean was an athlete who worked towards participating in the Olympics. He followed his coaches to the letter with physical and psychological coaching and was extremely promising until he was in a car accident. He then had to give up his dream.

What Dean did not know was that he had developed the foundation of discipline necessary to be a star trader. When Dean looked at everything he had to do as a trader, he felt that he was in training again to be a star athlete. Within three months of Dean starting his trading career, he was a professional trader making consistent profits.

Conclusion

In order to be a consistently successful trader you must trust yourself and your strategy. This will only happen if you are willing to take the right steps and follow through on each of those steps. If you do, then you will be one of the few who joins the ranks of those who earn high profits from the market.

Free Monthly Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

GG Relative to the S&P 500 |

GG Relative to the Sector |

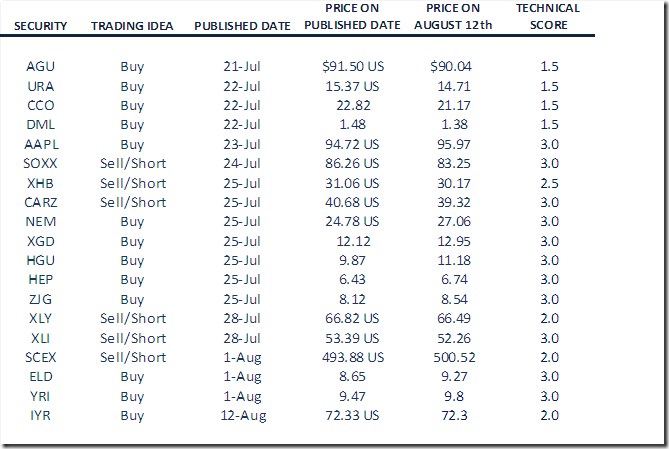

Monitored Technical/Seasonal Trade Ideas

0

Editor’s Note: IYR was added yesterday. XLP mentioned in yesterday’s Tech Talk as a candidate was not added because its technical score is less than 1.5.

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Improved Technical Score

Red: Reduced Technical Score

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC August 12th 2014

High: $14.73

Low: $14.70

Close: $14.70 (Up $0.02)

Volume: 16,166

Net Asset Value per Unit: $14.69 (Up $0.01)

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray