by Don Vialoux, Timing the Market

Interesting Charts

The Shanghai Composite Index continues to lead world equity markets. Yesterday, it moved above its 200 day moving average.

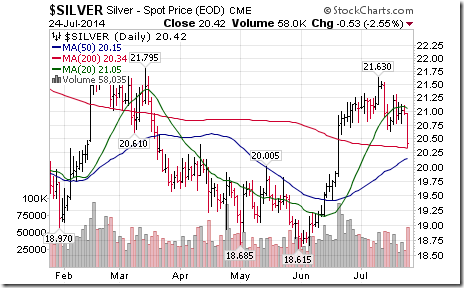

The U.S. Dollar Index continues to move higher and has reached intermediate overbought levels based on most momentum indicators. Strength in the U.S. Dollar has negatively impacted precious metal prices.

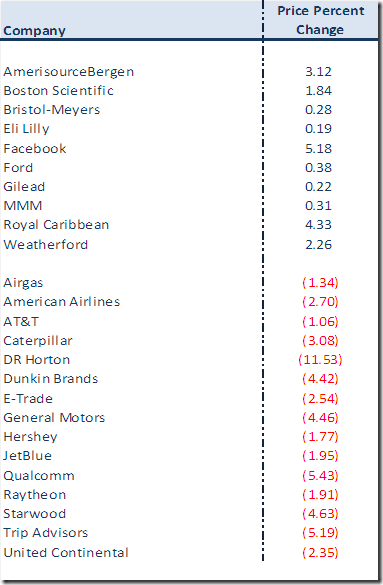

Responses to Second Quarter Reports

Once again, responses were extreme in both directions. Prior to yesterday’s opening, 25 S&P 500 companies reported results. Responses on the downside slightly exceeded responses on the upside by15 to 10. At the close yesterday, following was the price response:

Weekly Technical Review on Select Sector SPDRs

Technology

· Intermediate trend remains up (Score: 1.0)

· Units remain above their 20 day moving average (Score: 1.0)

· Strength relative to the S&P 500 Index remains positive (Score: 1.0)

· Technical score based on the above parameters remains at 3.0 out of 3.0

· Short term momentum indicators are trending up, but are overbought.

Materials

· Intermediate trend remains up

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index remains neutral

· Technical score improved to 2.5 from 1.5 out of 3.0

· Short term momentum indicators are trending up, but are overbought

Industrials

· Intermediate trend remains down

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 0.0 out of 3.0

· Short term momentum indicators remain mixed.

Consumer Discretionary

· Intermediate trend remains up

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index changed to negative from neutral.

· Short term momentum indicators are trending down

Financials

· Intermediate trend remains up.

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index remains neutral

· Technical score improved to 2.5 from 1.5 out of 3.0

· Short term momentum indicators are mixed

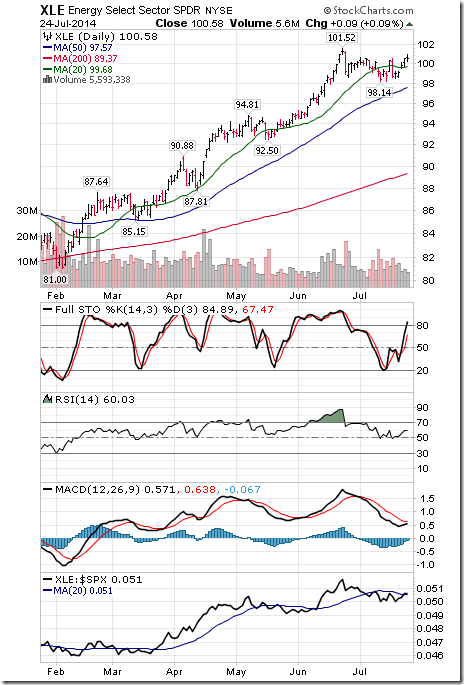

Energy

· Intermediate trend remains down

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index remains neutral.

· Technical score improved to 1.5 from 1.0 out of 3.0

Consumer Staples

· Intermediate trend remains up.

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index changed from neutral to negative

· Technical score slipped to 1.0 from 1.5 out of 3.0.

· Short term momentum indicators are trending down.

Health Care

· Intermediate trend remains up.

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index changed from negative to neutral.

· Technical score improved to 2.5 from 1.0 out of 3.0

· Short term momentum indicators are mixed.

Utilities

· Intermediate trend remains up

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 1.0 out of 3.0

· Short term momentum indicators are mixed.

Summary of Weekly Seasonal/Technical Parameters for SPDRs

Key:

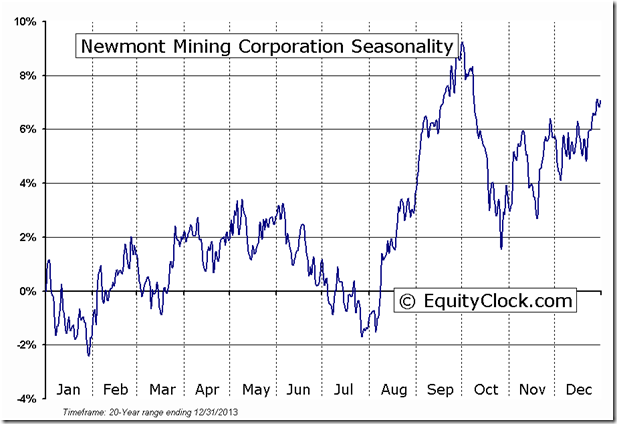

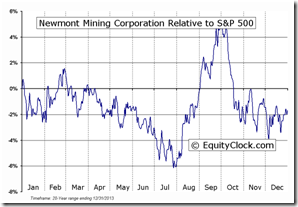

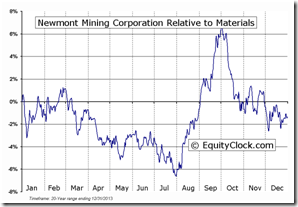

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade from last week

Red: Downgrade from last week

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example

NEM Relative to the S&P 500 NEM Relative to the Sector

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC July 24th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/386350eb1c943a9d7b4473d3baa34911.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/HLIC/2bc283f86d12f095d608e4cd5b47a5ca.png)