As unrest in the Middle East pushes oil prices higher, and indicators like the consumer price index (CPI) show signs of an improving economy, many investors are wondering: is now the time to build more inflation protection into my portfolio? Matt Tucker weighs in.

At its June meeting, the Federal Reserve opted to reduce its monthly mortgage and Treasury bond purchases (or quantitative easing) to $35 billion each month from its previous level of $45 billion. I discussed in a recent Blog post that this action continues the Fed’s shift in monetary policy from “excessively easy” to “easy”; but many wonder if the central bank is moving too slowly.

What do I mean by this? Over the past five and a half years the Fed has put an unprecedented amount of stimulus into the economy, all in an effort to jump start growth in the wake of the Great Recession. As the economy recovers, the question becomes when the Fed should remove that accommodation. Move too soon and they risk stifling growth. Move too slowly and it risks igniting inflation. For bond investors inflation represents a significant market risk, as it generally leads to higher interest rates and declining bond prices.

Over the past few weeks the market’s expectation of short term inflation has been trending up. The consumer price index (CPI) posted a year-over-year change of 2.1% and a month-over-month change of 0.4% in May and we have seen an increase in oil and gold prices, as well as the Fed’s indication that it will continue to slowly withdraw stimulus from the economy. At BlackRock, we think inflation will increase only moderately through the end of the year, though we recognize that many investors are looking to prepare their portfolio for a potential rise in prices.

While we still advocate caution towards Treasury Inflation Protected Securities (TIPS), investors looking to hedge against higher rates that result from inflation may want to consider very short duration. Shorter duration investments have less interest rate risk, and thus less inflation risk. Right now we advocate for very short duration exposures — zero to less than two years. Two potential solutions for building exposure to very short duration within your portfolio include the iShares Short Maturity Bond ETF (NEAR), which has an effective duration of 0.85 years, the iShares 1-3 Year Credit Bond ETF (CSJ) which has an effective duration of 1.9 years. Another consideration is the iShares Floating Rate Bond ETF (FLOT), which has an effective duration of 0.15 years.1

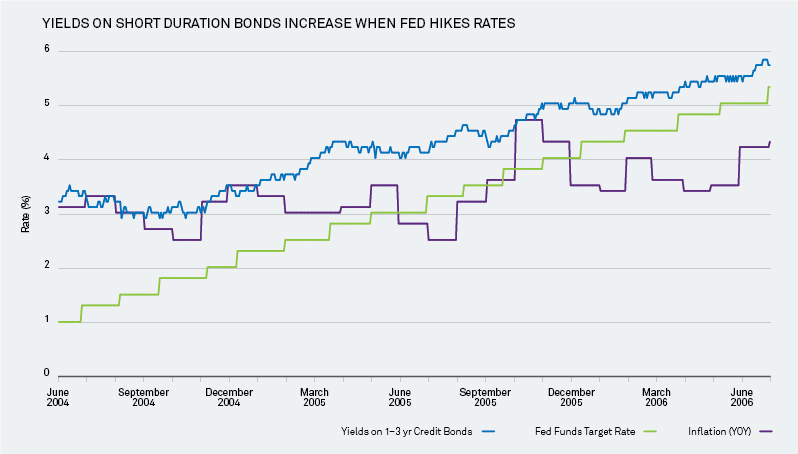

Investors in short duration fixed income should be mindful that their yields will be lower than those of longer duration exposures and that a rise in inflation can still erode their purchasing power. If inflation increases sharply, we will likely see longer term interest rates rise in response. Shorter term rates may not be as impacted, but the realized yield produced by a short duration investment would still be reduced on an inflation adjusted basis. For example, the last time the Fed increased the Fed Funds target rate was from June 2004 to June 2006. The Fed Funds rate rose from 1% to 5.25% over the period and the yields on short duration bonds rose as well. At the same time inflation increased from 3% in March 2006 to 4% range by September 2005. Importantly, short term yields rose in-line with increases in the Fed Funds rate. In this way you can think of short term yields as not being driven by inflation directly, but rather by the Fed’s response to inflation. The bottom line is that, short duration investments can help limit the initial shock of inflation, but the inflation adjusted yield on all investments is still reduced.

Source: BlackRock and Bloomberg. Yields on 1-3 year Credit bonds using the yield to worst on the Barclays 1-3 yr Credit Bond Index from June 2004 to June 2006. Inflation represented by the year-over-year change in the Consumer Price Index (All Urban Consumers). For illustrative purposes only. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

In my next Blog post I will discuss another potential strategy for positioning for rising inflation, inflation-linked bonds (ILBs).

1Effective duration as of July 1, 2014

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to The Blog. You can find more of his posts here.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

The iShares Short Maturity Bond ETF is actively managed and does not seek to replicate the performance of a specified index. The Fund may have a higher portfolio turnover than funds that seek to replicate the performance of an index.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. The Fund’s income may decline when interest rates fall because most of the debt instruments held by the Fund will have floating or variable rates.

TIPS can provide investors a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses.

The iShares Short Maturity Bond ETF will invest in privately issued securities that have not been registered under the Securities Act of 1933 and as a result are subject to legal restrictions on resale. Privately issued securities are not traded on established markets and may be illiquid, difficult to value and subject to wide fluctuations in value. Delay or difficulty in selling such securities may result in a loss to the iShares Short Maturity Bond ETF. The fund may invest in asset-backed (“ABS”) and mortgage-backed securities (“MBS”) which are subject to credit, prepayment and extension risk, and react differently to changes in interest rates than other bonds. Small movements in interest rates may quickly reduce the value of certain ABS and MBS. Diversification and asset allocation may not protect against market risk.

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2014 BlackRock. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners.

Copyright © Blackrock