by Don Vialoux, Timing the Market

Interesting Charts

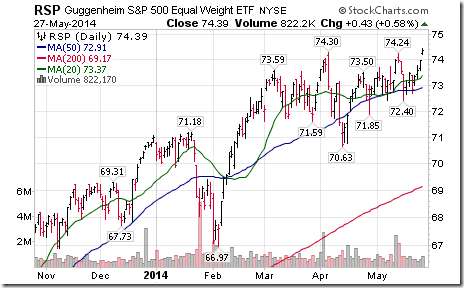

The S&P 500 Index closed at another all-time high. The Equally Weighted S&P 500 Index and its related ETF closed at an all-time high for the first time.

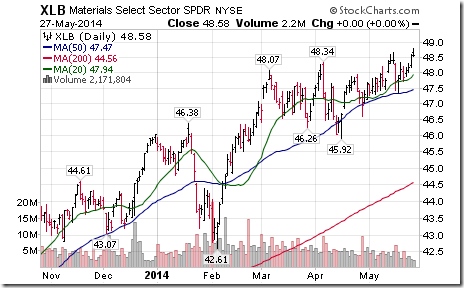

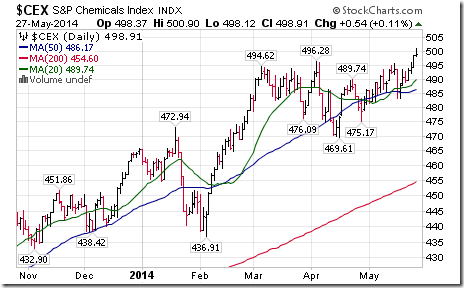

The S&P Materials Index and its related SPDR closed at an all-time high thanks mainly to strength in the Chemical sector. It also closed at an all-time high.

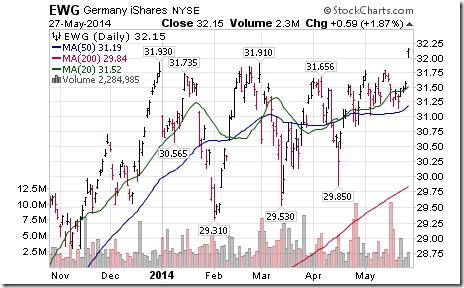

International equity markets, most notably equity markets in Europe, also broke to new highs.

Even the Nikkei Average is showing signs of recovery!

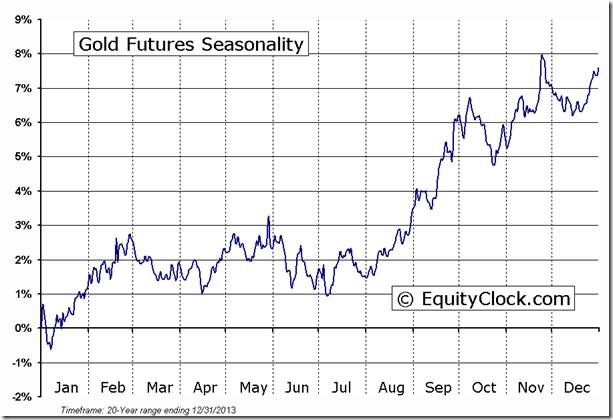

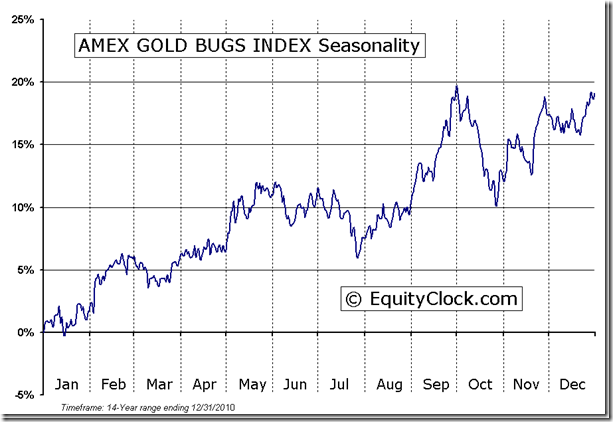

On the other hand, gold and gold equities broke key support levels and moved strongly lower. ‘Tis the season for gold and gold stocks to move lower between the third week in May to mid-July.

Technical Action by Individual Equities

“Risk On” trades with S&P 500 equities were notably stronger yesterday. 25 S&P 500 stocks broke resistance. Notable among stocks breaking resistance were Consumer Discretionary, Material, Financial and Technology. One S&P 500 stock broke support, Newmont Mining.

Three TSX 60 stocks broke resistance: Magna, Rogers Communications and Bank of Montreal. Two stocks broke support: Talisman and Goldcorp.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following are examples:

Gold Futures (GC) Seasonal Chart

AMEX GOLD BUGS INDEX ($HUI) Seasonal Chart

FP Trading Desk Headline

FP Trading Desk headline reads, “Disappointing U.S. data could follow long weekend”. Following is a link:

http://business.financialpost.com/2014/05/26/disappointing-u-s-data-could-follow-long-weekend/

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Horizons Seasonal Rotation ETF HAC May 27th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray