Gold Market

For the week, spot gold closed at $1,293.46, up $4.67 per ounce, or 0.36 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, declined 1.30 percent. The U.S. Trade-Weighted Dollar Index rose 0.19 percent for the week.

Strengths

- Gold and the equity markets barely budged with the release of the latest Federal Open Market Committee (FOMC) minutes on Wednesday. The minutes revealed that the Federal Reserve is likely to carry on with its plan to achieve full employment, disregarding recent concerns over inflation risks. More importantly, this week we heard statements from the Federal Reserve Bank of New York’s President Dudley on the policy outlook. Dudley indicated that rates are likely to normalize well below previous recovery cycles. Historically rates have averaged 4.25 percent when inflation was around 2 percent, which according to Dudley, is much too high in the current economic environment where headwinds persist. The lower-rate normalization, with inflation running at 2 percent, ensures that real rates remain negative, traditionally supportive for gold prices.

- Rio Alto Mining and Sulliden Gold announced intentions to merge and create a new mid-tier gold producer. The transaction combines Rio Alto’s producing La Arena asset with Sulliden’s Shahuindo development project, both located in Peru. The transaction highlights the renewed interest in merger and acquisition (M&A) activity in the gold space.

- Since the start of the second quarter, Lucara Diamonds announced the recovery of 13 diamonds larger than 100 carats, eight of which are of gem quality. The ongoing recovery of such stones from the company’s Karowe mine provides another encouraging stone tender. Klondex Mines provided underground infill and exploration drilling results from its Fire Creek deposit in Nevada with grades up to 10 ounces per tonne. The drill results enhance the understanding of the rich mineralization and raise confidence over the resource definition.

Weaknesses

- Gold dropped $7 per ounce early Tuesday morning after a suspicious panic seller dumped $520 million in gold futures during thin trading volumes. In an initially unrelated news story, the U.K. Financial Conduct Authority (FCA) announced that it had fined Barclays bank 26 million British pounds for manipulating the gold-price fixing in order to avoid paying out on a client order. However, the U.K. FCA also confirmed that Barclays sent out burst orders aimed at moving the gold market, more specifically, the inexplicable early-morning gold raids that dump outsized positions into early-morning thin trading.

- Hedge funds have reportedly cut bullish bets on gold futures following strong new home sales and manufacturing data in the U.S. As a result, the SPDR Gold Trust bullion ETF holdings dropped to 780 tonnes, the lowest since December 2008.

- The European Central Bank (ECB) announced the revised framework for its five-year gold sales agreement, which will come into effect in September. The statement is virtually identical to the existing agreement, except for one key aspect. While the previous agreement capped annual gold sales to 400 tonnes, the revised document removed the existing cap. Although the signatories have been noticeably absent from the gold market, with sales of under 200 tonnes over the past five years, the lack of an explicit quota introduces pointless uncertainty.

Opportunities

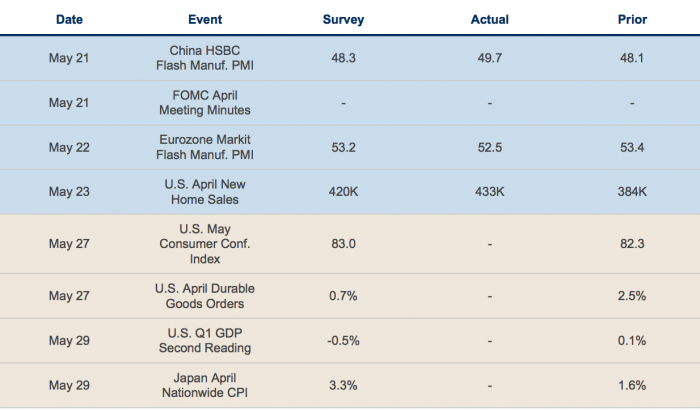

- One of the most important economic data points of the week, the Flash HSBC China Manufacturing Purchasing Managers’ Index (PMI) handsomely beat economists’ expectations by rising to 49.7. The reading marks a five-month high along with a short-term trend reversal, with the one-month reading crossing above the three-month average. The rising PMI bodes well for a stabilization of growth in China, translating into greater consumer confidence and increasing gold sales. China’s commodity import numbers for the first four months of the year surprised economists. Copper imports rose 56 percent and zinc imports rose 44 percent over the period. The outsized copper demand is likely to add pressure to the refined copper market deficit at a time when London Metals Exchange (LME) inventories reach multi-year lows, and new water legislation threatens supply growth out of Chile, the largest supplier of the metal.

- Jim O'Neill, former chairman of Goldman Sachs Asset Management, says the Indian market is on the cusp of a bull run following the primary elections results. The reform-hungry BJP Party has already announced a number of measures to unblock trade, break up monopolies and spur economic growth. The opportunities for gold are two-fold; firstly, analysts expect gold import curbs to be relaxed during the second half of the year, which could expand inbound shipments of bullion to the tune of 15 tonnes per month. The incremental demand could result in an additional 5.7 million ounces imported per year, a very sizeable figure. Secondly, if the new government is successful in reenergizing the Indian economy, demand for gold as part of the love trade could multiply several times over, just as it has in China previously.

- Balmoral Resources is exploring a newly-discovered, semi-massive, nickel-copper-PGE mineralization sulphide zone at its Grasset project in Quebec. The latest intercepts reported caught the market’s eye, including a 45-meter at 1.79 percent nickel intercept with significant copper byproduct. Given the project’s location, product mix and grade, it has the potential to become a prolific mine if a sufficiently large deposit can be delineated. Dundee Precious Metals announced the addition of John Lindsay to its executive team, as it seeks to optimize the output coming from its copper concentrate Tsumeb smelter. Mr. Lindsay is an engineer with extensive experience at Barrick and SNC-Lavalin.

Threats

- Deutsche Bank reiterated its bearish outlook on gold despite strength year-to-date. Analysts at the German bank expect gold price weakness to be driven by acceleration in U.S. growth and a strong upswing in the U.S. dollar. Furthermore, the bank’s analysts expect gold to trade close to its marginal cost of production, and to start behaving more like a commodity as the market refocuses on supply and demand dynamics.

- Gold has the worst prospects among commodities over the next 12 months, according to an investor poll conducted by Credit Suisse. According to the bank’s global head of metals trading, Kamal Naqvi, gold continues to dominate in terms of the vast majority of commodities analysts “hating it.”

- Reuters reported a fifth mineworker has been killed while on his way to work at Amplats’ Union mine in South Africa. The mineworker, a National Union of Mineworkers (NUM) member, had allegedly been threatened by striking workers belonging to the Association of Mineworkers and Construction Union (AMCU) and was asked to stop working. The pressure has mounted on employees who wish to continue working amid the 17-week-long strike that is threatening to send platinum and palladium into shortage this year.