In the latest issue of Morningstar magazine, Russel Kinnel authored an article entitled, “How Bloated is Your Manager?” (It is apparently not online at this time.) As he wrote, “Asset bloat can weigh down a fund, making it less nimble.”

A related question was recently asked of the Wall Street Journal Experts: “Are there investment strategies that no longer work, because too much money has flowed into them?” (My response.)

Bloat can definitely be a problem for a fund, for an organization, or for a strategy that has gotten too popular throughout the market. The opportunity set cannot accommodate unlimited size. So, when does size become a problem? That is a key question for investors. (There are also advantages to size; I explored some of the issues in a 2010 piece on how size matters.)

Kinnel had used what he calls “the bloat ratio” more than a decade earlier and returned to it in the article. He noted that the worth of the ratio as an assessment tool seems to vary by market regime — like most things. It would also be interesting to overlay the flows into and out of the funds in making judgments. Just think of the famous Janus example among others: When there were strong flows in, the purchases were supportive despite the bloat — a virtuous cycle — but when the flows reversed, the bloat was crushing.

The ratio “multiplies turnover by the average day’s trading volume of a fund’s holdings (asset-weighted).” Kinnel says “it’s not something to put at the top of your manager-selection criteria,” but thinks it can be helpful. He gives a variety of examples of funds with low and high levels of bloat, at least as measured by his ratio.

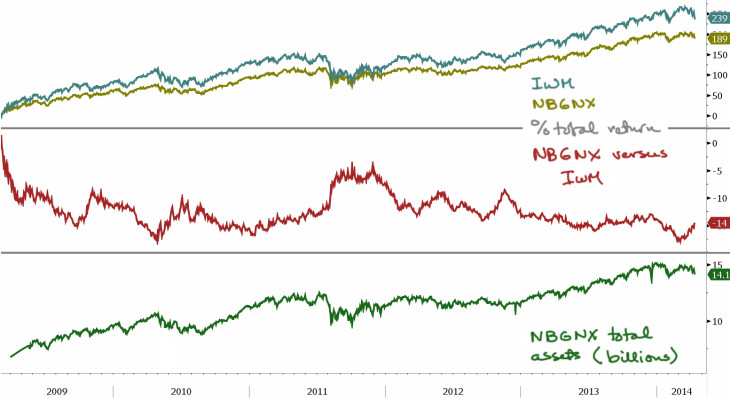

The one pictured above is Neuberger Berman Genesis (NBGNX). While it has low turnover, when you’re pushing $14 billion around in “rather small names,” the size can be an issue. The fund is shown from the 2009 bottom and you can see that it has underperformed the Russell 2000 (shown here via its ETF, IWM) over that time, although it had outperformed it previously.

Has the fund lagged for that reason? I have no idea, nor do I know whether Kinnel’s ratio is a good one. But you’d better be asking the question for any fund, rather than just buying on past performance. (Chart: Bloomberg terminal.)

Do you have your copy of Letters to a Young Analyst yet?

Copyright © Research Puzzle