by David Stockman via Contra Corner blog,

America is being run by an unelected gang of essentially self-perpetuating PhDs. The notion of an economics coup d’ etat is not so far-fetched. After all, the Eccles Building controls the levers of the nation’s fiscal policy; is the pied piper of the entire financial system; intentionally inflates financial bubbles which powerfully impact the distribution of wealth and income; and is the master builder of the nation’s towering edifice of $59 trillion in credit market debt that flattens growth, jobs and incomes on Main Street.

To take one case in point, consider further the matter of fiscal policy and the Washington machinery by which $4 trillion of economic resources are allocated directly, and countless trillions more indirectly owing to tax policy and Federal matching grants.

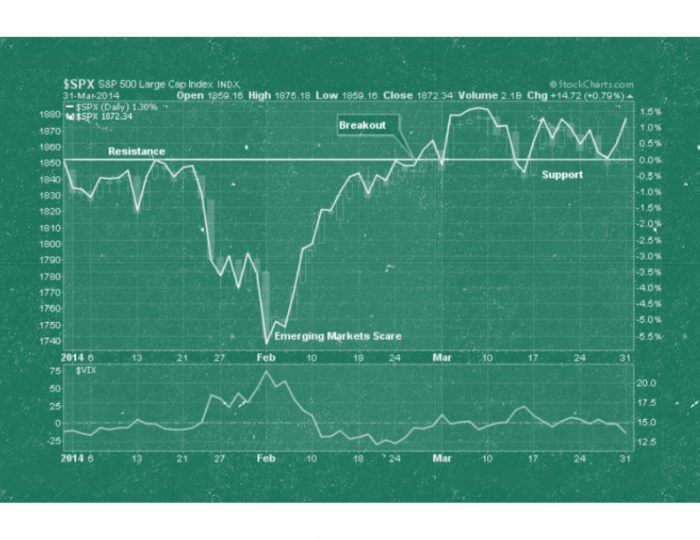

This entire apparatus is now frozen in place because the Fed’s QE policy amounts to a giant fiscal fraud. Even if it sticks to the taper, the Fed’s balance sheet will have expanded by 5X—from $900 billion to $4.5 trillion—in 70 months. Yet it has no intention whatsoever of unwinding this stupendous emission of fiat credit. Indeed, selling-down its massive piles of treasuries and MBS would ignite the mother of all melt-downs in the fixed income markets, which have gorged on over-valued paper that was priced by the Fed’s huge, artificial bid in the debt markets.

So if this $4.5 trillion balance sheet is permanent, then the Fed’s post-crisis money printing spree amounts to a massive monetization of the public debt. Too be sure, all of this was done in the name of rubbery abstractions like “accommodating” recovery, supporting the “labor market” and “stimulating” consumption and investment spending, but the real world effect was quite different and far more tangible: It allowed Washington to treat the financing cost of our $17.5 trillion national debt as a free good.

In a world in which even the official inflation rate (CPI) has averaged 2.4% during the last 14-years, there is no other way to describe a policy that actually drove the 5-year Treasury note yield to a low of 75 bps, and pulled the weighted average cost of the total Federal debt down to about 2.5%—which is to say, zero, nichts, nada or nothing in real terms.

And part of this fiscal scam is even more egregious than the Fed’s own acknowledgement that is artificially suppressing the treasury coupons. What the Fed is also doing is issuing second-hand “greenbacks”— those notorious non-interest bearing IOU’s that financed the Civil War. Since the crisis the Fed has returned $400 billion of “profits”, including $80 billion each in the last two years, to the US treasury, thereby off-setting upwards of 25% of the interest cost on the Federal debt.

But then again, how is it that the Fed is more profitable than the wholesale, retail, entertainment, food service and hospitality industries of America combined? Self-evidently, its the magic of printing press money: The Fed buys treasuries and MBS with a coupon; pays for them by issuing new liabilities without a coupon; collects the spread which gets recorded as a “profit”; and then returns this ‘profit” to Uncle Sam at year-end. Had the Treasury Department dusted off Lincoln’s playbook, instead, it could have simply issued “greenbacks”, and dispensed with the round trip. In less polite company it might be called a fiscal circle jerk.

Based on its historic rate of expansion the Fed’s balance sheet would be about $1 trillion today. So during the past 70 months, the monetary politburo has issued about $3.5 trillion worth of Abe Lincoln’s “greenbacks”.

But here’s the thing: Even as Lincoln took many matters in his own hands like suspending habeas corpus, closing newspapers and imprisoning dissenters, he did bother to get an act of Congress to print his paper money. And as much as the beltway bandits of today’s Washington have enjoyed the quasi-free financing of $9 trillion in new public debt since the crisis—even they would have never passed something called the “Greenback Authorization Act of 2009?. We do indeed have a rogue central bank operating in the deep waters of extra-constitutionality.

Then consider the orgy of debt issuance in the business sector. During the last year, every single record from the 2007 blow-off top has been exceeded. This encompasses $1.1 trillion of investment grade corporate debt, including a staggering $49 billion issue by Verizon to fund what was essentially an LBO of its own subsidiary. Next in line is about $600 billion in leveraged loans—-more than 60% of which have been “cov-lite” style spit and prayer loans. And then there are $400 billion of new junk bonds proper, along with the return of that bell-ringer for speculative tops called leveraged recaps, wherein the LBO barons freight down their debt mules with even more debt in order to pay themselves a dividend.

In all, business sector debt stood at about $11 trillion on the eve of the 2008 crisis, and has now vaulted upward to $13.5 trillion. Yet nearly the entire gain has gone into the preferred financial engineering games of bubble finance—namely, LBOs, cash M&A deals and stock buybacks. Indeed, in the latter case the big corporates are now borrowing hand-over-fist to fund buybacks at nearly a $1 trillion annual rate. Compare that to investment in productive plant and equipment where real outlays are still running $100 billion or 8% below its late 2007 level.

Needless to say, this massive leveraging and stripping mining of cash from the business economy is not the unseen hand of the free market at work. It is the consequence of the Fed’s very visible pegging and rigging of the financial markets.

Fast money speculators are subsidized by the Greenspan/Bernanke/Yellen put, which drastically compresses the cost of market risk insurance and artificially fattens the margins on carry trades. So enabled, the hedge funds then bray incessantly for M&A deals and stock buybacks, which option-gorged corporate executives are eager to undertake—especially with more borrowed money.

And then yield-chasing money managers scoop up the resulting junk bonds, cov-lite leveraged loans and investment grade issues alike because the Fed has bought out the belly of the treasury curve, meaning there is nothing else to buy that will keep the fixed income PMs employed.

Likewise, also comes the $5k Wall Street suits—streaming into America’s busted sub-prime neighborhoods fixing to become single family landlords. Yet without the Fed’s gift of cheap financing, there is not a snowballs chance that these clueless spread-sheet jockeys would own a single, single-family home— let alone upwards of 500,000 at last count.

In short, the Fed has interposed itself throughout the very warp and woof of the nation’s business economy. It does this in a manner that makes a mockery of our purported mechanism of economic governance—that is to say, the spontaneous actions and decisions by millions of producers, consumers, investors and savers on the free market in response to honest price signals arising from the vineyards of commerce and industry. Instead, in a manner like the “caribou” soccer of 6-years olds, today’s economic actors have no choice except to ceaselessly chase the Fed around the economic fields.

So where did the Fed get this mind-boggling grant of plenary power? Fed Chair Yellen explained it succinctly in a recent speech:

The U.S. economy is still considerably short of the two goals assigned to the Federal Reserve by the Congress of low and stable inflation and maximum sustainable employment.

Yellen was obviously referring to the Humphrey-Hawkins Act of 1977—-one of the most pernicious pieces of legislation ever enacted, and one I am proud to say I voted against as a freshman Congressman. Yet even in those halcyon days of Keynesianism, few in Congress believed that they had mandated the Fed to pursue rigid quantitative targets for inflation and unemployment—let alone precisely a 2% annual gain in the PCE less food and energy or 6.5% on the U-3 measure of unemployment, which didn’t even exist then. By contrast even the voluble Senator from Minnesota saw the law as essentially an expression of congressional sentiment that it would be swell to have more jobs and less inflation.

And most certainly, the Congressional majority that passed the act did not in its wildest imagination foresee that the route to the quantitative inflation and unemployment targets it didn’t mandate would be through the canyons of Wall Street and the made-up monetary doctrine of “wealth effects” as the surest route to their achievement.

So the last 35 years have brought the greatest exercise in mission creep ever undertaken by an agency of the state. That explains why the monetary politburo persists in its absurd quest to force more debt into an economy which is already saturated with $59 trillion of the same. To pretend, as does Yellen and most of the monetary politburo that they must plow ahead printing money at lunatic rates because Congress so mandated it, is the height of mendacity.

The Fed has seized power and is not about to let go—-common sense be damned, and the constitution, too.

Copyright © Contra Corner blog