by George Washington, Washington's Blog

Bloomberg reports:

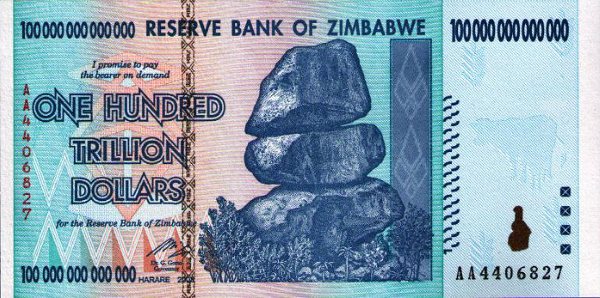

The amount of debt globally has soared more than 40 percent to $100 trillion since the first signs of the financial crisis as governments borrowed to pull their economies out of recession and companies took advantage of record low interest rates, according to the Bank for International Settlements.

Has all that money gone to stimulate the economy?

Nope …

Virtually none of it has. Instead, governments chose big banks over their own people. The huge amount of debt was racked up to bail out the big banks.

Central banks have been engaged in the the “greatest backdoor bailout of all time.”

And yet – as Bloomberg notes – everyone else gets austerity:

Concerned that high debt loads would cause international investors to avoid their markets, many nations resorted to austerity measures of reduced spending and increased taxes, reining in their economies in the process as they tried to restore the fiscal order they abandoned to fight the worldwide recession.

In essence, the elite financial players are manipulating the game so that they get the stimulus … and the little guy gets the austerity.

Indeed, the IMF is recommending “financial repression” of the average person, to plug the giant debt holes created by the bank bailouts.

And – whether or not you like Keynesian stimulus (most ZH readers don't!) – you should know that governments never really engaged in meaningful stimulus.

But didn’t we have to do this to save the economy after Lehman crashed?

Nope … top economists say we should instead of done what Iceland did: let the big banks go bust, and use resources instead to help the people.

Proof can be found in the fact that throwing money at the big banks has led to a “jobless recovery” – a permanent destruction of jobs – which is a redistribution of wealth from the little guy to the big boys. (And see this.)

Indeed, everything the government has been doing since 2008 has made unemployment much worse. And here and here.

Postscript: In 2010, economics professor and former Senior Economist for the President’s Council of Economic Advisers Laurence Kotlikoff said that - when unfunded liabilities are taken into account - the fiscal gap for the U.S. alone exceeds $200 trillion:

Based on the CBO’s [Congressional Budget Office's] data, I calculate a fiscal gap of $202 trillion, which is more than 15 times the official debt.

As of a couple of months ago, Kotlikoff put the figure at $205 trillion.

Copyright © Washington's Blog