Attached is the latest edition of The Technical Take, prepared by Ryan Lewenza, North American Equity Analyst, TD Wealth.

Highlights of today’s report include:

· The technical evidence is mounting for a short-term pullback in the S&P/TSX Composite Index (S&P/TSX). However, any pullback is likely to be shallow, and given that the primary trend for the S&P/TSX remains bullish, we would look to add to positions and increase exposure on any short-term weakness.

· The S&P/TSX Capped Energy Index has experienced an important technical breakout, and as such, we are growing more constructive on the sector.

· If the S&P 500 Index (S&P 500) breaks and remains above 1,850, which is our expectation, then the pullback seen in January would be over and we would expect further upside. From a seasonal perspective, March and April are historically strong months for the U.S. equity market, which increase the odds that the S&P 500 will break and hold above the key 1,850 level. With the S&P 500 in a long-term uptrend, we remain bullish on U.S. equities and continue to recommend a “buy on the dips” strategy.

· The technical profile of the S&P 500 Telecommunications Services Index remains bearish and we continue to recommend investors underweight this sector in their portfolios.

· In this week’s report, we highlight Analog Devices Inc. (ADI-N), and Davis + Henderson Corp. (DH-T) as attractive buy candidates and recommend investors trim/sell Canadian Utilities Ltd. (CU-T) and Genworth MI Canada Inc. (MIC-T).

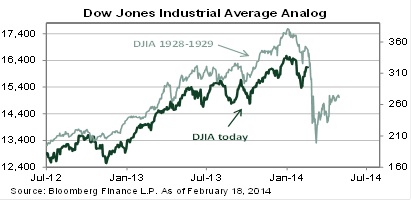

Chart of the Week – The current path of the Dow Jones Industrial Average is tracking the path made in 1928-29. Does this portend an imminent collapse in the stock market? We don’t believe so.

You may read/download the entire report below: