Is Monetary Velocity Finally Rising???

February 27, 2014

by James Paulsen, Chief Investment Strategist, Wells Capital Management

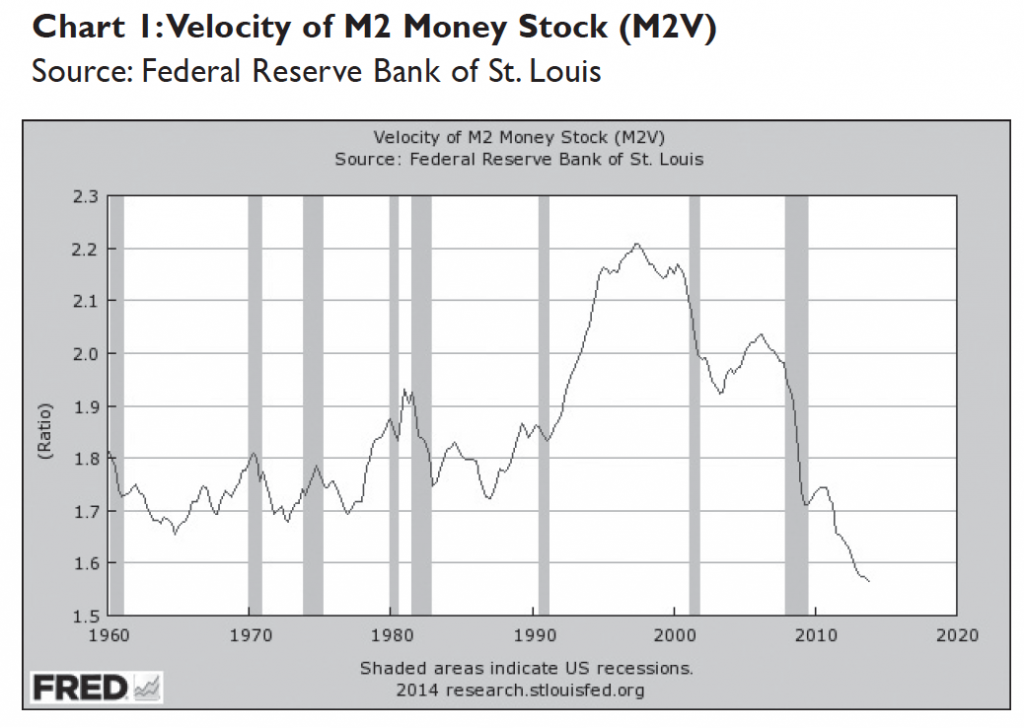

Although money supply velocity (i.e., the turn of the money supply or how much nominal GDP is produced by each dollar of the money supply) declined again in the fourth quarter, there are growing indications it may finally be starting to rise. As we have discussed elsewhere (see Economic and Market Perspective from November 11, 2013), the direction velocity takes this year may prove critically important both for the economy and for the financial markets.

Chart 1 shows money supply velocity since 1960 during both expansions and contractions. Velocity typically declines during the early years of economic recoveries as it has again in the contemporary recovery. Many believe the traditional monetary mechanisms have been broken in this recovery. Fallout from the Great 2008 recession is expected to keep velocity muted for some time. However, velocity has eventually turned higher in “every” post-war economic recovery and usually rises thereafter until the next recession. Indeed, there is nothing irregular about the chronic decline in velocity so far in this recovery. For example, it fell nearly as long during the beginning of the 1960s, late-1970s, and 1980s recoveries before finally turning higher.

Currently, many are focused on the Federal Reserve as they begin tapering their quantitative easing program and are trying to gauge how long before the Fed begins raising short-term interest rates. However, the most important monetary event during the rest of this recovery may not even involve the Fed. In our view, monetary policy will be primarily defined from here by if, when, and how fast money supply velocity rises? Should velocity uncharacteristically continue to weaken, concerns about disappointing economic growth are likely to return, anxieties about deflation will intensify and questions surrounding whether the Fed is out of bullets will escalate.

Conversely, if velocity follows its historical pattern and does soon begin rising, attitudes and concerns will be quite different. Suddenly, both real and nominal economic activity would improve (as spending propensities are boosted by a faster turn in the money supply), most inflation measures would rise, the Fed would be forced to accelerate its tapering program and initiate rate hikes, the bond market would likely get spooked and reprice long-term yields higher and finally good news for the economy may become bad news (because of overheated fears) for stocks.

Indications of rising velocity

In the last couple quarters, a few indicators now suggest velocity may be turning up. First, borrowing and lending propensities have improved. Second, commodity prices have recently risen and core producer price inflation has accelerated. Third, the pace of private nominal economic activity has accelerated sharply in the last six months. Fourth, private sector money velocity has risen in each of the last two quarters. Finally, the performance of the stock market in the last year is consistent with past recoveries during periods preceding when velocity first turned higher.

Read or Download the whole report below: