by Eddy Elfenbein, Crossing Wall Street

Lately, many investors have been tripping over themselves in an attempt to call the current stock market “a bubble.” Me, I’m in the doubter camp. But what’s interesting is that this question misses a much larger point — we’ve been watching a bubble pop all year. The bubble was in fear.

Here are a few charts that illustrate this point. Check out the return of the S&P 500 compared with the Long-Term Bond ETF (TLT):

Volatility has also dropped. The S&P 500 had only three days all year of moves greater than 2%. Here’s the Volatility Index (VIX) going back three years:

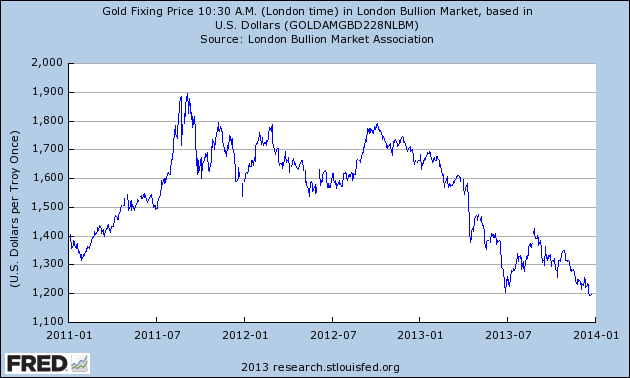

Check out gold, everyone’s favorite Doomsday investment, which has been falling like..well, a rock. This will be gold’s first losing year since 2000:

Even within stocks, safe-haven sectors like utilities lagged the market:

Meanwhile, small-cap stocks have been living large:

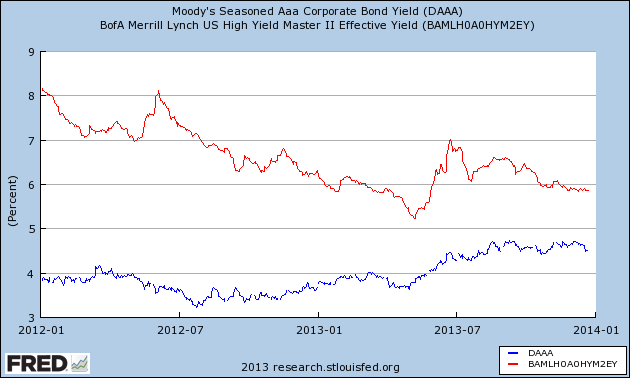

And within bonds, the safety premium between risky and non-risky has narrowed dramatically:

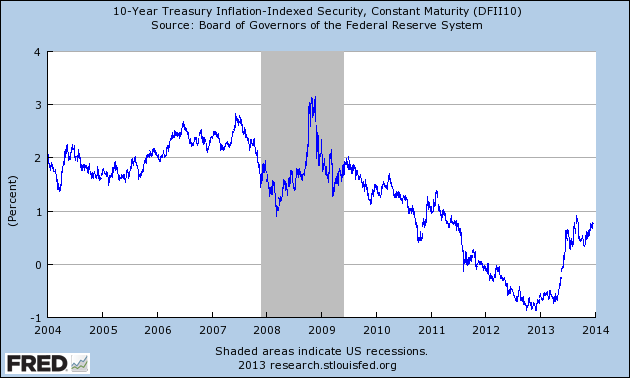

Whoa! Long-term TIPs yields are finally positive:

Posted by Eddy Elfenbein on December 26th, 2013 at 11:25 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Copyright © Crossing Wall Street