Old Wall Street was happy on Monday as bitcoin crashed and the S&P made a new closing high. Everyone else was miserable for the rest of the week because the highs made by a very efficient market on Monday, looked far too high on Tuesday, Wednesday, Thursday and Friday. Why? Taper-heavy fedspeak forced everyone to re-calibrate the QE musical chair guessing game. Selling came on the back of great news: a record jobs number, the government officially exiting the last of their General Motors position, and a blockbuster budget deal passed almost unanimously.

All good news, and all sold hard. Such is the functioning of a well valued market. More importantly, such is the power (or perception) of QE.

Thin to win?

A criticism of the market lately is that the rally is very thin. Instead of rising on robust breadth, the market was making gains mostly on select names. Part of this is seasonality where tax loss selling pushes down the price of laggard stocks and the difference between winners and losers becomes even more pronounced. Of course, this wreaks havoc on breadth. This is one of the most well documented phenomenon in the market. It is also a trade that prop traders and hedge funds look forward to all year. Stocks which are down on the year tend to do poorly in December as investors realize tax losses. Stocks that are up on the year tend to do well in December as investors are reluctant to trigger capital gains. Once January comes around, the trade tends to reverse itself as small-cap speculative risk comes back on the books (remember, they love the stock and the story) and winners are sold to fund new spec longs.

Is the Santa rally still coming?

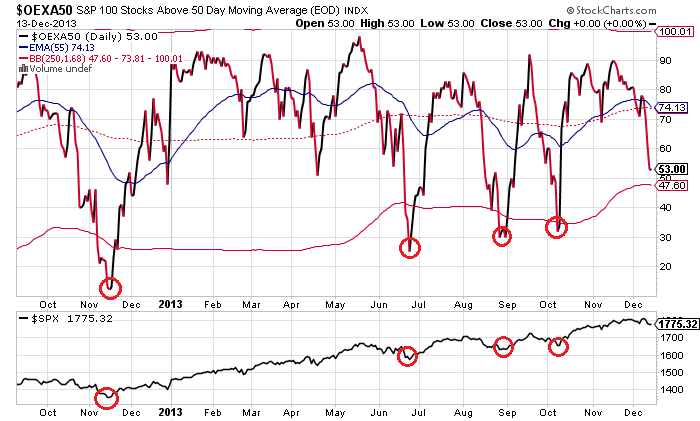

No one knows. Stop asking. The long side certainly still has trend and momentum on its side but the risk profile is and has been fairly lopsided. Not a huge reward for the risks. That said, the best buying opportunities have come when OEX stocks above their 50-day MAs gets close to the lower bollinger band. These drops have been getting shallower and shallower.

Weeklies

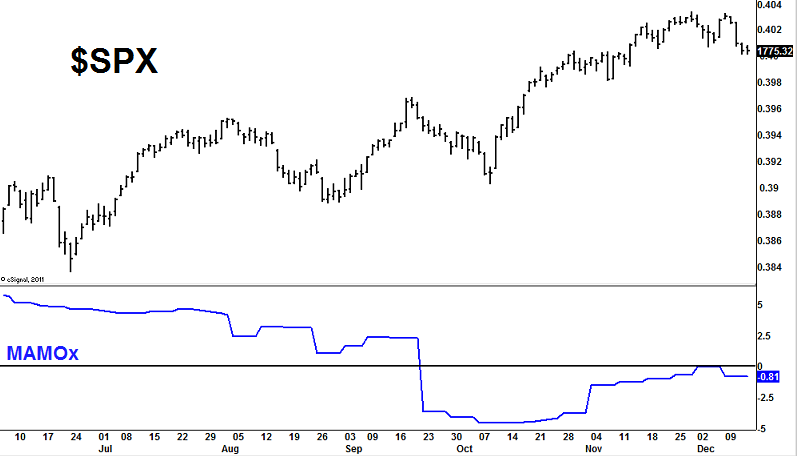

If you want to be bearish, wait until the blue line is below the red line. Science.

The MAMOx indicator is still bearish, fwiw. Behavior like this (prolonged rally without turning bullish) usually precedes a monster selloff. Problem is, you never know precisely when it will hit.

Rotation

Why are utilities selling off hard in a risk off week? Oh right, end of year effect — worst performing sector of the year getting punished. Why are consumer discretionary stocks holding up well in a down market and after a disappointing holiday shopping season? Oh right, best performing sector of the year going into year end.

Copyright © Dynamic Hedge via StockTwits

Disclaimer: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please click here for a full disclaimer.