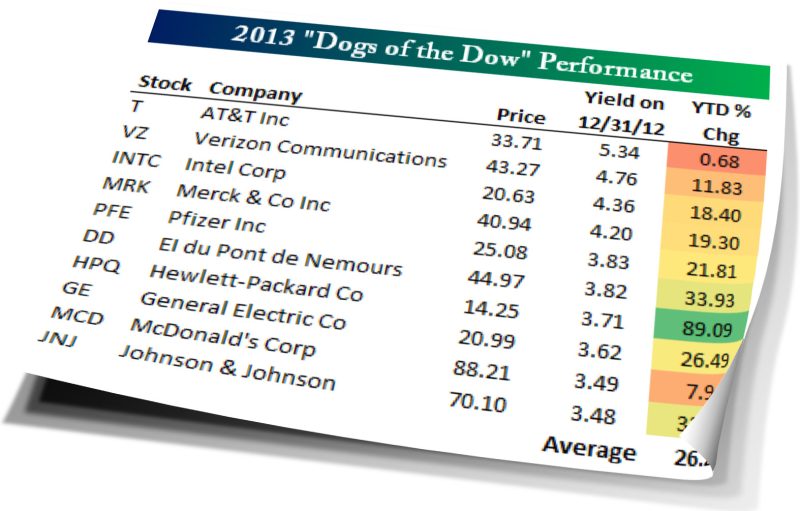

The "Dogs of the Dow" is a widely-known passive investment strategy that says to simply buy the 10 highest yielding Dow 30 stocks at the start of each year. Below is a look at how 2013's Dogs of the Dow have fared thus far.

As shown, the 10 highest yielding Dow stocks at the start of the year are up an average of 26.22% year-to-date. So far the Dogs are just barely outperforming the average gain of 24.26% for the 20 other stocks that were in the Dow at the start of the year. Outperformance is outperformance, though, and if it holds it will be a winning year for the strategy.

With the new year right around the corner, below is a look at the 10 Dow stocks (highlighted in yellow) that would currently gain entry to the "Dogs of the Dow" portfolio in 2014. Seven stocks would rollover from last year's portfolio, and there would be three newcomers to this year's list -- Cisco (CSCO), Microsoft (MSFT) and Chevron (CVX). Who would have thought a dozen years ago that Cisco (CSCO) and Microsoft (MSFT), along with Intel (INTC), would be part of the Dogs of the Dow??

One other thing to note is that the three stocks added to the Dow in September of this year -- Goldman Sachs (GS), Visa (V) and Nike (NKE) -- are all at the bottom of the index in terms of dividend yield. Visa (V) is actually the lowest yielding stock in the index at just 0.78%.

Copyright © Bespoke Investment Group