What's the Optimal Allocation to Foreign Equities?

by Rick Ferri

Nearly every financial adviser will tell you that foreign stocks should be part of a well-diversified portfolio. Yet, an analysis of the data shows that non-US (foreign) stocks as an asset class have underperformed the US market by a meaningful amount for more than 40 years, in addition to having higher risk. So, why do it?

Despite their shortcomings, I’m still a believer in foreign equities as part of a well-diversified portfolio. The allocation has created a higher risk-adjusted return, and there is the potential for higher nominal returns in the future.

Since 1970, the MSCI World ex USA Index (net of dividends) has underperformed the CRSP US Total Market Index by about 1% annually. Over the past five years, the same non-US stock index has fallen short of US stocks by more than 4% annually. In 2013 alone, foreign stocks have lagged US stocks by more than 15% through November. Given these unimpressive results, why bother investing outside the US?

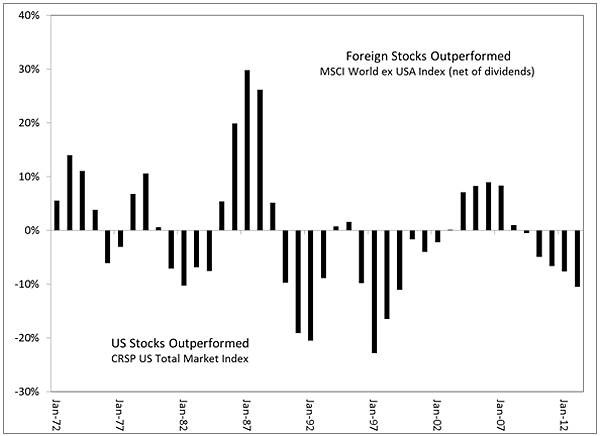

There are several reasons to hold non-US stocks in a portfolio. To understand why, first consider that foreign stocks do not always underperform the US equity market. Figure 1 illustrates the annualized three-year difference between non-US stock returns and US stock returns since 1970. From 1986 through 1988, the MSCI World ex USA Index outperformed the CRSP US Total Market Index by almost 30% annually. Foreign stocks also outperformed US stocks following the millennium.

Figure 1: Three-year annualized return of foreign stocks versus US stocks since 1970

Source: Data from CRSP and MSCI from January 1970 through October 30, 2013. Chart by Rick Ferri.

There may appear to be a return pattern in Figure 1 that one could use to predict when non-US stocks will outperform in the future; however, a statistical measurement called autocorrelation finds no predictability in the numbers. This means that past relative performance has no useful value when trying to forecast the best asset class to own in the future.

This leads us to a question of asset allocation. There are two standard asset allocation techniques that are used by investors. Strategic asset allocation assigns a fixed weight to each asset class in a portfolio, and there is a method employed to rebalance back to this allocation. The second asset allocation method is called tactical (also called market timing, dynamic, opportunistic, etc.), and it’s used by investors who believe they can opportunistically shift asset classes around and earn better results.

The lack of predictability in foreign stock returns relative to US stock returns lends itself to a strategic asset allocation strategy. This brings us to one of the most frequent questions I’m asked as an investment adviser: What is the optimal amount of foreign index funds to own in a strategic allocation? Should an investor own 20% foreign stocks and 80% US stocks, 30% foreign and 70% US, 40% foreign and 60% US, or perhaps some other mix?

That’s a great question, and one that I cannot answer definitively. The optimal amount of foreign stocks depends on their future performance relative to US stocks, and I don’t know the future (nor does anyone else). Yet, we must invest, which means we must make an intelligent asset allocation estimate using information that we do know.

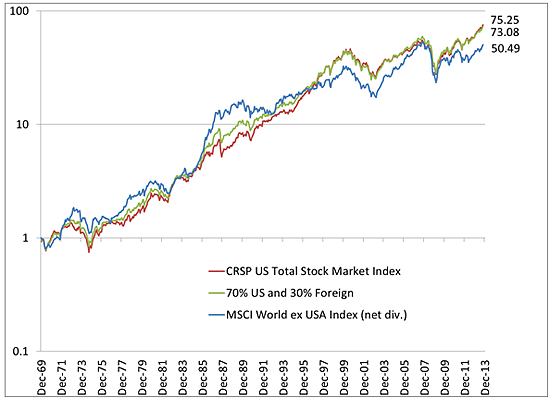

Let’s first review the performance of foreign stocks versus US stocks. Figure 2 illustrates the total return of $1 invested in US stocks since 1970 ($75.25) and $1 invested in foreign stocks ($50.49) over the same period. I also included the performance of $1 invested in an allocation of 70% in US stocks and 30% in foreign stocks rebalanced annually ($73.08). I’ll talk about this allocation more in a short while.

Figure 2: Growth of $1 in US stocks, foreign stocks, and a 70% US / 30% foreign mix since 1970

Source: Data from CRSP and MSCI from 1970 through October 30, 2013. Chart by Rick Ferri.

The big surge in foreign stocks that occurred during the 1980s was due primarily to the Japanese stock market. You may remember the Japanese asset price bubble era that ended in 1991. Real estate and stock prices became overly inflated due to changes in Japan’s monetary policy. The Nikkei 225, a broad measure of Japanese stock prices, tripled in value from 1984 through 1989 before collapsing. The index is still trading at less than half its 1989 peak price.

High volatility and lower returns are not a good reason to add an asset class to a portfolio. However, while adding some foreign stocks to a US stock portfolio didn’t help the overall equity performance nominally, it didn’t hurt much either, and it may have helped on a risk-adjusted basis. The lower return of foreign stock exposure was more than mitigated by the lower overall portfolio volatility created by mixing asset classes together and rebalancing annually.

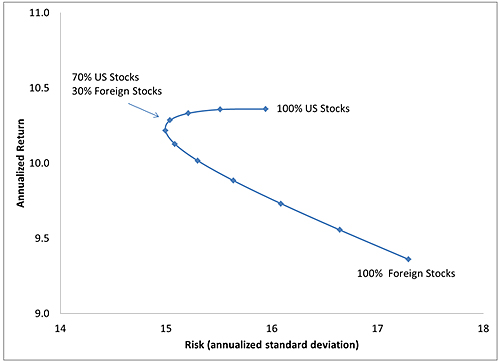

Figure 3 illustrates the efficient frontier that was formed by mixing foreign stocks with US stocks. Each point represents a 10% increment shift between foreign and US holdings and assumes the portfolio was rebalanced annually.

Figure 3: Efficient frontier of US stocks and foreign stocks from 1970 through October 2013

Source: Data from CRSP and MSCI from 1970 through October 30, 2013. Chart by Rick Ferri.

The risk of a portfolio (as measured by annualized standard deviation) with an allocation of 70% in US stocks and 30% in foreign stocks was about 1% per year lower than a portfolio of 100% US stocks and had only a slightly lower annualized return. Lower risk without a large decrease in return often results in an increased Sharpe ratio, which means the portfolio had a higher risk-adjusted return over the period.

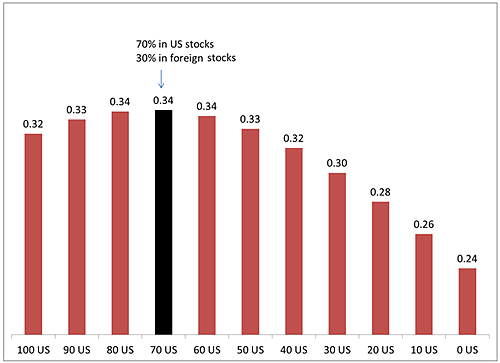

The higher the Sharpe ratio in a portfolio the better the risk-adjusted return of that portfolio. Figure 4 illustrates the Sharpe ratios for 10 different allocations to US stocks and non-US stocks. It starts with 100% US stocks (0% in foreign stocks) on the left through 0% US stocks (100% in foreign stocks) on the right.

Figure 4: Sharpe ratios for portfolios of US stocks and foreign stocks from 1970 through October 2013

Source: Data from CRSP and MSCI from 1970 through October 30, 2013. Chart by Rick Ferri.

Although the returns of foreign stocks have not kept pace with US stocks, and their risk was higher, a portfolio allocated to 70% in US stocks and 30% in foreign stocks generated a higher risk-adjusted return than a portfolio of all US stocks. This assumes the 70% US and 30% foreign stock allocation was rebalanced annually.

A higher risk-adjusted return alone is a good reason to maintain a balance between US and non-US equity. I believe that a 70% position in a US stock index fund and 30% position in a foreign stock index fund is a good position to maintain in a portfolio.

Secondly, it’s my belief that there is a regression toward the mean in financial markets over the long term. This means that like asset classes should return the same risk and return over the long term.

Refer back to Figure 2: US stock and foreign stock cumulative returns have matched or crossed many times since 1970. The last time this occurred was in 2008. If foreign stock markets do regress to the mean, as I expect they will, those two lines should cross again sometime in the future and non-US stocks will outperform US stocks nominally.

I don’t know when a regression toward the mean will occur in foreign stocks versus US stocks, but there is economic precedence for a regression. The global market is competitive and money is fungible. Titanic shifts in global economic power do occur, although not rapidly. Thus, a 70% US stock and 30% foreign stock return will benefit from the next shift when it does occur.

Foreign stocks have been an underperforming asset class for a very long time, but that doesn’t mean you shouldn’t invest in them. A 70% allocation to US stocks and 30% to foreign stocks has provided a return diversification that led to higher risk-adjusted returns without giving up much in nominal return. If regression to the mean does hold true between these two asset classes, then there is also the potential for an increased nominal return benefit from owning some non-US equity in the future.

Copyright © Rick Ferri