by Morgan Harting, AllianceBernstein

The failure of emerging economies to piggyback on the rich-world recovery this year is giving investors pause, despite enticing emerging-market (EM) valuations. But investors shouldn’t underestimate the power of this normally symbiotic relationship—or the upside potential in EM stocks next year on even a modest pickup in EM economic activity.

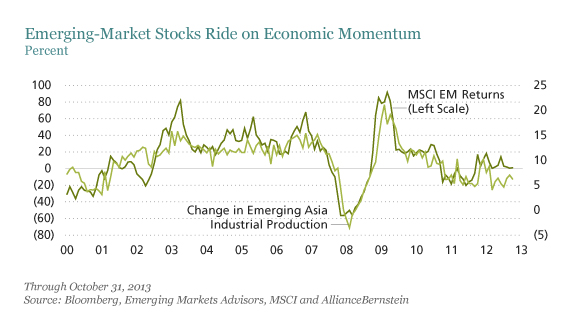

After all, the connection between EM economic health and EM stock performance has been amazingly tight historically. For instance, since 2000, a 1% increase in emerging Asia industrial production has been associated with a nearly 5% gain in EM stock returns (Display 1).

The relationship between developed- and developing-world economic growth has also been powerful. Over the past decade, a 1% rise in developed-market (DM) industrial production has tracked with a 2.4% increase in EM industrial production. But that symbiotic “lift” hasn’t materialized this cycle. Activity in the advanced economies has only recently stopped contracting, while growth in emerging countries has stagnated (Display 2). It’s little wonder that EM stocks have done so poorly this year.

EM’s sluggish response has sparked a fervent debate: Is this an anomaly that will soon correct itself, or a longer-lasting structural condition?

In our view, developed and emerging economies haven’t separated for good, but their relationship is facing new strains. The DM recovery has been feebler and less synchronous than in past cycles, and it’s drawing less from what developing nations produce. The US rebound is coming from housing, the shale energy boom, domestic car production and services for high-income consumers, all of which are boosting domestic demand. In some cases, improving US manufacturing productivity is coming at the expense of EM producers. Tech spending has been unusually tepid, so South Korean and Taiwanese exporters haven’t benefited as much as in the past. While Europe appears to be stabilizing, many countries and sectors still suffer from significant excess capacity. The US Federal Reserve’s tapering warning has raised EM financing costs, particularly for those countries with larger external imbalances.

In addition, many of the trends that drove EM productivity over the past decade are losing potency. In China, the slowdown in migration of “surplus” labor from rural areas to factories and the working-age population growth is eroding the country’s labor-cost advantages. Moving production to poorer, lower-cost nearby countries has addressed parts of this problem, but none of these neighbors has the population or efficiency that China enjoys. Other EM growth drivers—notably, domestic credit expansion, declining transportation costs and the rise of the Internet—are also losing steam.

On the other hand, new structural supports are forming. The Trans-Pacific Partnership agreement could expand trade among some of the largest emerging and developed countries across four continents. Infrastructure spending is rising rapidly throughout Africa, driving strong economic growth across the continent. Falling commodity prices, if sustained, would be a big boost for major commodity-importing countries such as Turkey and India.

All told, we think staying underweight EM stocks poses substantial opportunity costs for investors, particularly given the run-up in DM stocks this year. Though the DM-powered lift to emerging economies may not be as strong as in past recoveries, we think even small improvements could drive outsized gains for EM stocks. Still, navigating this landscape will be trickier than it has been historically, with investing success relying more on selectivity than on mere beta exposure. Companies most directly tied to developed-world end demand would seem to be the most obvious beneficiaries, while returns for companies in Latin America, South Africa and Russia may hinge more on the direction of commodity prices and global liquidity conditions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Morgan Harting leads the Emerging Markets Multi-Asset portfolio team at AllianceBernstein.

Copyright © AllianceBernstein