by Robert Arnott, Chairman & Chief Executive Officer of Research Affiliates, a global leader in smart beta and asset allocation strategies, and one of the originators of fundamental (as opposed to market cap weighted). His models now drive over $100 billion in assets in various funds, and an additional $75 billion at PIMCO.

~~~

“Conventional wisdom holds that regular rebalancing is a sound practice to control investing risk. But I’ve concluded that some of that conventional wisdom is wrong.”

-Paul Merriman, Why rebalancing could be a huge mistake

DFA has done some wonderful, and intellectually robust work, over the years. Merriman’s brief dismissal of rebalancing within the stock market is not part of that list. His same flimsy argument works just as well for rebalancing between stocks and bonds, a form of rebalancing that he finds acceptable. If Merriman believes that his analysis discredits rebalancing within segments of the stock market, then the same logic sure as heck discredits rebalancing between stocks and bonds.

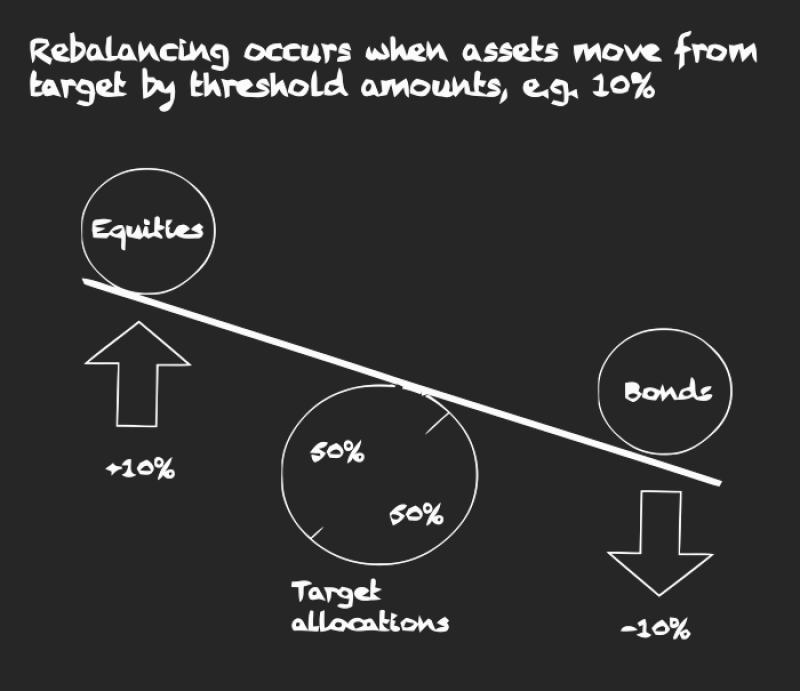

Let’s go back 100 years for stocks and 10-year Treasury bonds. Stocks gave us 9.79% per annum, while 10-year Treasuries gave us 4.99%. We might think that a 50/50 blend should have given us the average of 7.39%. Nope … it gives us 7.94%. So, glass half full, rebalancing seems to have added 55 bps per annum. Over the last 50 years, when the difference between stock and bond returns has narrowed to a scant 2.77%, rebalancing still adds an impressive 44 bps per year above the average of stock and bond returns. That’s a lot!

Now, let’s try Merriman’s glass half empty analysis. What if we just let the mix drift? We’d have earned 9.0% per annum with a drifting mix! That’s 110 bps per year better without rebalancing, than with consistent annual rebalancing to a 50/50 mix! Wow. Of course, we’d also have finished the century with 99% in stocks. That’s not exactly the risk profile we intended up front, is it?

In fact, the mix drifts so far away from our intended 50/50 starting point that even the great depression doesn’t suffice to bring it back to 50/50. It first reaches 60/40 after 12 years, 70/30 after 15 years, 80/20 after 37 years, 90/10 after 42 years, 95/5 after 46 years, 98/2 after 68 years, and 99/1 after 85 years. Wow.

Merriman dismisses rebalancing among the four equity segments by saying, “Assuming each asset class started with $10,000, the portfolio would have grown to $6.6 million without rebalancing, versus only $4.2 million with rebalancing. Rebalancing, in other words, cost the portfolio $2.4 million, taking away 36% of its gains.” How bad is the corresponding situation for the balanced investor, who rebalances to a 50/50 stock/bond mix, a strategy that Merriman still seems to endorse? Assuming each asset class (stocks and bonds) started with $10,000, the portfolio would have grown to $115 million without rebalancing, versus only $42 million with rebalancing. Rebalancing, in other words, cost the portfolio $73 million, taking away 63% of its gains. Ouch.

Let’s now consider what happens to the asset allocation, with his four-asset-class portfolio within equities. Remember that the fallacy of Merriman’s argument is that the drifting mix takes us far away from our intended risk-controlled starting mix, all the way from 50/50 to 99/1 with a stock/bond portfolio after 100 years? For our investor who begins with 25% in each of the four equity portfolios, how does the mix change in 50 years, without rebalancing? The ending portfolio has 76% in small-cap value stocks and a scant 3% remaining in the S&P 500; the mid-range performers, small-cap stocks and large-cap value, have both dwindled to 9% and 12%, respectively. Is this the risk profile that Merriman’s diversified 25%-in-each-portfolio investor intended fifty years ago?

Merriman has merely put forth, and knocked down, a flimsy and meaningless straw man: His argument requires that an investor, who values a particular asset mix at the outset, has no cares about how far that mix may drift away from that starting mix over time. If rebalancing is useful for asset allocation, it’s useful within segments of the stock market; his argument against the latter is just as powerful – and just as weak – as an identical argument against the former.

(h/t: Barry Ritholtz)