When is enough, enough? That’s the question you might be repeating to yourself if you’re a Gold Bull (physical, futures, or otherwise). Or maybe, that’s what you might be thinking if you’re invested in a long Gold ETF. Upon surfing the interwebs for useful financial commentary and statistics, we stumbled upon the Worst 10 ETF performer’s YTD from Index Universe… and can you guess what most of them have in common?

(Disclaimer: Past performance is not necessarily indicative of future results)

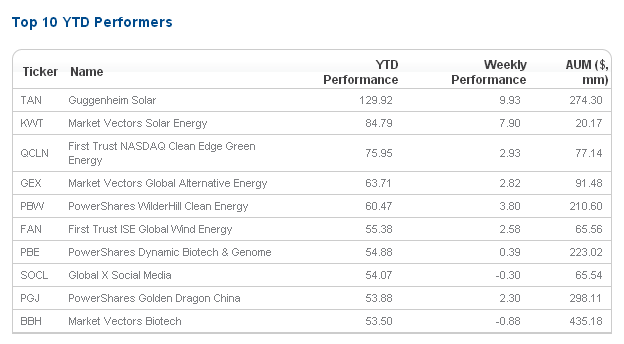

(Disclaimer: Past performance is not necessarily indicative of future results)

Table Courtesy: Index Universe

Five of the ten worst performers in 2013 are Gold ETF’s (4 of those Gold Miners ETF’s which we’ve discussed before here), two are Silver ETF’s (which from a commodity standpoint is highly correlated to gold), with the remaining three short VIX ETF’s. The range of the top ten was in between -43% and -56%. Ouch. Hopefully, most of those investors got out before Gold started turning bear, but there have to be some investors in the ETF, or well… it wouldn’t exist.

On the futures side of things… Gold has consistently dropped more than -26% since the start of 2013 (Disclaimer: past performance is not necessarily indicative of future results). That’s nothing to shrug off… but if you’re a frequent reader of our blog, you would know that the managed futures world isn’t concerned with a falling or rising gold futures, because trend following has the ability to go both long and short, and -26% performance over almost a year is definitely a short trend.

Moreover, while the benefits of passive indexing for equity etfs are well documented, it is our belief that investors are much better served getting commodities exposure through an actively managed CTA product (aka trend following) then a simple buy and hold approach…the scary numbers above are exhibit 1A. Plus ETF products like USO and UNG that are tied to futures markets rather than actual physical commodities are even worse off as they have the potential to lose (due to the cost of rolling futures positions) even when the markets are moving favorably aka higher.

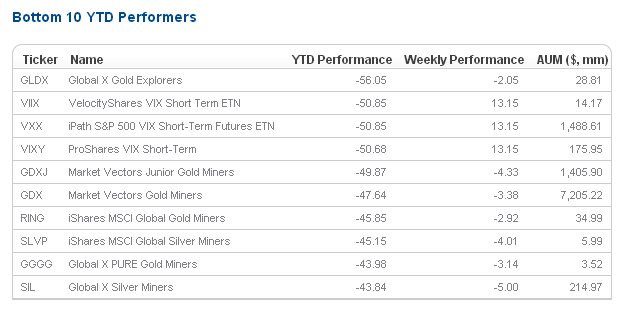

We’d like to point out it may appear we are harping on ETF’s the past couple of days with our latest post, “Nobody ever lost money in a Spreadsheet.” We don’t dislike ETF’s… and it would only be fair to show the Top Ten ETF’s of 2013.

(Disclaimer: Past performance is not necessarily indicative of future results)

Table Courtesy: Index Universe

Copyright © Attain Capital