Not my post, but definitely worth a re-post on my own blog. Special thanks to Frank Holmes.

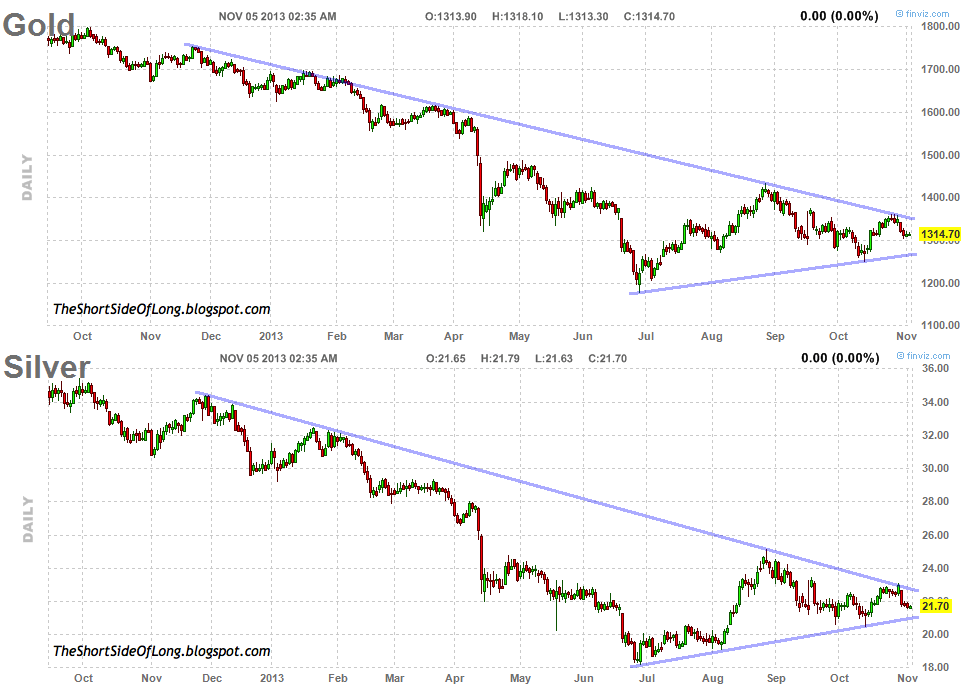

Chart 1: Gold stocks poised to bounce, according to BCA Research

Frank Holmes writes:

Jeffrey Currie, an analyst with Goldman Sachs, suggested just under a month ago that gold miners should hedge their output and lock current prices. In his opinion, gold would be the next big short trade. Other analysts, including Tom Kendall of Credit Suisse, also followed with negative commentary on the gold market, adding their names to the short-selling list.

It’s interesting that this group dares to recommend that investors do the exact opposite of what asset allocation studies show: adding gold and gold stocks to a portfolio can add alpha without a significant increase to risk. Not only are these analysts ignoring proven academic research, they seem to be ignoring reality.

BCA Research published a report at the end of last week highlighting that gold prices have failed to rise in recent months in spite of a weak dollar, adding that a catch-up is likely. BCA argues that gold is oversold on a technical basis, as seen in the chart above, which in itself could be enough to drive a gold rally above the $1,500 per ounce threshold.