Data Source: "Family, Education, and Sources of Wealth among the Richest Americans, 1982-2012" American Economic Review

The economic story of the past decades is supposed to be the death of the American Dream. Income inequality has risen, the wealth of the middle class stagnated, and stories of the poor working their way to prosperity became just stories. The popular view of America's upper class is that of an ossified aristocracy. But research from the National Bureau of Economic Research shakes up this view, at least among America's richest individuals.

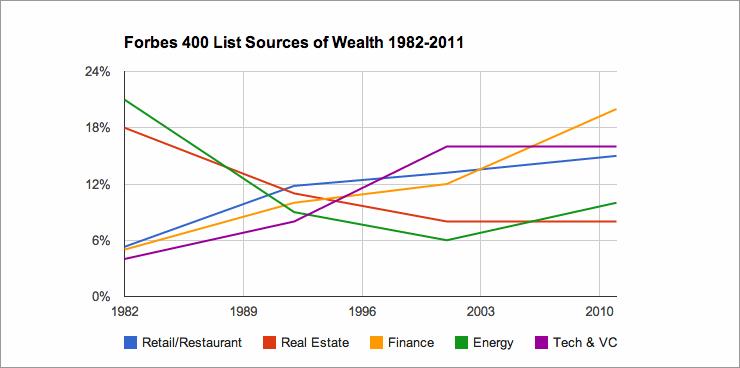

The individuals of the Forbes 400 List are the wealthiest people in America - the top .0001%. The above chart depicts the source of its members’ wealth.

Wall Street and Silicon Valley rank as the top industries. (VC stands for venture capital - the financing of early stage startups.) Industries beside these two usual suspects, however, also account for a large number of the richest Americans. Media empires make up almost 10% of the Forbes 400 list. The Walton family, owner of Wal-Mart, holds four top 10 spots.

Data Source: "Family, Education, and Sources of Wealth among the Richest Americans, 1982-2012" American Economic Review

Finance and technology companies emerged as a dominant source of wealth in America over the last 30 years. Less intuitive is the similar rise of the retail and restaurant sector over the same period. The share of moguls whose wealth comes from real estate or energy companies declined.

The data for the above charts comes from a research paper, "Family, Education, and Sources of Wealth among the Richest Americans, 1982-2012." Its authors - Steven Kaplan of the University of Chicago and Joshua Rauh of Stanford - argue that the rising share of the Forbes 400 List accounted for by technology and finance supports theories that explain America’s rising income inequality by how technology has favored the accumulation of wealth and made certain sectors more scaleable. Tech moguls like Mark Zuckerberg and Sergey Brin account for a rising share of new fortunes. But among all the businesses whose owners are on the list, the number with a strong technology component (such as energy companies using fracking) has increased from 7.3% in 1982 to 17.8% in 2011.

Over the last 30 years, income inequality has grown and intergenerational mobility has decreased. The rich are getting richer and drawing up the ladder to the upper class with them.

The story differs for the members of the Forbes 400 List.

Kaplan and Rauh find that America’s wealthiest are no longer a collection of Rockefellers and Carnegies. During the period the researchers investigated, the number of individuals on the Forbes 400 who were the first in their family to run a business rose from 40% to 69%. Sixty percent of individuals on the list grew up wealthy in 1982 while only 32% did in 2011.

Although being born into wealth is less and less necessary for admission to the club of America’s wealthiest individuals, being born into the middle class and getting a college education remains an important prerequisite. The percentage of Forbes 400 members without any college experience declined from 17% to 5% (although the number of college dropouts rose from 6% to 8%) and the share born into poverty stayed level at 20%.

America’s .0001% is becoming more meritocratic, but the means of a middle class background remain a necessary launching board.