Financial intermediation reduces volatility. In bull markets, demand for financial intermediaries drops.

by David Merkel, Aleph Blog

Ordinary people do well if they have a budget and stay within it. They do even better if they save and invest, but really, they don’t know what to do. Market returns are like magic to them. They don’t know why they occur, positively or negatively. Life would be best for them if a mutual financial company gave them smooth returns 0n a regular basis, and absorbed all of the market volatility over a market cycle. That would be hard for the mutual financial company to do, because they don’t know what the ultimate returns will be, so how would they know what smooth returns to credit?

There is a reason why banks, mutual funds, money market funds, life insurers, and defined benefit pension plans exist. People need vehicles in which to park excess cash that are more predictable than direct investing. Set an average person free to make his own investment decisions with individual bonds an stocks, and he will make incredibly aggressive or scared moves. Fear and greed will seize him, making him sell low, and buy high.

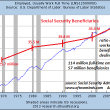

That’s why entities that reduce volatility, whether absolutely or relatively, whether short-run or long-run, exist. But there is seasonality to this: average people seek intermediaries during and after bear markets, when they have been burnt. After losses, they seek guarantees. That is often the wrong time to seek guarantees, because often the market turns when average people are running.

During bull markets, the opposite happens. When easy money is being made by amateurs, the temptation comes to imitate.

- If my stupid brother-in-law can make money flipping houses, so can I.

- If my stupid cousins can make money buying dot-com stocks, so can I.

- If my stupid neighbor can make money buying gold, so can I.

First lesson: don’t be envious. Aside from being a sin, it almost always induces bad investment and consumption decisions.

Second lesson: build up your investment expertise, piece-by-piece. Don’t follow the crowd. Develop the mindset of a businessman who calmly analyzes opportunity, asks what could go wrong, and estimates likely returns dispassionately. Pretend you are a Vulcan; if they actually existed, they would be some of the best investors, and not the Ferengi.

Third lesson: an experienced advisor can be of value even if he does not beat the market, by avoiding selling out at the bottom, and avoiding taking more risk near the top.

Fourth lesson: remember that market returns tend to be lumpy. The economy may be volatile, but markets are more volatile, and not in phase with the economy, because markets anticipate.

Fifth lesson: if you can do it in a disciplined way, invest more during bad times, after momentum has slowed, and things cease getting worse. Also, if you can do it in a disciplined way, invest less during good times, after momentum has slowed, and things cease getting better.

The main idea here is to be forward looking, and avoid the frenzies that take place near turning points.

Copyright © Aleph Blog