via Linette Lopez, Business Insider

Once bankers reach a certain age and want to be true bosses in their own right, they often ask themselves — should I get my CFA or my MBA?

It's a great question. While the MBA — the Masters in Business Administration — offers variety and camaraderie, the CFA — Chartered Financial Analyst — offers precision and rigor.

The MBA means you take a few years and go to school (part or full time) and the CFA is a 3-level test that requires years of solitary study (and sometimes solitary failure).

We've evaluated the decision making process, and presented the argument for why getting your MBA is superior.

Now it's the CFA's turn.

It's cheaper.

You know about that famous MBA price tag. A good school can cost you well over $100,000.

Not so with the CFA. Each of the three tests costs between $1,000 and $1,500 depending on when you register. If you fail a test and need to retake it, you don't have to pay the fee again. Any prep classes you take, of course, will be an additional cost.

You don't have to quit your job.

Sony Pictures / Columbia

A lot of people considering whether or not to get their MBA are worried about quitting their jobs and getting off a career track — not so with the CFA. Finding the time to study is hard, but if you love your job it's worth it.

There's no application process.

No digging for your transcript, no asking for recommendations... no application process with the CFA. Anyone can take the test.

No group work.

AP Photo/Craig Ruttle

If you like working alone and having dominion over your own schedule, consider that you are the master of your CFA study time. In Business School that won't always be the case.

And no snobbery.

flickr

A CFA is a CFA is a CFA... there's no snobbery about where you got it.

But not everyone can get it.

"Anybody can get an MBA at a certain level," said Jesse Marrus, founder of recruiting firm Street ID. "If you're decent at math and you know how to plug in equations and you're paying attention, it's not going to kill you."

The CFA requires a lot of math and reasoning skill... it (probably) won't kill you either, but it will try.

You'll learn a very specific, important skill for Wall Street.

www.media.tumblr.com

The CFA is for investment analysts. If you want to be a portfolio manager, taking this tests forces you to adopt the skills that will make you good at it. Then it will give you the stamp of approval you need so that others know that.

And you'll learn things you probably didn't learn in undergrad.

One CFA Charterholder told us that while he found his MBA friends were learning a lot of things they learned during their undergraduate years, his CFA study taught him a lot of things he'd never known before.

It was founded by Benjamin Graham.

Maybe you don't care that one of the most legendary value investors of all time founded the CFA Institute.

But you probably do.

You can use it to move to the buy side.

Recruiters told Business Insider that while sell side clients have become more interested in people with their MBAs, the buy side (hedge funds, private equity, etc.) prefers the CFA.

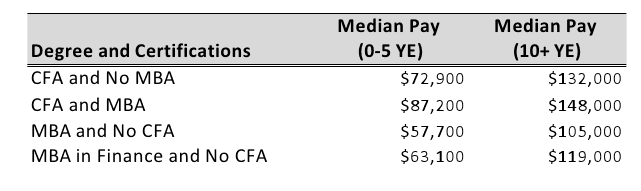

It gets you higher pay.

We reached out to Payscale for the average pay of CFA Charterholders vs. the average pay of people who've gotten their MBA:

Maybe you want to see things the other way around?

David Lerman

11 Reasons Why Getting An MBA Is Better Than Getting A CFA>

Source: http://www.businessinsider.com/cfa-better-than-getting-your-mba-2013-5#ixzz2gfKPCHBl

Copyright © Linette Lopez, Business Insider