September 3, 2013

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

Key Points

- Since moving into the "pullback" camp in early August, the market has had a mini-correction and it may not be over.

- Sentiment and technical conditions have improved; as has the economic backdrop, but risks remain.

- Until we get past Syria, Fed tapering and the debt ceiling, volatility may remain elevated.

We have been in the market pullback camp since early August and the S&P 500 has "delivered" with a 4.6% retreat from August 2 through the 27th. My caution was rooted in the deterioration of some of the market's technical and sentiment conditions; on top of seasonal tendencies and exogenous risks, including Fed tapering, the debt ceiling, and now Syria. I will address the more macro-oriented risks in near-future reports.

Much of the technical and sentiment deterioration has been repaired, but the aforementioned exogenous risks have not. I remain a longer-term bull and think the market could really rip again relatively soon; but for the more short-term and tactically-inclined, we may not yet see an ebbing of the recent volatility.

Sentiment … getting there

Let's start with sentiment, where I often start when writing about the market's short-term trends. Remember, it's a contrarian indicator. First, we'll look at the Ned Davis Research (NDR) Crowd Sentiment Poll (CSP), which amalgamates quite a few individual sentiment indices; all of which I monitor individually as well.

Sentiment Less Bullish

Source: FactSet, Federal Reserve, Ned Davis Research (NDR), Inc. (Further distribution prohibited without prior permission. Copyright 2013 © Ned Davis Research, Inc. All rights reserved.), as of August 27, 2013.

Sentiment has come off the boil; but not to the levels of extreme pessimism that served as market bottom points over the past several years.

Although I can't show a chart due to subscription requirements, I do want to point out the latest trend in the Investors Intelligence reading of investment advisor sentiment. It is one of the components of the CSP. Bearishness among advisors has dropped into extreme pessimism territory and is now in a zone in which the market has appreciated at a double-digit pace historically. In addition, over the past six weeks, the percentage of advisors that have moved into the “correction” camp has jumped from 28% to 38%.

Finally, the percentage of bulls in the American Association of Individual Investors (AAII) survey also dropped quickly alongside the market's pullback, as you can see below.

Individuals Less Bullish

Source: American Association of Individual Investors (AAII), FactSet, as of August 30, 2013.

Let's also look at a non-contrarian sentiment indicator—action among company insiders. After a major pick-up in insider sales around the market's early August highs, their selling has dried up. They are not yet buying to any significant degree, but they are no longer selling.

Seasonals … we're in the thick of it

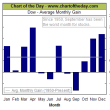

From a seasonal perspective, we are in the beginning of the weakest month historically for the stock market. September only saw positive returns 44% of the time since 1950; the lowest reading for any month.

The Cruel Month of September

Source: FactSet, Strategas Research Partners, LLC. 1950-August 30, 2013.

But the good news, at least historically, is that in years when the market was very strong leading into September (as was the case this year), September’s performance—as well as the remainder of the year—was historically better than average.

Technicals … getting there

Technically from a short-term perspective, the percentage of S&P 500 stocks trading above their 50-day moving average has dropped from over 80% in August to near-30% at present. If this were to head near 20%, it has historically been a very good indicator of an oversold market. What's also good is that there has not been much deterioration in the longer-term technicals; with more than 80% of the S&P 500 stocks' 50-day moving averages still above their 200-day moving averages.

Economic fundamentals … improving

The August reading from the ISM Manufacturing Index surprised the skeptics, and even the consensus, and climbed from its elevated July reading; jumping to 55.7 from 55.4 and signaling continued healthy expansion in manufacturing. Construction spending also rose much more than expected at 0.6%. This comes on top of the latest revision to second quarter gross domestic product (GDP), which now stands at 2.5%, up from the initial read of 1.7%. It's also in keeping with the recent downside breakout in initial unemployment claims—a strong leading indicator for improving job growth.

But with Fed tapering on the market's mind, today might be an example of "good news is bad news" given the reversal of the market's strong early gains as I write this. I never make much of one day's action; but I do not believe that good news is bad for the market at this stage in the cycle. I think better economic fundamentals will translate to higher earnings and be a favorable backdrop for equities, once we get past these near-term obstacles.

Cyclicals vs. defensives … trend since April continues

In keeping with our relatively optimistic view on the economy, we have had a bias toward more cyclical sectors. Technology, industrials and consumer discretionary remain our favorites; while we have been de-emphasizing the more defensive sectors like consumer staples, utilities and telecom.

As you can see in the charts below, since the beginning of May, when longer-term interest rates began their rapid ascent, defensives have underperformed cyclicals. And even in this latest pullback, the cyclicals have held up quite well relative to the defensives, which are typically safe-haven stocks during market corrections. We think the cyclicals' outperformance has legs.

Cyclicals Favored Over Defensives

Source: FactSet, as of August 30, 2013. Rebased to January 1, 2013=1. Equally-weighted average.

Since the market's recent peak in early August, these trends have continued, with materials, technology and energy the best performers; while financials, utilities and consumer staples have pulled up the rear.

Not out of the woods

The bottom line is we're not likely out of the woods for the stock market, even though some of the heavy-lifting of improvement has been done on the sentiment and technical front. With better economic news on the radar, skittishness about the upcoming Fed meeting on September 17-18 will likely remain elevated. We also have the uncertainty about a new Fed chair, the upcoming debt ceiling fight and ongoing consternation about the implementation of the Affordable Care Act. And of course there's Syria; which could have an impact on confidence as well as an even bigger effect on oil prices.

But the market remains reasonably valued and the possibility of military action in Syria could mark a nice entry point for more market timing-oriented investors. Keep your cards close to the vest, but don't fold 'em.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.