by Ryan Detrick, CMT, Schaeffer's Trading Floor

A few charts caught my attention today and they all are concerns. Now that right there could be contrarian fodder for higher prices. Still, here they are.

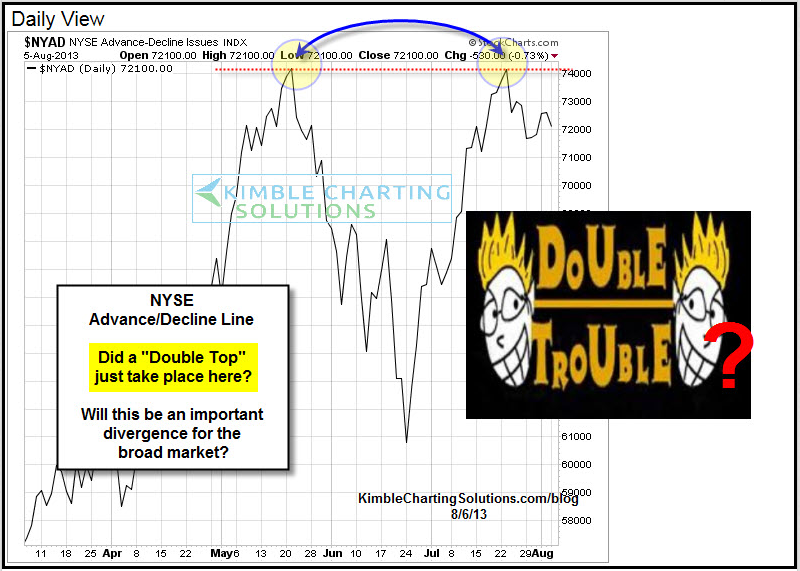

First up, my pal Chris Kimble noted a potential double top in the Advance/Decline line. I mentioned same chart in Monday Morning Outlook two weeks ago as a big level. Well, until we clear the previous peaks, it is still a very big worry.

Next up, Andrew Thrasher noted the big divergence in how many stocks are above their 200-day moving averages. In fact, this has weakened recently while the SPX moved up to new highs. Again, under the surface this is a worry.

Lastly, our own Chris Prybal noted there were another 83 buying climaxes last week. This comes after the 337 we saw last week, which was the third highest this year. In fact, the past four weeks we’ve seen a staggering 750 buying climaxes. Remember, a buying climax is when a stock makes a new 52-week high, then closes lower on the week. Clusters of them can be warning signs. Safe to see we’re seeing a cluster of them right here and now.

Tags: SPX

Copyright © Schaeffer's Trading Floor