“Bad Trade?!”

by Jeffrey Saut, Chief Investment Strategist, Raymond James

July 29, 2013

“I asked the obligatory question: How do you decide when to make a trade?” “Through experience,” he says, propping his foot up on a small fold-out seat screwed to his post. “Over the course of eighteen years as a specialist, I’ve had every type of experience – up market and down market, people getting shot, wars, you name it – and you learn how to react based on those experiences. I guess I’ve had everything happen, and I guess you store it in the computer in your head. You don’t have a lot of time to decide, that’s for sure. And you have to anticipate. You have to look at the tape and anticipate – two months or three months, maybe a day or so, maybe two or three seconds before someone else. That’s what makes you a good trader ... People talk a lot about their bellies. I guess that has something to do with it too. You do feel something in your gut.”

He clears his throat with a loud harrumph and goes on: “You watch the tape. There’s a talent to reading the tape. Later today, either the market is going to go further down or it’s going to rally. It’s down fourteen now, at eleven-thirty. You have to anticipate when the rally will start and end. An outsider looks and sees the market down six points for the day. A student of the market looks at what the market was doing over the course of the day. Here, we live and die by the moment. The market is constantly breathing during the day. You have to breathe with it and sense its pulse. That determines whether you’re a successful trader or an unsuccessful trader.”

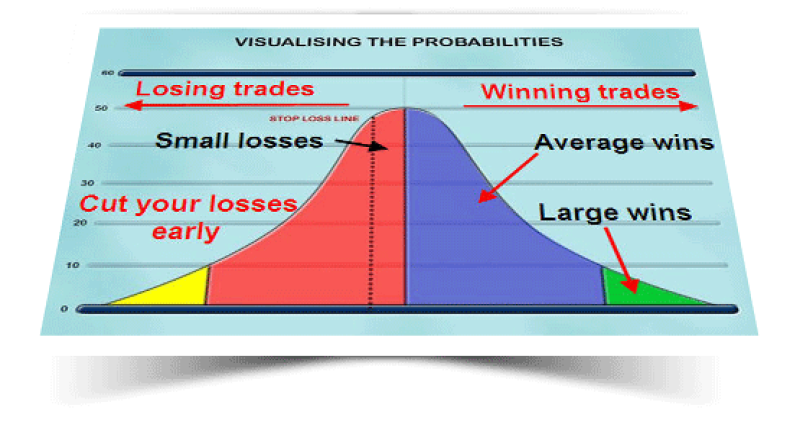

Do you ever hold on to a bad trade and hope for a rebound? I ask. “Live in hope,” Milton says ruefully, “and die in despair.” He goes on to say, “You try to stretch your profits and limit your losses. The worst thing you can do in this business is try to protect a bad trade. You do this and they carry you out of here. This reminds me of the kid who (poops) in bed and gets it all over his legs trying to kick it out of the crib. You see, a bad trade is like a diseased piece of meat. You don’t want it any more of it. Throw it away. Bury it. Burn it, just get the damned thing away from your mouth. When you’re breaking in a new trader, the hardest thing to learn is to admit that you’re wrong. It’s a hard pill to swallow. You have to be man enough to admit to your peers that you are wrong and get out. Then you’re alive and playing the game the next day. A lot of traders don’t learn that and they fail.”

... “The Traders” by Sonny Kleinfield (1983)

Last week I asked myself the obligatory question, “Did I make a bad trading decision by targeting mid-July through mid-August (with the date specific of July 19th) as the timing point for the first meaningful decline of the year?” The reason for said question was that every time the S&P 500 (SPX/1691.65) sold off last week, buyers showed up to save the day. And, the operative word is “trading” because that potential downside strategy was merely a short-term tactical call. Indeed, I continue to believe the odds are high that we are into a new secular bull market. My conviction level was raised last week by the media as, “There they go again,” to quote a President from an era gone by. To be sure, “There they go again” as the recent pullback attempts have caused the media to trot out the usual “Bear Boo” suspects. Why is a mystery to me, because these broken-clock bears have been wrong for more than four years! Of course, I too have been called a broken-clock bull, and just last week a client requested to be deleted from an advisor’s email list because I was only writing about “gloom and doom.” Now anyone is entitled to be wrong, lord knows I have been wrong more than I care to admit, but as my father used to say, “If you think the equity markets are going up, be bullish, and if you think the markets are going down be bearish.”

Speaking of being wrong, I had thought while this quarter’s corporate earnings reports were going to look pretty good, I also thought the revenues reports would come up short. So far, that is just not the case with 56.3% of reporting companies beating their revenue estimates. Meanwhile, 65.2% have beaten their earnings estimates for the best reporting season since 4Q10. As for the sectors doing the best on the earnings front, Technology (+71.3%), Industrials (+68.7%), and Financials (+67.9%) have the best beat rates, while Utilities (+22.2%), Telecom (+33.3%), and Materials (+51.0%) have done the worst. By my work, the only sectors NOT currently overbought, on a short/intermediate–term basis, are Materials, Technology, and Telecom.

As for individual companies beating their estimated earnings/revenue estimates, and guiding future earnings estimates higher, six favorably rated companies from the Raymond James research universe have hit my screens. They are, in no particular order: Skyworks Solutions (SWKS/$23.95/Outperform); Xilinx (XLNX/$46.18/Outperform); SanDisk (SNDK/$57.00/Outperform); EastGroup Properties (EGP/$63.39/Outperform); Equifax (EFX/$61.79/Outperform); and Advanced Micro Devices (AMD/$3.87/Outperform). We offer these names for your potential “buy list,” especially if we get the envisioned 10% pullback.

This week we get a barrage of economic reports having the potential of a negative impact on the equity markets. Monday we get the Pending Home Sales (-1.0e) and on Tuesday the S&P Case Shiller (+1.45) and the Consumer Confidence (81.0e) reports. Wednesday ushers in the ADP Employment (180Ke), Q2 GDP annualized (+1.0%e), the GDP Price Index (+1.1e), the Core PCE (+1.0e), the Chicago PMI (54.0e), and the FOMC interest rate decision. Thursday sees the release of the Initial Jobless Claims (+345Ke), the ISM Manufacturing (52.0e), the ISM Prices Paid (54.0e), the Total Vehicle Sales (15.8Me), and then on Friday the all-important employment data.

As for the here and now, at the beginning of this missive I asked the obligatory question, “Did I make a bad trading decision by targeting the mid-July through mid-August timeframe (with the date specific of July 19th) as the timing point for the first meaningful decline of the year?” Given the weight of the evidence, I am sticking with that “call.” To recap a few of those “evidences” mentioned over the past few weeks: we had a 7.5% decline in the SPX between May 22nd and June 24th that was accompanied by a much more severe ~17% decline in the NYSE Advance/Decline Line; for the last 10 years between mid-July and early August, nine of the 10 S&P macro sectors have declined; the SPX has been making new rally highs without a similar expansion in new yearly highs for stocks (at the May 21st high there were 536 new 52-week new highs, last Monday there were 325); when they start “running” the laggards it’s time to look over your shoulder; the 14-day Stochastic Indicator has fallen below its moving average; and the list goes on. So, the weight of the evidence continues to suggest caution until the mid-July into mid-August point of vulnerability passes.

The call for this week: On Friday, July 19th (D-Day) the SPX closed at 1692.09. The following Monday it closed at 1695.53 and then at 1692.39 on Tuesday. Subsequently, the SPX has not been able to recapture those highs. Anybody that follows my work knows that such D-Day “calls” have a tracking error of one to three days. Also worth remembering is that I have always thought the SPX could travel into the 1700 – 1730 level before any meaningful decline begins. Whether that happens remains to be seen, but so far the SPX has been merely “hanging on,” but I think its “hanging” remains on borrowed time. Whatever the near-term resolution, I know old traders, and I know bold traders, but I know no old and bold traders! Be cautious my friends ...

Copyright © Raymond James