Upcoming US Events for Today:

- Weekly Jobless Claims will be released at 8:30am. The market expects Initial Claims to show 337K versus 343K previous.

- Import/Export Prices for June will be released at 8:30am.

- The Treasury Budget for June will be released at 2:00pm.

- Chain Store Sales for June will be released throughout the day.

Upcoming International Events for Today:

- The ECB will publish its monthly report at 4:00am EST.

- Canada New House Price index for May will be released at 8:30am EST. The market expects a year-over-year increase of 1.9% versus an increase of 2.0% previous.

Recap of Yesterday’s Economic Events:

| Event | Actual | Forecast | Previous |

| CNY Trade Balance (USD) | $27.12B | $27.80B | $20.42B |

| CNY Exports (YoY)% | -3.10% | 3.70% | 1.00% |

| CNY Imports (YoY)% | -0.70% | 6.00% | -0.30% |

| JPY Consumer Confidence Index | 44.3 | 45.6 | 45.7 |

| EUR German Consumer Price Index (MoM) | 0.10% | 0.10% | 0.10% |

| EUR German Consumer Price Index (YoY) | 1.80% | 1.80% | 1.80% |

| EUR German Consumer Price Index – EU Harmonised (MoM) | 0.10% | 0.10% | 0.10% |

| EUR German Consumer Price Index – EU Harmonised (YoY) | 1.90% | 1.90% | 1.90% |

| USD MBA Mortgage Applications | -4.00% | -11.70% | |

| USD Wholesale Inventories | -0.50% | 0.30% | -0.10% |

| USD Wholesale Sales (MoM) | 1.60% | 0.30% | 0.70% |

| USD DOE U.S. Crude Oil Inventories | -9874K | -3200K | -10347K |

| USD DOE U.S. Gasoline Inventories | -2634K | 1000K | -1719K |

| USD DOE U.S. Distillate Inventory | 3038K | 1000K | -2418K |

| USD DOE U.S. Refinery Utilization | 0.20% | 0.20% | 2.00% |

| NZD Business NZ Performance of Manufacturing Index | 54.7 | 59.2 | |

| JPY Machine Orders (YoY) | 16.50% | 3.30% | -1.10% |

| JPY Japan Buying Foreign Bonds (Yen) | ¥973.1B | -¥965.0B | |

| JPY Japan Buying Foreign Stocks (Yen) | -Â¥14.1B | -Â¥38.8B | |

| JPY Machine Orders (MoM) | 10.50% | 1.90% | -8.80% |

The Markets

Markets traded around the flat-line on Wednesday as investors digested the minutes of the latest FOMC meeting. Many of the voting members had indicated that further improvement in the job market is required before a gradual tapering is enacted. Still, a number of the members expect that the present stimulus will unwind by the end of this year, leaving little time for the economic fundamentals to prove themselves. The S&P 500 index "popped" above short-term resistance at 1654.19 following the meeting minute release, however, the benchmark closed below this hurdle at the final bell. Momentum indicators have recently curled positive, suggesting a run towards the all-time highs for the large-cap index could soon be realized. Next level of resistance can be found at 1687.18, the all-time high.

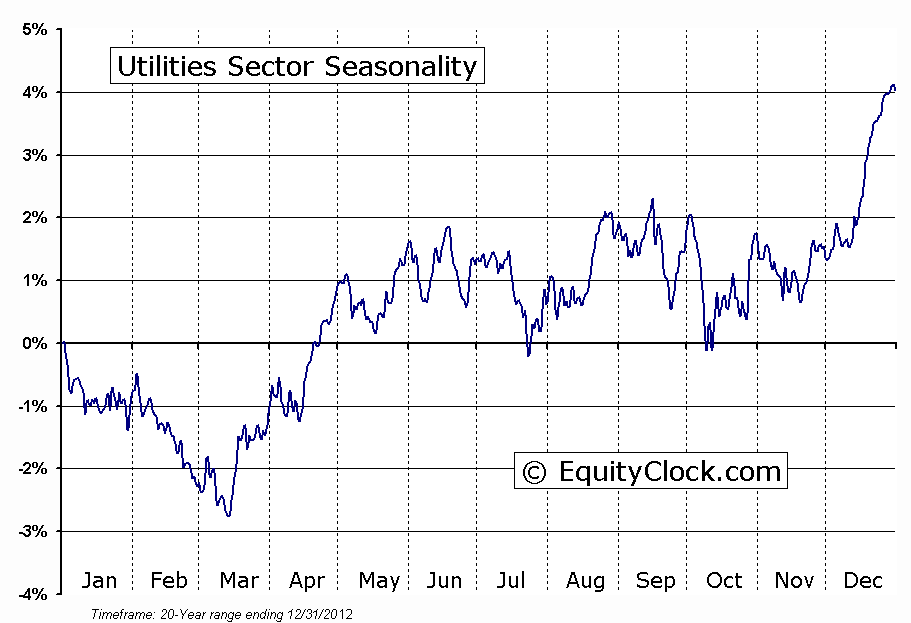

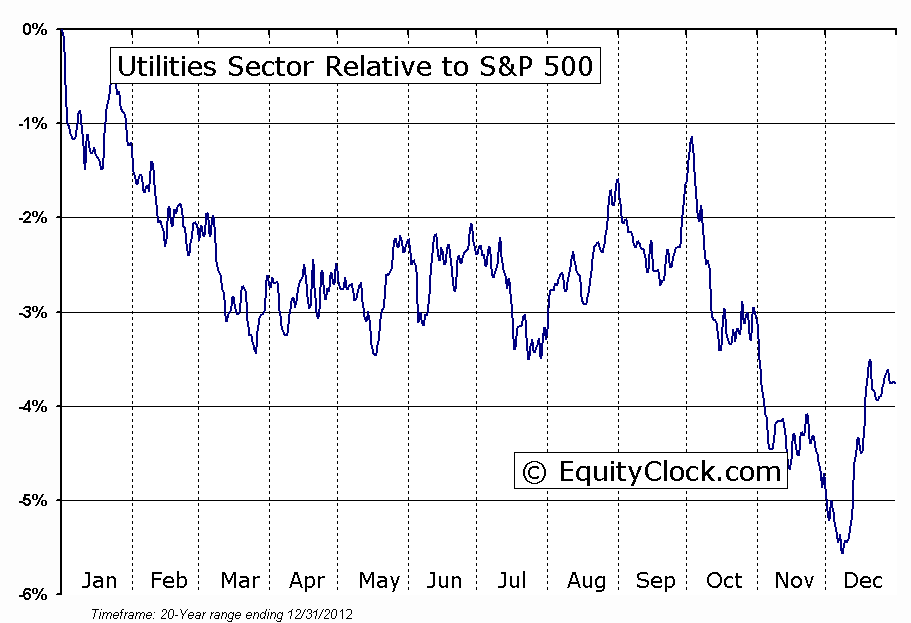

An upcoming seasonal trade is showing a bullish setup on the charts. The utilities sector has a period of seasonal strength from July 17th through to October 3rd. Based on data over the past 20 years, average gain over the period reaches 2.2%, outperforming the S&P 500 index by a similar margin. The trade has proven successful 14 out of the last 20 periods. The defensive, high-yielding characteristics of the sector draw investors in during this typically volatile period for equity markets. Currently, the Utilities Sector ETF (XLU) is showing the appearance of a reverse head-and-shoulders bottoming pattern with the neckline presently at $38. A break above the neckline would imply upside potential to the next level of resistance at $40. The trade remains dependent upon interest rates, which have risen over the past couple of months, increasing the cost of borrowing to these often leveraged enterprises. As interest rates decline, as they typically do in the summer months, utility stocks benefit. The yield on the 10-year treasury note recently became the most overbought in years, suggesting that some type of correction is likely following a move that has come too far, too fast. Another seasonal trade that follows the same timeframe, and for many of the same reasons pertaining to interest rates, is Real Estate Investment Trusts (REITs). Both trades are lining up for a rebound off of the recent lows, precisely as the period of seasonal strength gets set to begin.

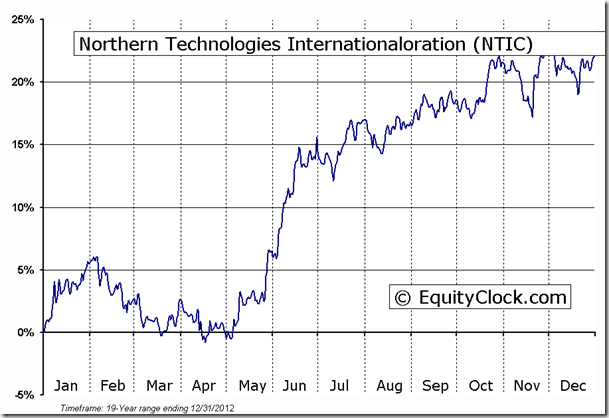

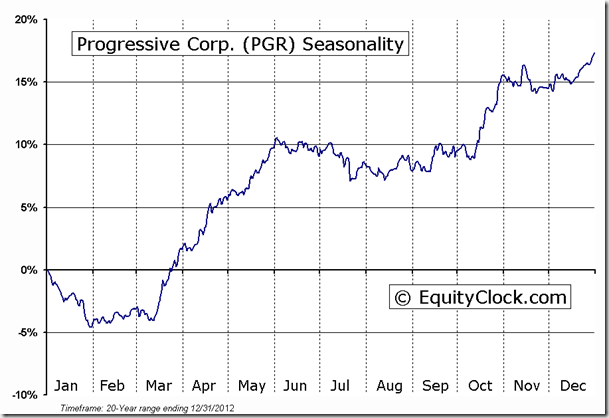

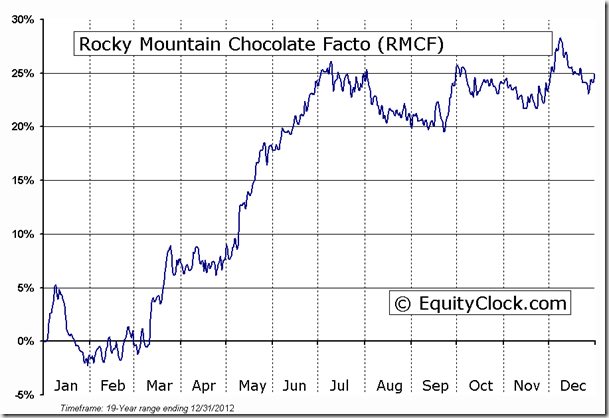

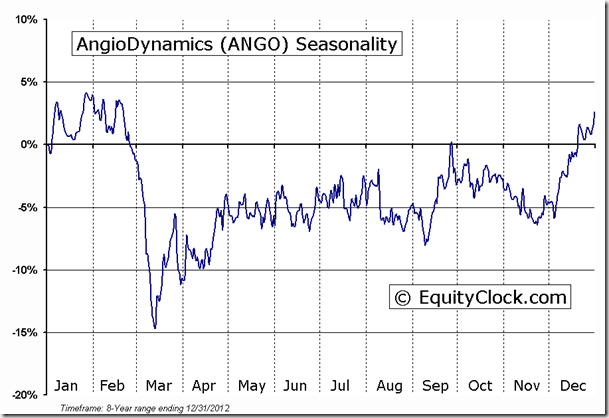

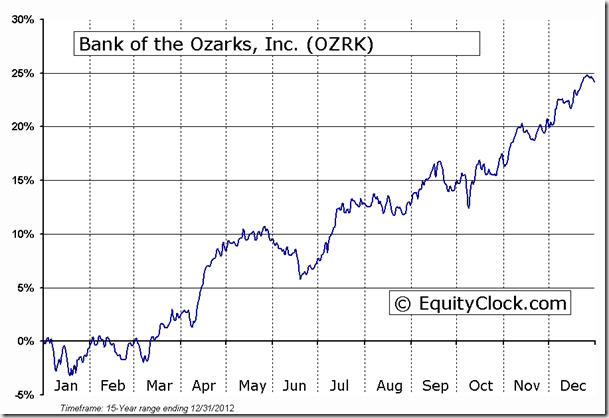

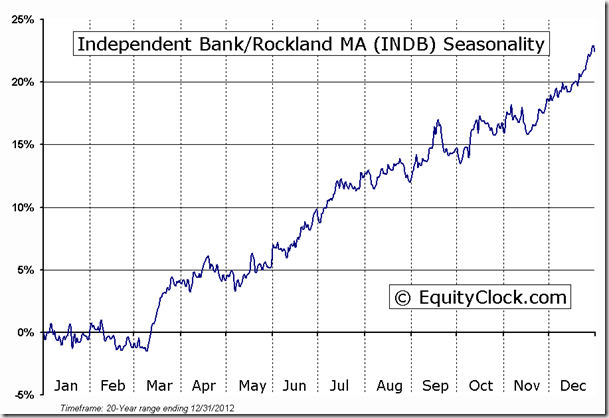

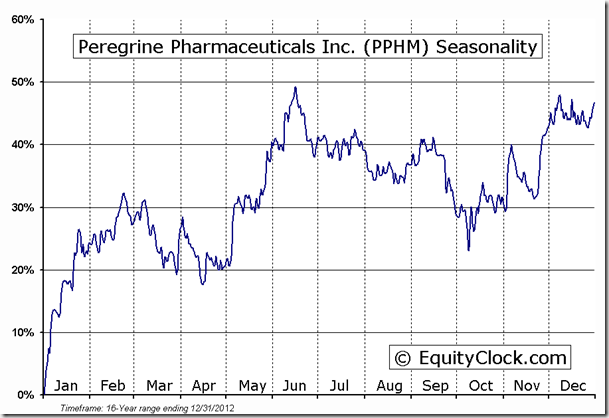

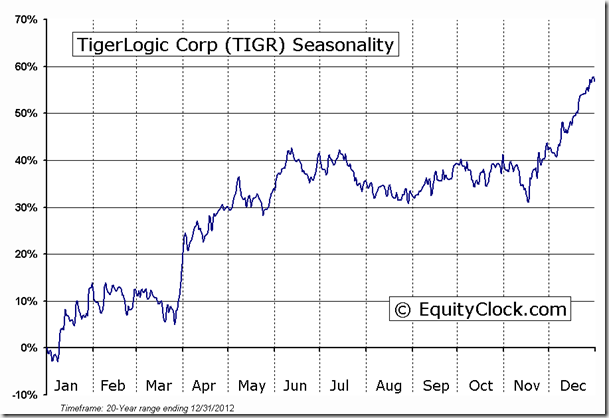

Seasonal charts of companies reporting earnings today:

Sentiment on Wednesday, as gauged by the put-call ratio, ended around neutral at 1.04. The put-call ratio has been drifting sideways over recent weeks as investors remain on the fence as to a bullish or bearish scenario for equity markets.

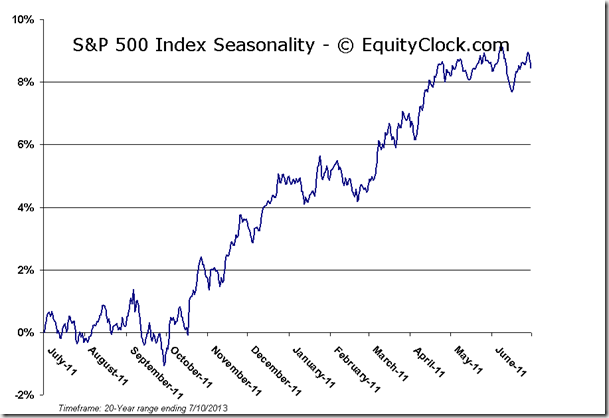

S&P 500 Index

Chart Courtesy of StockCharts.com

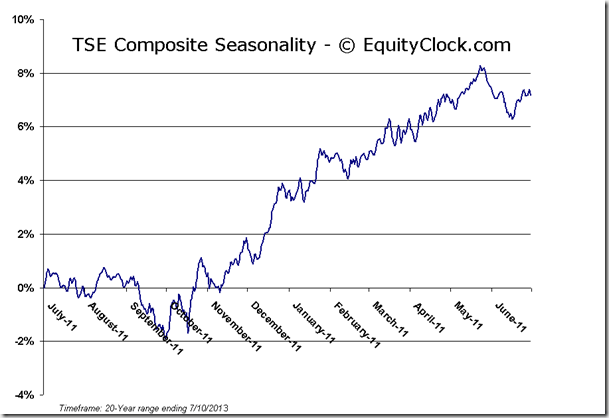

TSE Composite

Chart Courtesy of StockCharts.com

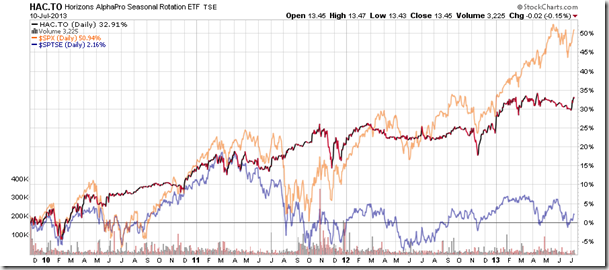

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.45 (down 0.15%)

- Closing NAV/Unit: $13.46 (down 0.01%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.82% | 34.6% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.