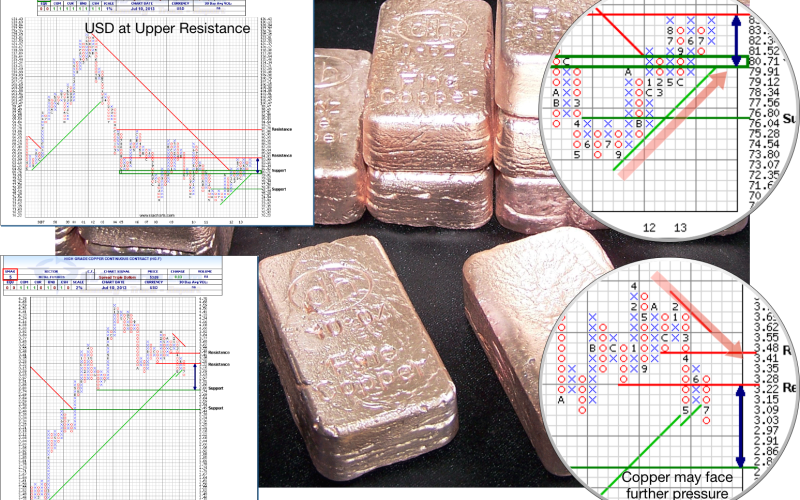

For this weeks edition of the SIA Equity Leaders Weekly, we will be taking a look at the U.S. Dollar Index and the High Grade Copper Continuous Contract. The first chart, the U.S. Dollar Index, continues to strengthen and is now sitting on a key resistance level that if broken could have an impact on many asset classes within the investment universe, including Commodities. Second, we will be taking a look at Copper, a Commodity that has benefitted from weaker USD values historically but over the past couple of years has suffered as the USD has risen.

U.S. Dollar Index Continuous Contract (DX2.F)

In the early part of 2012 we saw the U.S. Dollar Index move above it downtrend line for the first time in over a decade. The movement since then has not been extremely dramatic to the upside but it cannot be disputed that the current pattern is bullish. Looking to the chart we can see that a close above 84.83 gives this chart room to the low 90 range, a significant and material potential move.

The importance of the possible breakout shown here cannot be understated as it implies continued flows of cash from around the world back into the U.S. investment universe. Essentially, economies that are Commodity based and Emerging Markets that dominated the 10 years prior to 2012 could see continued weakness from their already relatively weakened levels.

Click on Image to Enlarge

High Grade Copper Continuous Contract (HG.F)

Our second chart today takes a look at an important Commodity that was, for the most part, a strong performer for most of the 2000's.

The chart though, shows us a very different picture than the USD chart we saw above. Here we see Copper breaching its uptrend line for the first time since 2008, when we saw broad based Commodity selling as markets collapsed on the fear of a Global financial crisis. The state of affairs today though, is not similar to the crisis of 2008 with Commodities ranking very low within the SIA Asset Class Ranking without the mess and uncertainty of 2008.

We have long talked about the relationship of Commodities to the direction of the U.S. Dollar with weakness in USD seeing strength in Commodities as holders of USD hedge their positions in deliverable assets. A story that from the early 2000's until the latter part of 2011 held true. Since then though, we have seen the opposite from Commodities such as Copper, as they continue to weaken in the shadow of a strengthening U.S. Dollar.

For those invested in Commodities such as Copper or those that have ignored the strength in the U.S. Equity Markets, both of these charts are important ones to consider when making decisions going forward. Should we see the breakout on the USD the impact on Commodities and Commodity based economies could be painful and more losses or Relative Underperformance is a likely outcome.

Click on Image to Enlarge