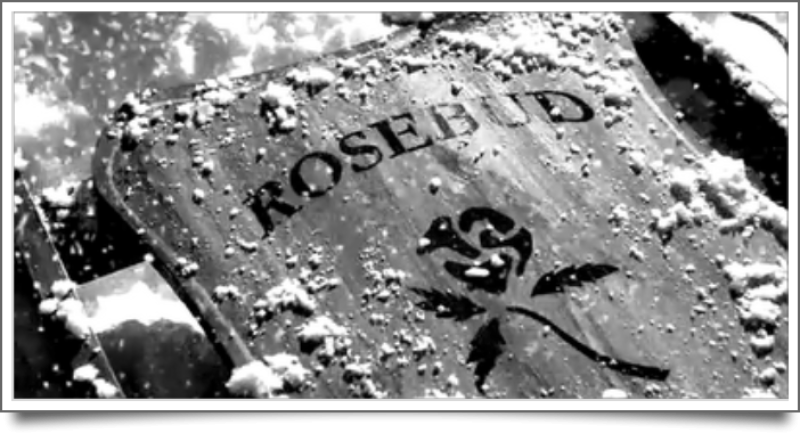

“Rosebud?!”

by Jeffrey Saut, Chief Investment Strategist, Raymond James

July 8, 2013

Produced in 1941, the movie “Citizen Kane” is heralded as one of the best movies ever made. It was one of the first to depict the American Dream, and materialism, as less than desirable and therefore causes one to contemplate what actually constitutes “a life?” Indeed, as a child the central character, Charles Foster Kane, is living in rural Colorado in a boarding house run by his mother (Mary). Kane is happy and content in the idyllic snow-swept setting riding his sled “Rosebud.” Then, in lieu of rent, one of the tenants gives Mary stock certificates that turn out to be shares in a working gold mine. Suddenly finding herself rich, she decides to send her son off to be raised by her banker, Thatcher, in an attempt to teach Charles the finer things in life. Thatcher, however, is too interested in making money to have compassion for a child. From there, through a series of vignettes, the viewer watches an abandoned, lonely boy grow up to be a fabulously wealthy media magnate. Yet in the process, Charles becomes arrogant, thoughtless, isolated, morally bankrupt, and incapable of loving except on his terms. Eventually, these faults cause him to lose his empire, fortune and friends. In the end, Kane is lying on his death bed surrounded by crated artworks, and other objects, that are being thrown into a blazing furnace. With his dying breath, Charles Kane lets the snow globe he is holding smash to the floor as he utters the word “Rosebud.”

To me, “Rosebud” represents the emblem of hope, security, and innocence that Charles Kane lost when he was torn away from his family as a child. Similarly, the equity markets have begun to “feel” like they have lost their hope and security over the past few weeks. To be sure, on May 22nd we experienced an “outside” Down Day reversal whereby that day’s intraday high/low was above/below the previous session’s high/low (read: negative). That has led to a series of lower highs, and lower lows, punctuated by the back-to-back 90% Downside Volume Days of June 19/20th. Recall, the “buying stampede” was kicked off with the back-to-back 90% Upside Volume Days of December 31, 2012 and January 2, 2013, begging the question, “Did June19/20th end the stampede?” (see chart on page 3). The answer to that question remains a resounding NO since the D-J Industrial Average (INDU/15135.84) has still not experienced four consecutive down sessions this year. Indeed, it has been the most remarkable upside skein I have seen in over 50 years of stock market observations with said stampede now at session 129! Nevertheless, we have now entered the month of July.

Recall that for months I have targeted mid-July as the timing point for the first “meaningful” decline of the year to commence. While I have not shared the exact timing points, they are July 11/12th (minor timing points) with July 19th being the major timing point. Those “points” are derived from quantitative and technical models, as well as what my Washington, D.C. network is suggesting will surface before Congress’ August recess. To wit, Chairman Bernanke will deliver the first day of his semi-annual monetary policy testimony on July 17th before the House Financial Services Committee. While his comments will likely echo his previous comments (no rate ratchet, open-ended asset purchases of $85 billion per month, all Fed actions will be “data dependent,” etc.), the Q&A could “rattle” the markets coincident with the Fed’s Beige Book providing an anecdotal glimpse at economic conditions. The next day, July 18th, Bernanke will deliver his second day of testimony before the Senate Banking Committee with an attendant Q&A period. Additionally, I think there will be some rhetoric about the sequestration starting to take a bite out of the economy accompanied by increasingly heated discussions on the upcoming debt ceiling and the continuing budget resolution. Moreover, we are now into earnings season where 2Q13 expectations have been ratcheted down from year/year growth estimates of +4.2% to the current +0.8% for the S&P 500 (SPX/1631.89). The sectors most vulnerable to earnings misses are Materials, Technology and Industrials, even though I continue to favor Technology and the Industrials. Another sector, namely Financials, could suffer as well because the recent interest rate rise has caused the banks to lose roughly $22 billion in their “Available for Sale” bond portfolios. Further, the U.S. dollar has been strong, and has broken out in the chart to new reaction highs, which may have a negative impact on international companies’ earnings.

Reinforcing my cautionary view is a stock market axiom I learned from an old Wall Street wag in the 1970s that states, “When they start running the ‘dogs,’ it’s time to begin looking over your shoulder.” So listen to this, as reprised in Barron’s and attributable to my friends at the Bespoke organization, about the first six months of the year: “The 50 smallest stocks in the S&P 500 jumped 21.9%, trumping the 13.3% gain by the 50 largest [stocks]. ... The decile paying no dividends jumped 19.9%, beating 12.2% for the decile paying the most generous yield. [The] most heavily shorted stocks rose 22.6%, versus 14.3% for their least-shorted cohorts. And the decile with the worst analyst ratings gained 22.7%, trumping 13.5% for the most beloved group.” So despite the fact that the SPX has recaptured its 50-day moving average at 1625.74, I continue to think the SPX is in the process of forming a double-top in the charts between 1650 and the May 22nd intraday reaction high of 1687.18. In fact, the SPX is currently at a very critical juncture having rallied back to its downtrend line that can be seen by connecting its May 22nd high with the June 18/19th intraday highs. As well, the SPX has rallied back to the underside of an uptrend line formed by connecting the February 26th low, the April 18th low, and the June 6th low, as can be seen in the attendant chart.

The call for this week: On a trading basis, raise cash ...