by Andrew Milne

China’s central bank issued a statement that the Chinese banking system had liquidity levels that were “reasonable” today. There by hangs a tale. ‘Reasonable’ is that which may fairy and properly be required of an individual (a case of prudent action observed under a set of given circumstances). It is just, rational, ordinary in usual circumstances. However, these are not usual circumstances, are they? Chinese cash rates hit a high of 25% on Friday 21st. Overnight bond-purchase rates ended up double what they should have been at 8.4920% on June 21st. Those aren’t ‘usual circumstances’, are they?

Wherever you might be standing, ‘reasonable’ in anyone’s book is far from good and should be cause for concern. That’s exactly how the world’s markets saw the statement as they plummeted today.

The interbank overnight rate may have decreased today still further from the dizzy heights of last week, but the going still looks as if it could be tough for the coming days. The markets don’t like ‘reasonable’. The overnight lending rate (which is the measurement for liquidity) stands at 6.489% today. On Friday it was 8.4920%. But, it has been at 3% on average over the past year and a half. That spells trouble. The markets have read exactly the self-same thing as Wall Street fell by over 1.5% and markets in Europe fell by just over 1% across the board:

- The FTSE 100 is down 1.24% (75.77 points to 6, 040.44) right now.

- The CAC40 has fallen by 50.66 points (1.38% to 3, 607.38).

- The DAX is down 0.89% at 7, 719.91 (down 69.33 points).

- The Dow Jones Industrial Average is down 243.29 points to 14, 556.11 (-1.64%).

It would appear that the People’s Bank of China knew what was looming ahead as the report that was issued today was actually dated last week (June 17th). The ‘reasonable-level’ statement was to try to allay fears that the Chinese banking system was no better than elsewhere, contrary to belief that it was flush with cash. They are actually strapped. What it did do, however, was send a message to the banking system in China to get its act together and cut the shady investments that have been taking place, in a bid to get them to focus on short and low-risk loans. It also seems like it’s the message that will be winging its way to bank boardrooms in China that the People’s Bank of China is neither able nor willing to carry out a bail-out of the banks if they fail. As a result, there are some smaller banks that might actually go under in the coming months. Some might be ready to argue that that is exactly what should be done. Don’t bail them out. Or will they be ‘too big to fail’ like our own banking system?

Liquidity has to be dealt with and quickly if this is going to be avoided.

Conditions are set to remain under pressure in the coming weeks with regard to interbank lending rates in China. In the meantime, it was the last thing that the market needed to give it a shove rather than a gentle push to wake up to what is happening in China.

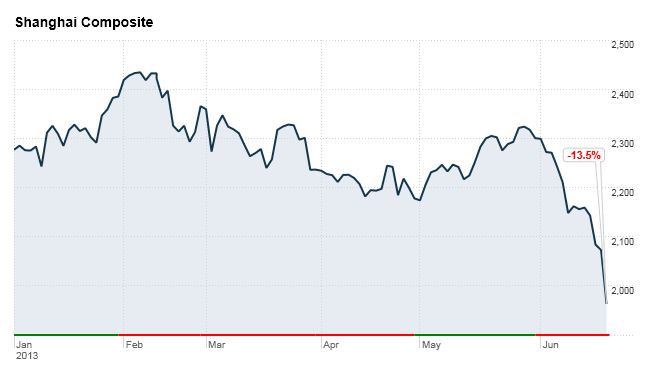

The Shanghai Composite dropped by 5.30% at market close today and ended up being the worst hit of all international markets. That means that it has plummeted in just six months by 13.5%. Today’s fall brought it to an equal footing with the state of affairs in August 2009. The Hang Seng in Hong Kong was down 2.79% and the Nikkei fell by -1.26%.

Shanghai Composite

It looks like some analysts are getting ready for another 2008-like credit-crunch time. If only we knew how and where to invest to strike it rich like some have done in the past. We could all retire and wouldn’t have to play the markets any more, leaving them in disarray. The 2nd-largest economy in the world is cause for great concern as the knock-on effect of a Chinese credit-crunch would be catastrophic to the global economy and would scupper all hopes of rising employment in the USA and increased output there.

Commodities were also reeling from the effect of such a slow-down in the world. Oil (crude and Brent) fell to lows that haven’t been seen for three weeks. Brent stands at $100.09, which is down 0.80% at 16:03 today. It reached as low as $99.68.

Brent on 24th June 2013

The word is on that China will kick off a new credit crunch that will bring us down. Buzz? Truth? Stocks are falling and that is a certainty right now, however. Some might say that it will remove the pressure from Ben Bernanke at the Federal Reserve. Remember, tapering and withdrawal of Quantitative Easing was to be dependent upon the situation of the economy in the US (if unemployment were to reach a better level to 7% from 7.6%). At least, it will take the attention away from him and the tapering of Quantitative Easing in the USA. Others will say that we might never know what is going to happen. Predicting how the Chinese market is going to react would be incredibly difficult given the lack of transparency there in statists and data. Maybe Edward Snowden should have let us in on the stuff a little bit earlier. Others will say that you can’t say for the moment what will happen given the current volatility of the market. But, one thing is for sure: bubbles usually burst.

If the People’s Bank of China is trying to bring the Chinese banks back into line, then the taste of the medicine is like bitter aloes. Herbal they might be. Purgative possibly! Sheer purgatory for sure for the Chinese banking system and the rest of the world!

Growth prospects for China have been dropped from 7.8% to 7.5% by analysts (Goldman Sachs) for yoy growth in the second quarter of 2013. The figure of 7.4% has been given for 2013, rising to 7.7% in 2014 perhaps.

China: Growth is down, markets are down, lending is down and liquidity is down. What’s up? Good question! It’s the answer that’s impossible to find.

Copyright © Andrew Milne